What’s their secret?

- Wellington Management Company

- Geode Capital Management

- Schroders

- Allspring Global Investments

- Ostrum Asset Management

- Asset Management One

- Union Investment

- Barings

- Western Asset Management Company

- M&G

- Loomis Sayles & Co.

- Dodge & Cox

- Russell Investments

- Baillie Gifford

- Lord, Abbett & Co

A quick note

Starting soon, The Week in ETFs will be coming from a new email address: mike@blackwateretf.com. Don’t worry, the same insights and updates will continue without interruption.

Stay tuned for more details about this change and the growth happening at Blackwater.

And now, back to your regular scheduled programming…

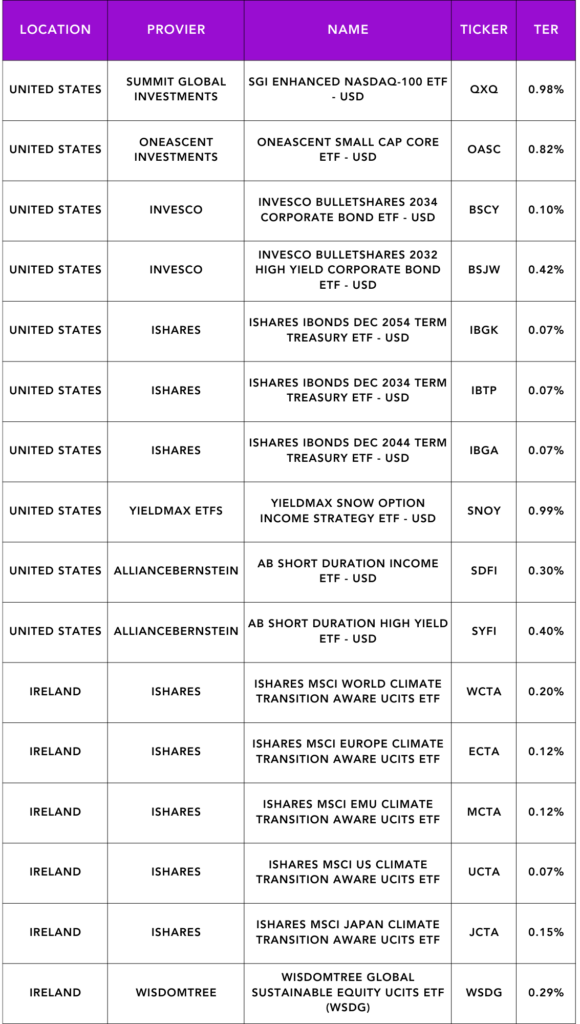

Launches this week

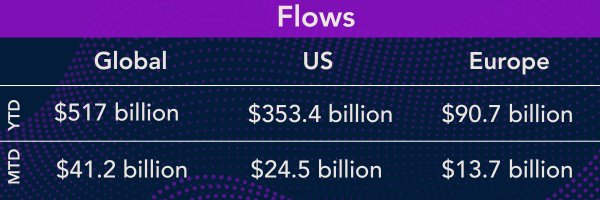

Flows & performance

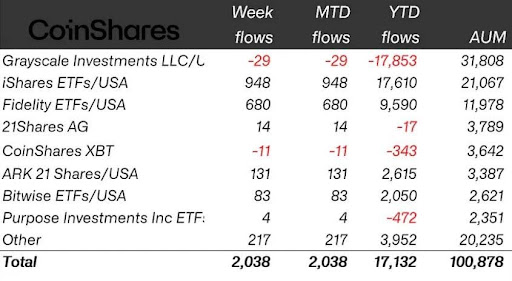

Digital asset investment products started positively in June, with almost all providers seeing inflows and recording an overall inflow of $2 billion, according to CoinShares.

Things of interest

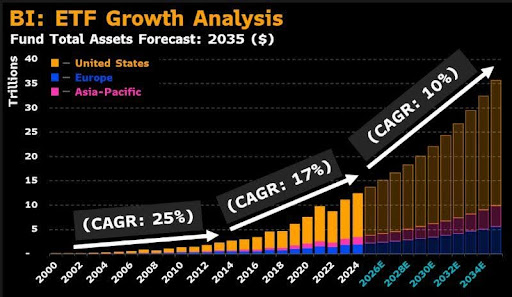

Bloomberg are predicting ETFs to grow to $35tn by 2035. This is based on 10% CAGR (past decade was 17%).

Their low-costs, intra-day liquidity, tax efficiency, flexibility, etc. will continue to attract investor cash which will result in more new products, innovative designs and more salespeople, according to Eric Blachunas.

Structural changes overseas favour ETFs long term while Mutual Fund share classes in US will add yet another tributary for cash to flow in.

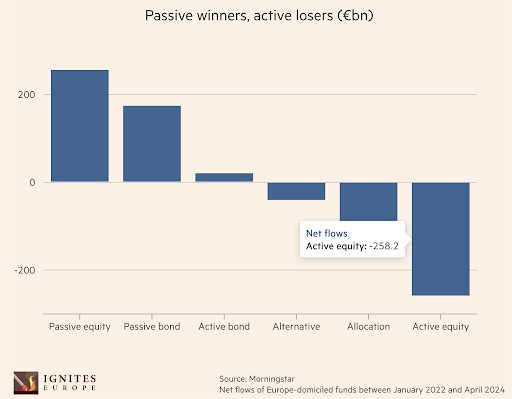

Europe’s active asset managers face an unprecedented challenge in dealing with continued mutual fund outflows, according to the FT. Investors have pulled €258bn from actively managed equity funds since the start of 2022, with a further €140bn withdrawn from multi-asset and alternative funds, Morningstar data shows.

However, passive product providers have prospered from investor demand, with inflows to index and exchange traded equity funds totalling €256bn.

According to both Bloomberg and the FT, Fidelity has reached revenue-sharing agreements with “dozens” of ETF issuers, and is continuing to negotiate with many others, for its new revenue sharing policy which will allow it to charge a 15% Platform Fee to ETF Issuers. Charles Schwab, Fidelity’s big rival, has yet to make a similar move.

Career corner

Movers and Shakers

- Dave Abner has joined Northern Trust as head of global ETFs and Funds. He will oversee NTAM’s mutual fund and ETF product strategy, research and development, product management, and capital markets, as well as fund services oversight and treasury functions

- Grant Gourley has joined BlackRock in London from JP Morgan to become an ETF Product Engineer.

- Shane Monks has joined BNY as Global Head of ETF & UIT Operations

- Ryan Katz has joined SSGA as Vice President, SPDR ETF Asset Manager & Hedge Fund Sales

Salary Trends

Communication roles are becoming more in demand. Managers need to get their message out there and build their brand with their target audience and Comms people are crucial for this to happen. Salaries of $200k + are becoming the norm for talented people in these roles.

Tip of the week

Don’t get old.

Not only does your body start behaving in ways you don’t want, but trying to find a new job can be a nightmare.

Everyone is very familiar with the gender pay gap, but what is less spoken about is the discrimination that goes on when you reach a certain age, 50 being the magic number.

Unfortunately most companies are managed by metrics and statistics and 50+ year olds don’t tick the right box. This is a real shame as wonderful talent and experience is being ignored in the haste to find the next young talent.