US-Listed ETF flows stall

A handful of thematic and crypto ETF products last week and flow numbers are beginning to trickle in and not looking so pretty.

Finally, a lot of exciting activity going on in the region of Asia ETFs.

Fund Launches and Updates

EMEA

21Shares launched Europe’s cheapest physically-backed bitcoin ETP as part of its new crypto winter range designed to help investors weather the bear market.

The 21Shares Bitcoin Core ETP (CBTC) listed on the SIX Swiss Exchange with a total expense ratio of 0.21%. ETF Stream

BlackRock has launched the iShares Digital Entertainment and Education UCITS ETF (PLAY) which is listed on the Euronext Amsterdam with a total expense ratio of 0.40%. ETF Stream

Invesco has launched the Invesco EUR Corporate Bond ESG Multi-Factor UCITS ETF and the Invesco EUR Corporate Bond ESG Short Duration Multi-Factor UCITS ETF. The funds have a TER of 0.19% and 0.15% respectively. Investment Week

Jacobi Asset Management announced their intention to launch the Jacobi Bitcoin ETF on the Euronext Amsterdam Exchange under ticker symbol ‘BCOIN’. The new ETF will begin trading in July and has a TER of 1.5%. This is also an industry first for Netherlands as this Bitcoin ETF will be the first primary listing of a Crypto fund in the Netherlands. Financial Post

VanEck has launched the VanEck Sustainable Future of Food UCITS ETF (VEGI) and VanEck Space Innovators UCITS ETF (JEDI). Both ETFs are listed on the London Stock Exchange and Deutsche Boerse with total expense ratios (TER) of 0.45% and 0.55%, respectively. ETF Stream

AMERICAS

BondBloxx Investment Management announced the launch of the BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF (XEMD), which began trading on the CBOE. Expense ratio 29bps. VettaFi

New ETF entrant, NightShares, is launching funds designed to give investors a way to tap into the outperformance of overnight markets. Its first two ETFs, the NightShares 500 ETF (NSPY) and the NightShares 2000 ETF (NIWM), have an expense ratio of 0.55%. Financial Times

Franklin Templeton announced the launch of the Franklin Responsibly Sourced Gold ETF (FGLD) on NYSE Arca. Expense ratio 0.15%. Business Wire

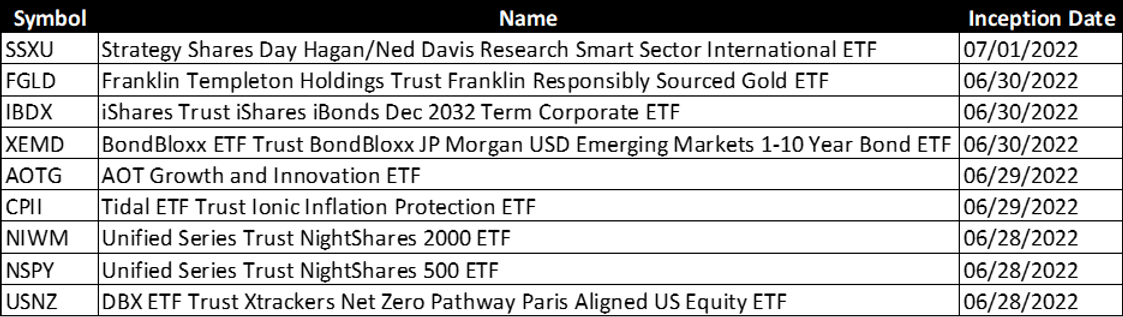

Full List of U.S. ETF Launches:

ASIA-PACIFIC

Fubon Fund Management is set to launch the Fubon Hang Seng Shanghai-Shenzhen-Hong Kong (Selected Corporations) High Dividend Yield Index ETF (3190 HK) on the Hong Kong Stock Exchange. The ETF has a management fee of 0.60%. ETF Strategy

Pending investor approval (75%), Hang Seng Investment Management plans to delist its $5.51bn Hang Seng index ETF in September as part of its process of taking over the management of the identical but larger State Street Global Advisors’ Tracker Fund.

It comes two months after Hang Seng IM announced it had been named as the new manager of the Tracker Fund, taking over the role from SSGA, which had held the position for more than two decades, after being appointed by the Hong Kong government to develop and launch the ETF. Financial Times

Flows

At the time of writing, June numbers were not out but we have a peek into ETF flows YTD and for the 2nd quarter. According to Matthew Bartolini, head of SPDR Americas research, US-listed ETFs have gathered around $223 billion this year through June 28.

This is a “significant deceleration” compared to both the first and second half of 2021 where ETFs attracted around $389 billion in the first six months of last year with 2022’s inflows so far dropping around 43% from that level.

Sector ETFs have collectively seen outflows of $13.3 billion in the second quarter through June 28 with the financial sector suffering “sizable” outflows of $15 billion through June 28 for that period.

In other sector outflows in the second quarter, investors have withdrawn around $3.1 billion from energy ETFs as of June 28 most likely capturing gains.

ETFs that invest in high-yield corporate debt have seen “massive” outflows in the first half of this year through June 28, with investors pulling about $15.9 billion. Marketwatch.

Noteworthy

Megatrend-themed ETFs are becoming a core element of many investment portfolios across Asia Pacific.

According to BlackRock, which has approximately $40 billion of thematic ETFs and index assets under management, there are five megatrends that transcend current economic and geopolitical events.

These include: 1) climate change and resource scarcity 2) demographics and social change 3) emerging global wealth 4) rapid urbanization and 5) technological breakthroughs.

As stated by a survey of institutional investors, 84% of respondents intend to increase their exposure to ETFs in 2022, with the three most popular themes being ESG, technology, and digital assets. And while the U.S. and EMEA remain the biggest markets globally for thematic investing, millennial Asian investors are turning more towards thematic ETFs.

This demographic, which finds ETFs easy to understand, is largely drawn to topical themes, such as blockchain, electric vehicles, clean energy and green tech. FI News Asia

ETFs listed on both Hong Kong and mainland China exchanges will be included in the existing Stock Connect scheme as of this week.

“ETF Connect is an important milestone because for the first time Stock Connect is expanded beyond stock trading,” said Ashley Alder, chief executive officer of the Hong Kong Securities and Futures Commission. “It will catalyse Hong Kong’s growth as an ETF hub and underscore Hong Kong’s unique role connecting global capital with the mainland,” he added.

After the launch, the trading of eligible mainland funds will be open to all Hong Kong and overseas institutional and individual investors through the scheme.The northbound list includes 83 mainland-listed ETFs, with 53 listed in Shanghai and 30 in Shenzhen. Fund Selector Asia

The European Securities and Markets Authority (ESMA) has said it is seeing “growing momentum” among regulatory bodies to address the issues of ESG rating providers after their shortcomings were again exposed in recent industry feedback.

In a call for evidence, in which the industry body received 154 responses, ESG rating providers were found to have several issues including: 1) insufficient granularity of data, 2) complexity and 3) lack of transparency around methodologies.

ESMA also highlighted concerns raised around market concentration, with the majority of users dealing with a small number of the same providers. ETF Stream

Additional reads

Is ETF education a lost cause in the UK?. ETF Stream

Last week, Citigroup had to halt online purchases of ETFs for their UK customers due to a system enhancement that caused tech issues. Financial Times

RBB Fund grows its ETF segment and is set for international expansion. ETF Express

VanEck files another application for a spot Bitcoin ETF. Inside Bitcoins

Grayscale got its answer on a Bitcoin ETF. And didn’t like it. Bloomberg

In the U.S., Fidelity plans to roll out a direct indexing tool that will require investment of as little as $1 per stock, a significant move opening up the concept to small investors. Financial Times

Wave of payout-focused ETFs on way as bond volatility builds. Bloomberg