Why do we not do more to support the underdog?

With Janus Henderson announcing that they are entering the European ETF market, it marks another milestone for the growth of ETFs in this part of the world.

Great news yes, but also a chilling reminder that the chances of success for the boutique manager with a “great product idea” is extremely slim.

Did you know that and 74% of all ETF managers in the US have less than $1b aum and in Europe it’s 52%.

Such numbers would make you think whether it’s even worth the effort in the first place.

BUT God loves a trier and as long as there are good ideas then there will be people willing to roll the dice with them. We all love the underdog, but yet we are never willing to bet on them. Just ask the guys at Tabula.

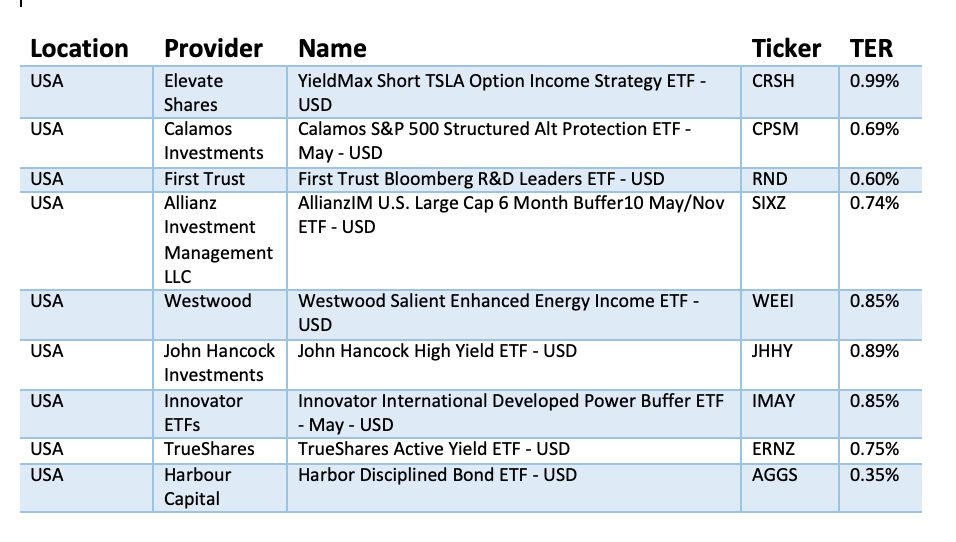

Launches this week

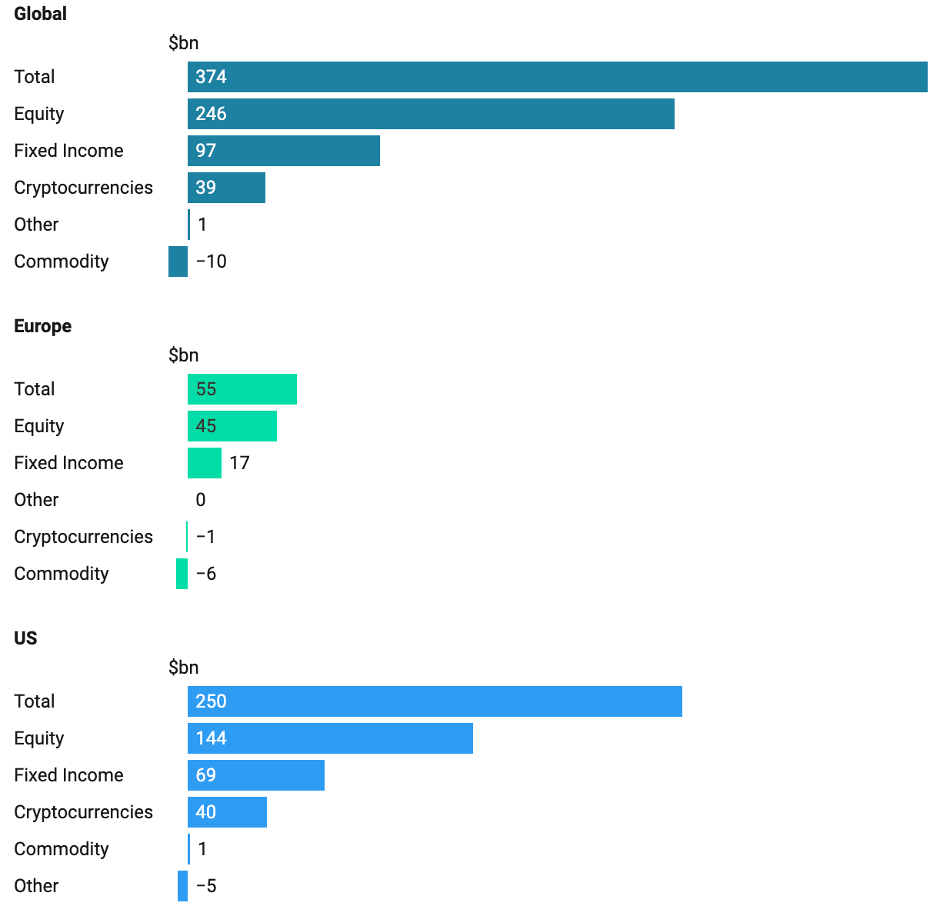

Flows Year to Date

Listen and Learn

Our newest podcast where we explore the stories behind companies who have achieved success in the ETF ecosystem, trying to uncover what led to that success.

This week we speak to Roundhill Investments co-founder, Tim Maloney. Listen to him HERE.

Things of interest

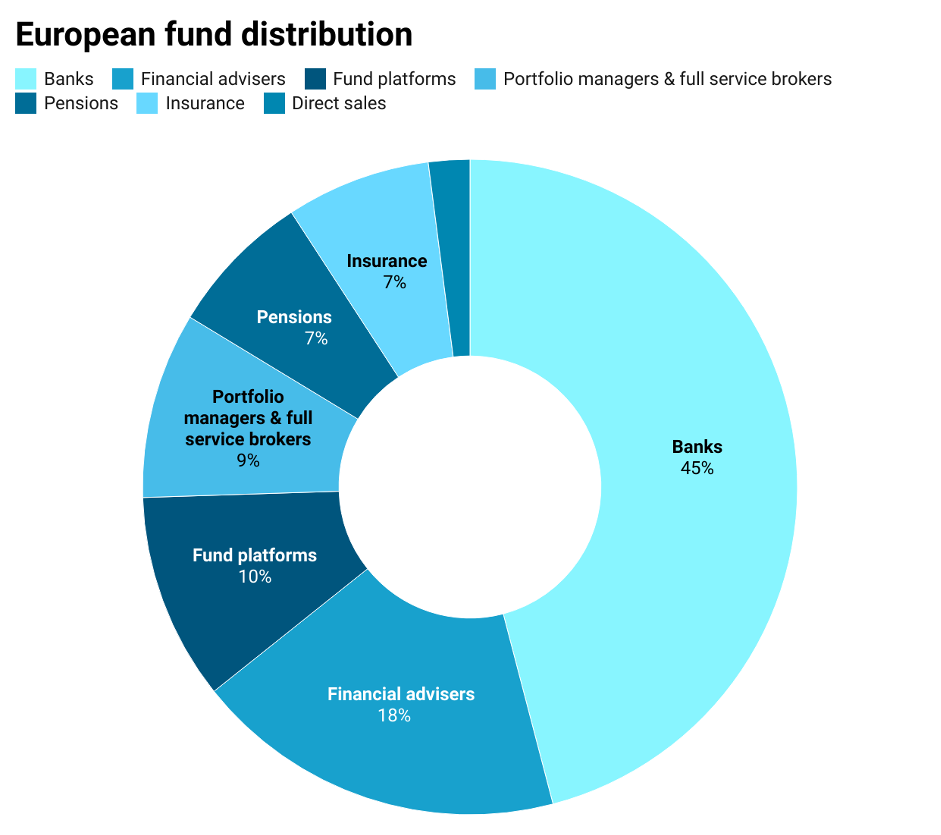

Banks rule distribution in Europe

Interested data published from EFAMA this week highlight how funds are distributed across Europe.

As you can see Banks dominate distribution, but unfortunately, Banks don’t dig ETFs as there are no sweet kickbacks for them.

It just highlights the challenge for managers to distribute their ETFs in Europe.

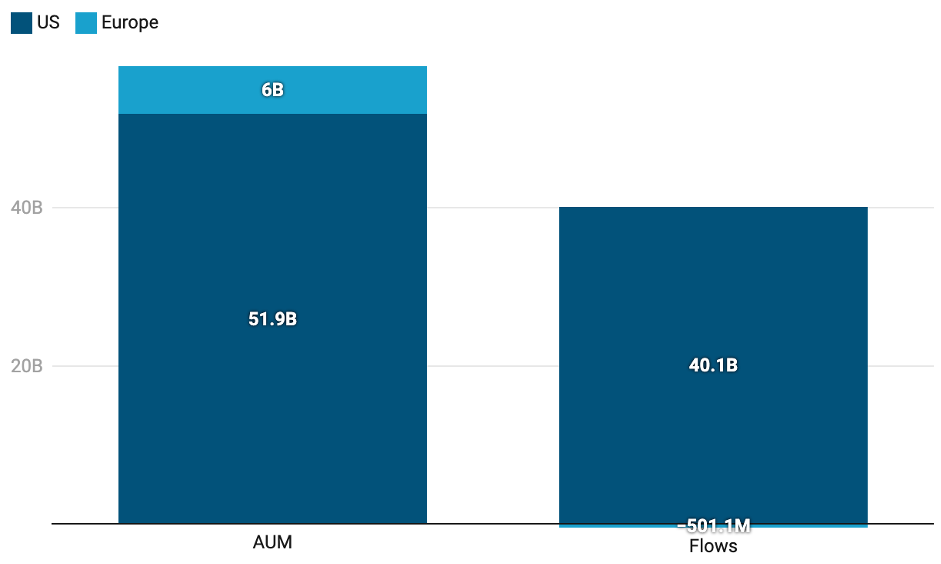

Tabula gobbled up

Speaking of challenges, Janus Henderson has announced that they are acquiring Tabula, the European Fixed Income ETF manager.

No surprise there really. Tabula, established in 2018, have struggled to kick on since launch, a common theme amongst boutique managers in Europe.

It just goes to show, the ETF space in Europe is hard to crack and without meaningful distribution channels you really are facing a massive challenge.

Crypto falling on deaf ears in Europe

Why is crypto not resonating with European Investors? The below graph says it all really.

Did you know crypto ETPs have been around in Europe since 2015, yet are barely scratching the surface in terms of AUM raise?

Other examples of the differences between US and European investors.

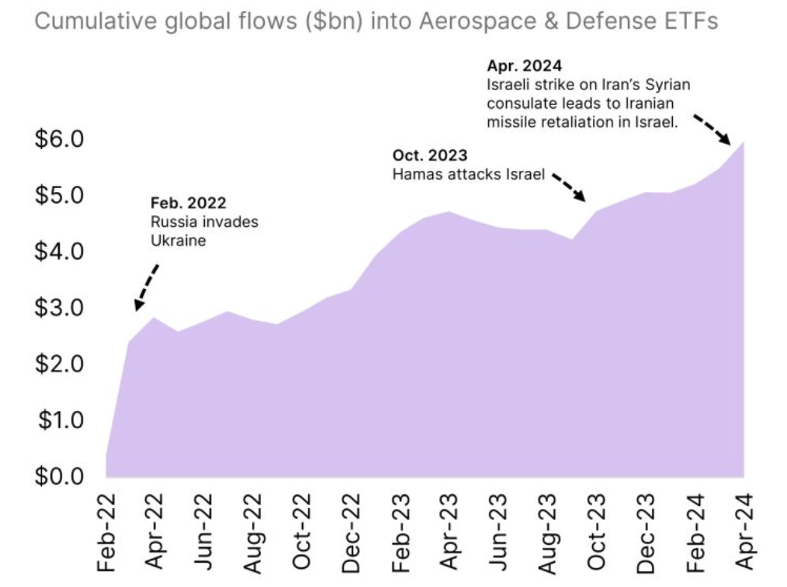

Investors flock to Aerospace & Defence ETFs amid conflict

Vanguard raising fees?

Vanguard picked up some bad press last week in the US by announcing a $25 “transaction fee” for any individuals calling the company for assistance in trading mutual funds and ETFs.

Whilst trading is still commission free, it seems like the company doesn’t want to be bothered with little old ladies calling them up asking random questions.

ETFCareer corner

Movers and Shakers

- Bryon Lake, head of ETFs at JP Morgan is leaving to join Goldman Sachs. A big blow for JP.

- Another loss for JP Morgan as Josh Jacobs leaves their Securities Services business after 16 years to join US Bank as Chief Commercial Officer.

Salary Trends

Stay tuned here. Our 2024 ETF salary has closed and the data is being analysed.

We are sure there will be some interesting trends to share so watch this space.

Tip of the week

In one of our recent podcast interviews, Sue Thompson, Head of Americas Distribution at SPDR said looking back on her career she realised she would have been a lot happier if she didn’t take things so personally.

Wise words indeed and something for us all to take on board.

About Blackwater

Blackwater is a leading global ETF Consulting, Recruiting, PR and Content Creation firm.

We are specialists in helping companies find the best strategy to enter and navigate the ETF marketplace, enhance their reputation, craft innovative and engaging targeted ETF content and source the very best of talent across the ecosystem.

If you would like to discuss any of the above then please reach out at mike@blackwatersearch.com