Vanguard: The best ETF manager in the world?

There’s a lot to be said about how Vanguard do business. Unlike other managers who sometimes seem like a dog chasing it’s tail, Vanguard do no such thing.

They know what they are good at, they stick to it and they don’t let themselves be distracted with the new shiny ball. Is Vanguard is the best ETF manager in the world?

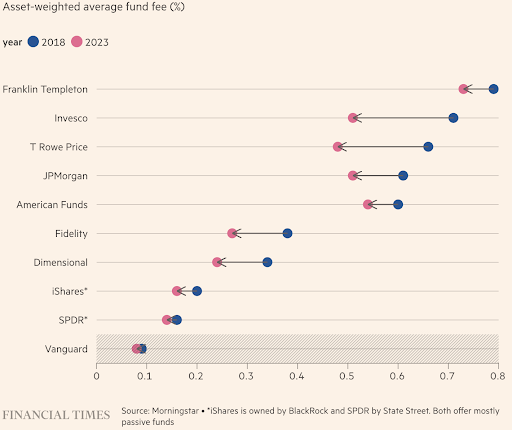

Even their approach to pricing, as eloquently demonstrated in the graph below, shows how consistent they have been over time. Some might say Vanguard are boring but I’d take boring any day if it produced the same “best ETF manager’ results that Vanguard are having.

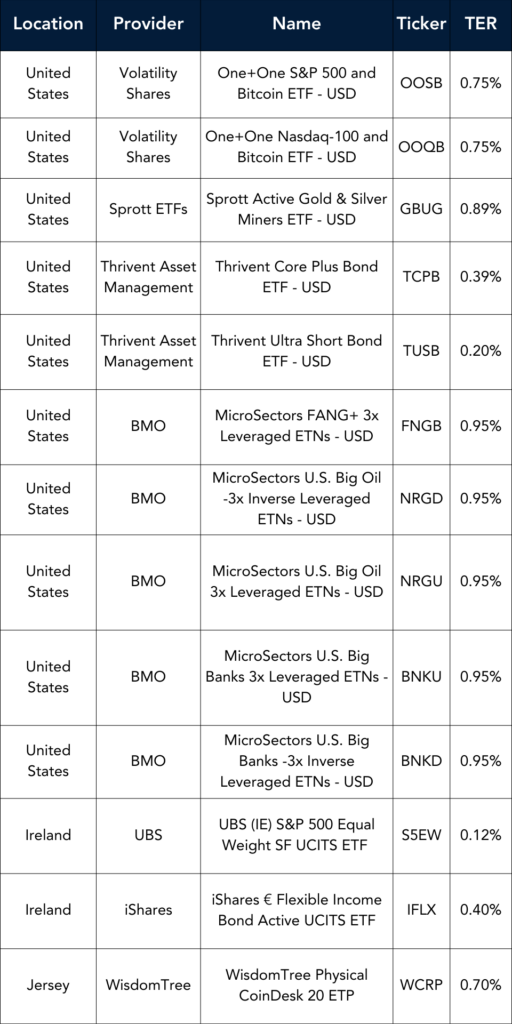

Launches this week

Flows & performance

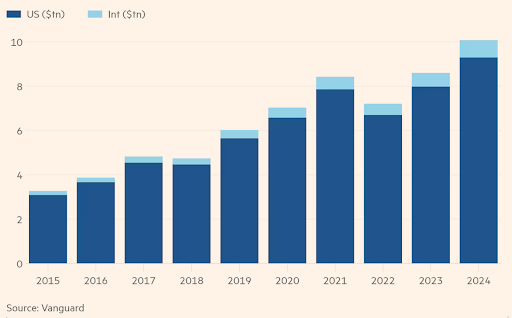

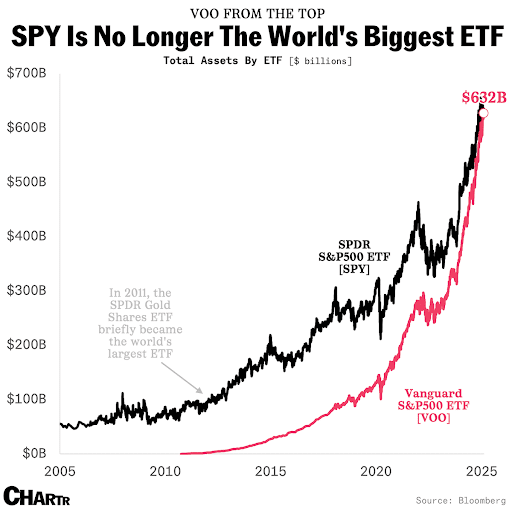

VOO has finally overthrown SPY for the title of world’s biggest ETF, ushering in a new world order for the $11 trillion industry.

Various arguments could be made, but there’s really only one reason: VOO is cheaper, charging a miniscule 0.03% per year for the privilege of investing in it, considerably less than the 0.09% expense ratio of SPY.

BlackRock has become the first European ETF issuer to reach $1trn AUM for its European ETP suite, cornering 41.5% of the market AUM more than three-times that of closest rival AmundI.

This milestone follows $91.7bn in inflows and 76 product launches in 2024, all while the iShares Core S&P 500 UCITS ETF (CSPX) became Europe’s first ETF to exceed $100bn AUM. BlackRock has become the first ETF issuer to break through $1trn assets under management (AUM) in its European exchange–traded product (ETP) range.

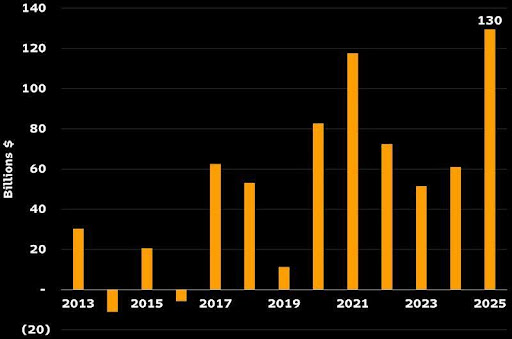

ETFs in the US took in $130b in first six weeks of year- best start to a year on record while the S&P 500 just hit another all time record.

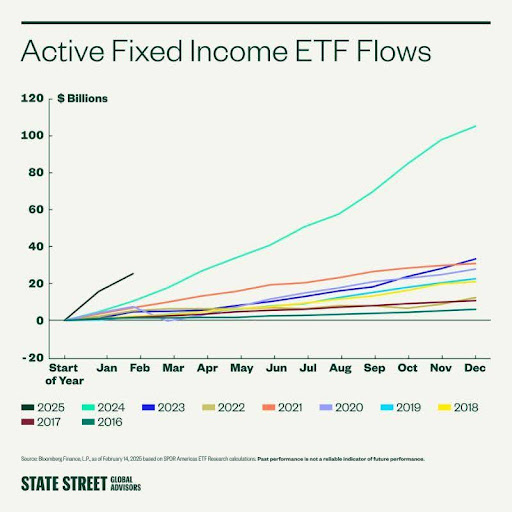

Active fixed income ETFs smashed records in 2024, taking in over $100 billion to far outpace the prior annual best of $33 billion in 2023.

And just a month and half into 2025, active fixed income ETFs have already taken in $25 billion — a quarter of last year’s record haul — putting inflows on track for $182 billion in 2025

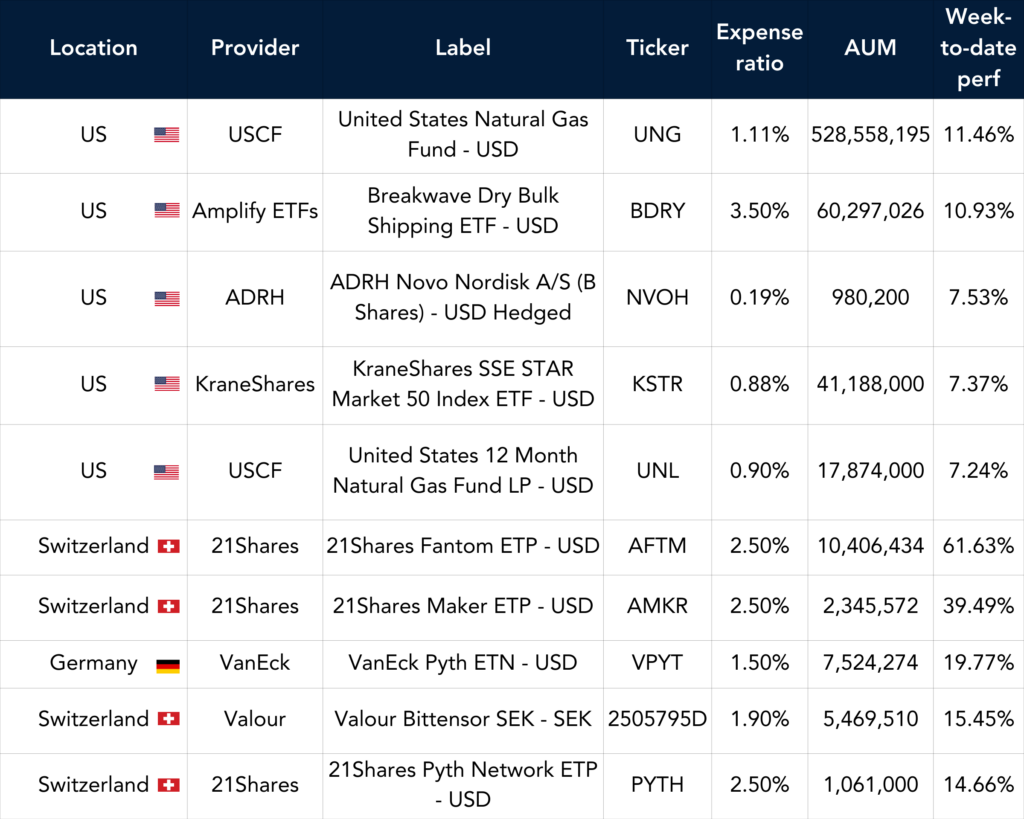

Best Performers US & EU

Listen and Learn

On this episode of Exchange Traded People, we sit down with John Davies to talk about his unexpected path into finance and the lessons he’s learned along the way.

From exploring different roles to finding the right career fit, John shares insights on adaptability, the power of networking, and why in-person connections still matter in a hybrid world.

He also discusses the importance of staying open to new opportunities-because sometimes, the best career moves are the ones you never saw coming. Tune in for a conversation on career growth, problem-solving, and making the most of every opportunity.

Things of interest

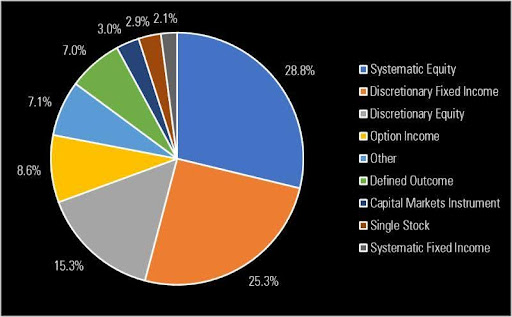

By count, active ETFs now represent ~49% of all ETFs. Soon there will be more active ETFs than index ETFs 3.) Fully discretionary active ETFs still account for a minority of overall active ETF assets (see Morningstar Direct data below as of Feb. 19, 2025). But on a combined basis, their share is growing.

Covered call ETF specialist YieldMax is set to enter the European market after filing for regulatory approval for a big tech income strategy in Ireland, ETF Stream can reveal.

The Yieldmax Big Tech Option Income UCITS ETF has been filed for registration with the Central Bank of Ireland (CBI) and will mark the firm’s first strategy in a UCITS format. YieldMax has 23 US-listed ETFs and specialises in covered call strategies.

An explosive growth for Digital Asset ETPs?

Bitwise’s Matt Hougan predicts explosive growth for Digital Asset ETPs as regulatory clarity looms. He anticipates the launch of larger-scale ETPs over the next decade, potentially featuring index-based products emphasizing that resolving the debate over whether cryptocurrencies should be classified as securities or commodities could significantly boost market development.

He stated, “Without clear definitions, market growth is hindered. However, once these definitions are established, I believe there will be explosive growth in U.S. products.

China’s wealth management advisers are increasingly favouring index investing, which has gained strong traction in recent years, with wealth advisers gradually shifting their preference from actively managed equities funds to passive index funds, the China Securities Journal reports.

According to a Fidelity survey, a majority of Intermediaries plan to increase allocations to active ETFs over the next 18 months.

The survey of 125 institutional investors and intermediary distributors in Europe and Asia, found that active ETFs were the product type that respondents were most likely to favour.

Some 37% of professional investors surveyed said they anticipated upping their use of active ETFs, compared with 29% and 26% for passive ETFs and index trackers respectively.

The greatest appetite for such products was among intermediaries, with 61% of those surveyed anticipating an increase in usage in their portfolios over the next 18 months.

Career corner

Movers and Shakers

- Magdalena Anna Kowalik has joined HANetf in London as a Capital Markets.

- Thebak Mathias Ehambaranathan has joined Amundi in London as an ETF Sales Specialist. He joins from Fidelity.

- William Kartholl has joined TD Securities in NY as Director – ETF Trading. He joins from Citi.

On the Move

Our clients are actively looking for ETF Sales Professionals, Product Specialists, and Traders across Europe and the U.S. If you have experience in ETF sales, structuring, trading, or product development, now is the time to explore new opportunities!

If you’re considering a move or just want to hear about what’s out there, get in touch. We’d love to connect and discuss how we can help take your career to the next level

Check out our job board for all the best ETF jobs in the market right now.

Looking to attract the best ETF talent? Why not post your open role directly on our ETF job board ETFCareer.com

Tip of the week

You know what’s riskier than taking risks in your career? Not taking them.

Yes, there’s comfort in stability, in choosing the “safe” path. But guess what? The people who actually go places aren’t the ones who always make the safe choice. They’re the ones who bet on themselves, take the unexpected route, and say yes to opportunities that make them a little, or a lot uncomfortable.

Not every risk will always pay off but you’ll learn more from those experiences than you ever will by playing it safe. And here’s the kicker: good people will ALWAYS be in demand. If one path doesn’t work out, another one will. If you’re smart, driven, and actually good at what you do, doors will keep opening.

So take the job at the startup. Move to that new city. Try the role that stretches you. Start the side hustle.

Trust yourself. Because the biggest career regret isn’t failing—it’s never trying in the first place.

About us

Introducing The Moolah Minute – Engaging Retail Investors Where They Are

Investor education is evolving, and Moolah Invest is leading the way. The Moolah Minute is a new content series designed to break down complex investment topics for retail investors – meeting them on social media with accessible, expert-led insights.

The first installment features HSBC’s Olga De Tapia, exploring the growing world of Islamic ETFs.

Connecting with informed investors is more important than ever. See how Moolah Invest is bridging the gap.

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.