Big Players, Bigger Deals: Why ETF M&A Could Explode in 2025

Last year was a snooze fest for M&A activity in the ETF world, but 2025 might just be the year things get exciting. The first move is already on the board: BNP Paribas is set to acquire AXA Investment Managers, meaning another ETF business will soon get absorbed.

But that could be just the start. Mutual fund giants continue eyeing the ETF space and let’s be honest—what’s easier than snapping up a well-established ETF platform to hit the ground running?

Names like Wellington and Schroders might come to mind when thinking about potential buyers. They have the scale and deep pockets to make a splash in the ETF space.

As competition heats up and new entrants look for shortcuts into the industry, consolidation feels inevitable. Smaller players could become attractive targets for those who want a slice of the growing ETF pie without building from scratch.

But the question is who will be next to make a move?

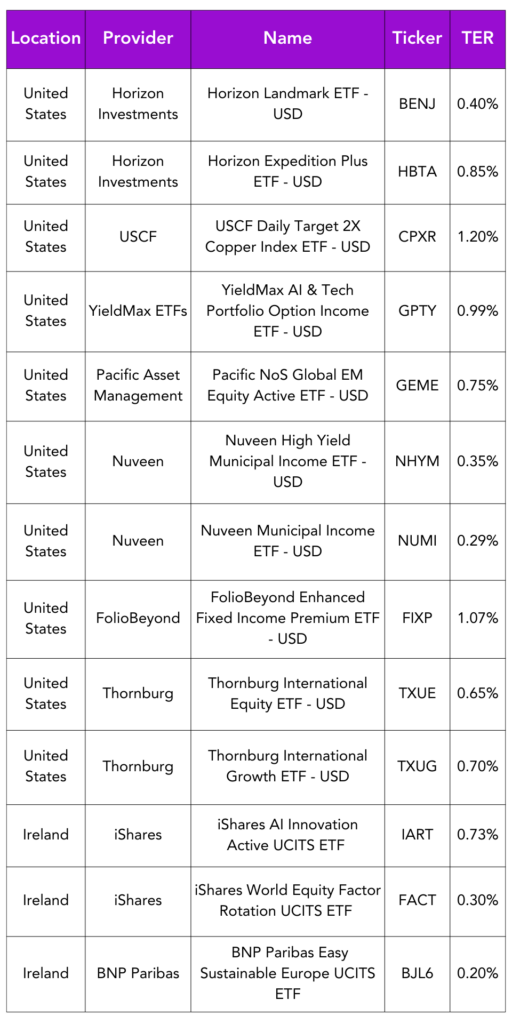

Launches this week

Flows & performance

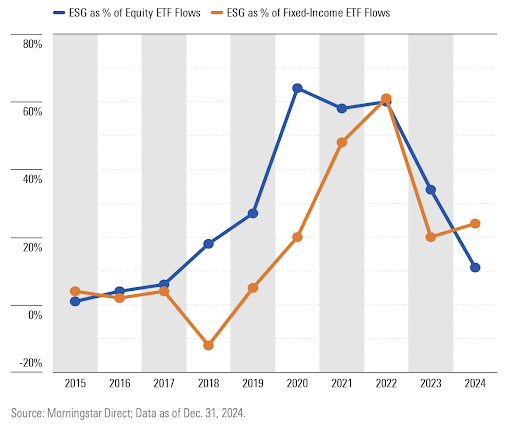

2024 was a bad year for European EGS ETFs.

The proportion of total flows into ESG strategies has declined abruptly since 2022.

In 2024, only 11% of all flows into equity ETFs in Europe were directed to ESG strategies. This was down from 34% in 2023 and 60% in 2022.

Meanwhile, for fixed income, flows into ESG represented 24% of the total, slightly up from 20% in 2023 but markedly below the high of 61% in 2022.

Underperformance relative to mainstream propositions and uncertainty around regulations have been the key driving factors in the decline.

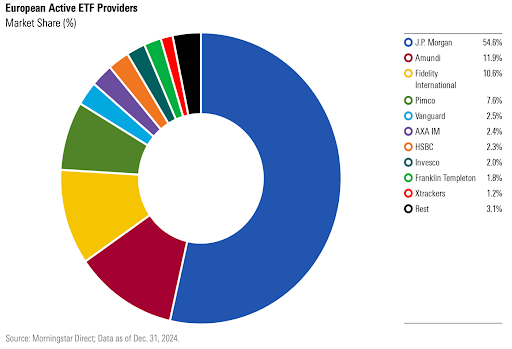

European active ETFs gathered speed in 2024 with Flows of EUR 19.1 billion, up from EUR 6.7 billion in 2023.

J.P. Morgan is the leading provider of active ETFs in Europe, with a commanding market share of 54.6%, up from 42.8% in 2023.

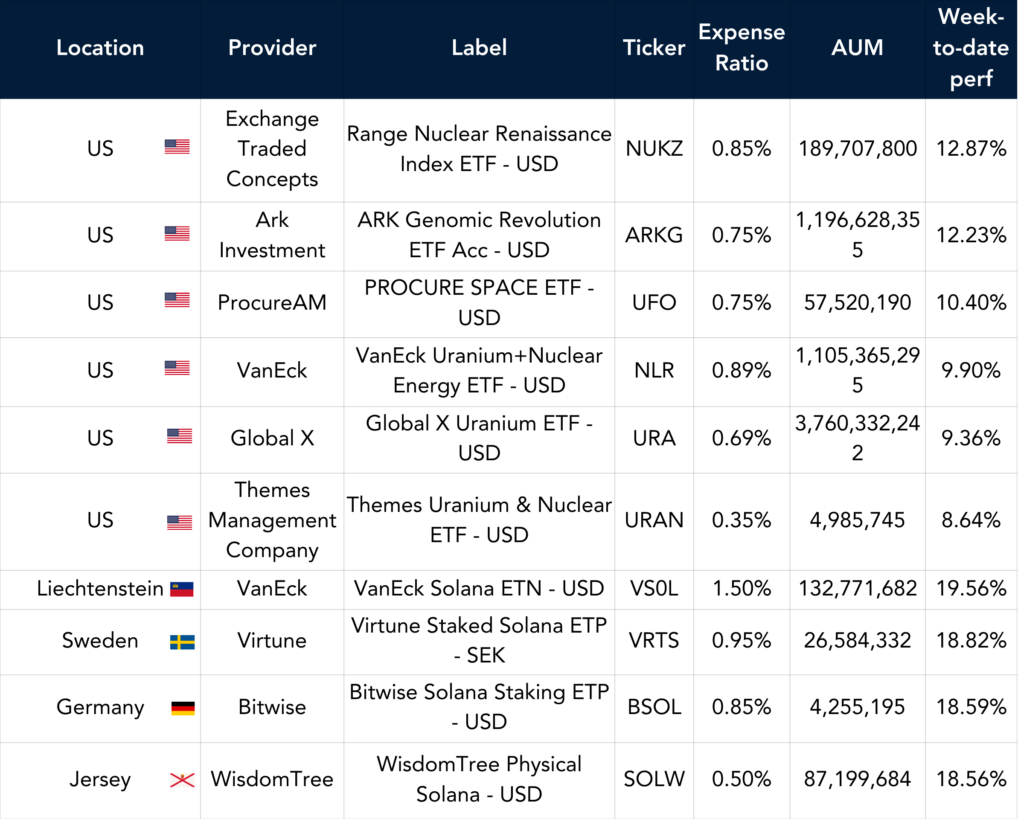

Best Performers US & EU

Listen and Learn

We’re back with new episodes of Exchange Traded People!

Kicking things off, we’re thrilled to welcome Olivier Paquier, Head of ETF Sales at AXA IM. From studying to be a teacher to becoming a leader in the ETF space, Olivier shares why networking is the career game-changer. Tap into his insights and discover how building connections can transform your career.

Things of interest

The growth of ETFs has improved the efficiency of stock markets, according to new research from London’s Bayes Business School. The analysis suggests ETFs has improved the efficiency of stock pricing at the market level, a concept dubbed “macro-efficiency”, reducing the prevalence of mispricing and improved the efficiency of stock pricing at the market level, a concept dubbed “macro-efficiency”, reducing the prevalence of mispricing.

Almost 30% of European institutional investors ‘considering’ active ETFs are already using them, according to a survey conducted by JP Morgan Asset Management (JPMAM) and Research in Finance.

Uptake has been highest Italy, France and Germany, with adoption in the UK lagging behind. Of the 70 fund selectors from 12 European countries interviewed for the study, 27% were ‘early adopters’ of active ETFs, 37% were active ETF ‘optimists’ and the remaining 37% were ‘sceptics’.

Call me a cynic but, considering the study was sponsored by JP Morgan the largest provider of Active ETFs in Europe, would you expect it to say anything else?

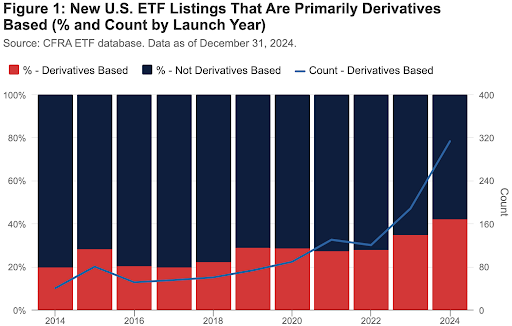

Derivative usage of ETFs in the US has increased dramatically according to a new report from Aniket Ullal, Head, ETF Research & Analytics at CFRA.

Entitled From Bogleheads to Gearheads, Ullal notes that over 40% of the ETFs listed in the US in 2024 used derivatives as a key component of their strategy, up from 20 per cent in 2014.

Leveraged and inverse products now make up a third of all derivatives-based equity ETFs by number, with the count of single stock leveraged products increasing.

HKEX is set to be Asia’s first exchange to offer Single Stock Leveraged and Inverse Products, following an announcement by the Securities and Futures Commission (SFC) permitting these new securities in Hong Kong.

The Single Stock L&I Products will provide exposure to selected mega-cap stocks, giving investors a new tool to capture opportunities and manage risks.

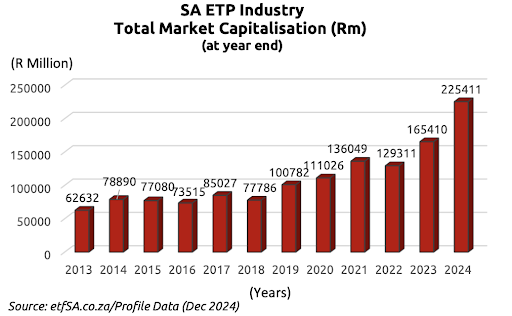

The South African ETF market is probably not on too many people’s radar but here are some stats.

The total market capitalisation of the entire ETP industry amounted to R225,4 billion (USD 18 billion) at the end of December 2024. This amounts to an increase of 36.3% on the market capitalisation at the end of 2023.

An extremely cynical article in the FT from Stuart Kirk (the former HSBC guy known for his criticism of ESG investing). The article critiques active ETFs, emphasizing that they often underperform their benchmarks, much like traditional active funds.

He claims active ETF portfolios often resemble passive funds with slight adjustments, providing minimal differentiation before going on to suggest that these funds are primarily a marketing tool to justify higher fees, rather than a genuine value-add for investors. Surely there is no truth in this, right?

Market makers trading ETFs on the Euronext Amsterdam are breaking the rules by colluding together to protect themselves from competition, according to new academic research conducted by the University of Oxford.

Strict conduct rules apply to all market makers to ensure that they treat customers fairly and to prevent them from acting in concert together to take advantage of investors.

However, the Oxford study, Anonymity, Signaling, and Collusion in Limit Order Books, found these rules are being flouted by ETF market makers on the Euronext Amsterdam exchange, who are sending signals about their order books to each other when the identity of the holders of these positions are supposed to be anonymous.

Career corner

Movers and Shakers

- Julia How has joined BMO in Canada as Director, ETF Distribution. She joins from Global X.

- Isabella Stack has joined Global X in the UK covering UK Sales, She joins from Betashares.

- William Jones has joined Tema ETFs as an Operations Associate. He joins from Tabula.

On the Move

European Featured Opportunities

- Product Development Specialist – Munich or London: Play a key role in developing and maintaining a unique product suite by sourcing and validating new product ideas across a variety of asset classes and managing the product life cycle from product design to launch and ongoing product enhancements.

US Featured Opportunities

- Business Development Manager, Southern States – Georgia, USA: This role is responsible for supporting the sale of exchange traded funds (ETFs) and mutual funds to broker-dealers, wire-houses, RIAs and institutional clients. The candidate will be responsible for managing their own territory and working in conjunction with our firm partners.

Tip of the week

Your LinkedIn Profile Deserves More Love – Even If You’re Not Job Hunting. Here’s why:

-

-

-

Your LinkedIn Profile Is Your Digital Business Card

Think of LinkedIn as a massive networking event happening 24/7, 365 days a year. -

No Job Is Truly “Forever”

Even if you’re in your dream job today, tomorrow could tell a different story. -

Skills Are the Currency of the Future

Skills are the No. 1 thing recruiters search for on LinkedIn. -

The Algorithm Loves an Active Profile

LinkedIn isn’t just a static platform; it rewards activity. -

You’re More Than Your Job Title

Too often, people treat their LinkedIn profiles like business cards. -

Opportunities Come When You Least Expect Them

You never know who’s looking at your LinkedIn profile.

-

-

The Bottom Line: Your LinkedIn profile isn’t just about finding a new job – it’s about building your professional brand, staying visible, and preparing for whatever the future holds.

About us

Exploring Your Next Career Move? Learn From an Expert in Our ETF Career Insights Series.

Curious about index development? Pat Wolf from Nasdaq shares what it takes to thrive in this crucial role in our latest ETF Career Insights interview. From designing indices to understanding market trends, index developers shape the ETFs investors rely on daily.

If you’re passionate about markets and data-driven decision-making, this is your chance to learn from an expert.