Whoever said crypto is boring?

There’s never a dull moment in the world of crypto and this story has been 10 years in the making since the first filing of a Bitcoin ETF.

There was a court case, a hacked social media account, a frenzy of anticipation but finally it came with news coming through last week that the SEC had approved all 11 Bitcoin ETF applications.

There is definitely enough material for a Netflix series here. We can see Ryan Gosling playing the part of Dave LaValle at Grayscale.

But what happens next? Can we assume an Ethereum ETF is next?

Is the price of spot Bitcoin going to hit a trillion dollars and are European investors going to wake up and think they need to follow their US friends and fill their pockets with Bitcoin ETFs?

We guess we all need to tune in to the Netflix series to find out. Now, we wonder if they will release the box set a or just one episode at a time.

Fund Launches and Updates

EUROPE

Europe’s ETF sector gets new entrant as US-based Pacer plans entry with news that the manager tends to launch four of its flagship Cash Cows ETF range as soon as next month. link

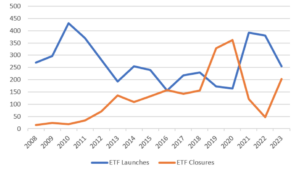

ETF launches in Europe dropped by a third last year as high interest rates left many asset managers feeling the pinch, according to Morningstar. link

CoinShares has exercised its option to acquire the cryptocurrency ETF business of US-based rival Valkyrie Investments.

The Jersey-based firm says its decision to exercise its purchase option for Valkyrie Funds, which provides actively managed crypto ETFs, “comes as a direct result” of the US regulator’s approval for the issuance of Valkyrie’s spot bitcoin ETF. link

Tabula Investment Management has slashed the fee on its euro-denominated high yield Paris-aligned climate ETF amid competition from BlackRock.

The fee on the Tabula EUR HY Bond Paris-Aligned Climate UCITS ETF (THEP) has halved from 0.50% to 0.25%. The move comes just a month after BlackRock unveiled an equivalent strategy, the iShares € High Yield Corp Bond ESG Paris-Aligned Climate UCITS ETF (HYPE), on 7 December. link

AMERICAS

Here is a list of all the firms who received approval for a Bitcoin ETF:

- Grayscale Bitcoin Trust

- Bitwise Bitcoin ETF

- Hashdex Bitcoin ETF

- iShares Bitcoin Trust

- Valkyrie Bitcoin Fund

- ARK 21 Shares Bitcoin ETF

- Invesco Galaxy Bitcoin ETF

- VanEck Bitcoin Trust

- WisdomTree Bitcoin Fund

- Fidelity Wise Origin Bitcoin Fund

- Franklin Bitcoin ETF

ASIA-PACIFIC

Australia expects to see bitcoin ETFs approved to list on ASX in the first half of this year with Brisbane-based Monochrome AM likely to be the first local provider to be approved, with Betashares making preparations to apply. link

Lion Global Investors and Nomura Asset Management have partnered to launch Singapore’s first active ETF, and first artificial intelligence-powered ETF, a little over a month after regulators first gave the go-ahead for such products. The Lion-Nomura Japan Active ETF (powered by AI), will list on the Singapore Exchange on January 31. link

Did you know the 10 largest ETF managers in China?

You do now.

A podcast series focused on exploring the career journey of industry leaders within the ETF and Digital Assets space. Get to hear their personal story and be inspired. This week with Matt Hougan, Chief Investment Officer at Bitwise Asset Management. Listen to him HERE.

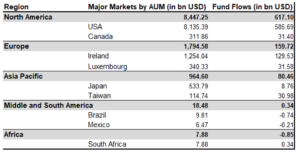

Flows

Assets under management in the global ETF industry increased from $9,232.0 bn at the end of December 2022 to $11,118.1 bn at the end of December 2023. The majority of these assets ($8,619.8 bn) were held in equity ETFs.

This category was followed by bond ETFs ($2,061.8 bn), commodities ETFs ($179.4 bn), ”other” ETFs ($87.7 bn), alternatives ETFs ($74.8 bn), money market ETFs (€56.4 bn), mixed-assets ETFs ($38.1 bn), and real estate ETFs (€0.02 bn). link

Noteworthy

Whilst the ETF/crypto industry was celebrating the Bitcoin approval last week, it seems the SEC most definitely were not.

“While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto” Gary Gensler, SEC chair, said in a statement. link

‘It is just the beginning’: BlackRock bullish on European ETF market growth where they see opportunities within model portfolio services and the rise of retail investing. link

We have just released our 2024 ETF and Digital Asset outlook report with insights from over 20 distinguished industry leaders.

This year’s edition covers a range of critical themes such as regulatory updates, technological advancements, sustainable investing trends, and the dynamic role of digital assets, while also providing expert insights into active ETFs and global market shifts. link

Movers and Shakers

Blackrock’s head of iShares Salim Ramji is set to depart after just over 10 years with the firm. No news yet on next destination.

JP Morgan have added 3 sales people to their European ETF team with the hire of Pav Sharma, Salvatore Accurso and Daphne Cramer.

John McElhiney has joined Allianz Life as National Account Manager – ETF Platform Sales.

From behind the Desk

“They” say it takes about 30 days to develop a new habit which is why January is such a special month seeing that it is the month of new year’s resolutions, packed gyms and alcohol detox.

Unfortunately, most of it tends to be wishful thinking on the part of most people but maybe this is the year when you grind it out and achieve the success you aspire.

As the famous philosopher Bruce Lee said “the successful warrior is the average man, with laser like focus”.

About Us

As Blackwater embarks on its 5th year of excellence, marking a significant milestone in providing global talent management and ETF consultancy services, we continue to evolve. Now also offering ETF PR and third-party content creation services.

If you would like to discuss any of the above then please reach out to us HERE.