The Race for Direct Indexing is on

A slew of large asset managers are acquiring or launching their own direct indexing strategies which may prove to be competition for ETFs.

Fund Launches and Updates

EMEA

BlackRock has launched the iShares € Corp Bond ESG Paris-Aligned Climate UCITS ETF (CBUJ) with €50m in seed capital. The ETF is listed on Xetra with a total expense ratio of 0.15%. ETF Stream

Franklin Templeton launched the MSCI China Paris-Aligned Climate UCITS ETF which listed on the London Stock Exchange, total expense ratio of 0.22%. Investment Week

This week Iconic Funds has two significant announcements with the launch of the Iconic Physical ApeCoin ETP. The ETP is listed on the Boerse Stuttgart and will provide exposure to the ecosystem built around the Bored and Mutant Ape Yacht Club NFTs developed by Yuga Labs. TER of 1.49%. The firm also revealed its intention to work with third parties to launch white label products from its platform. ETF Stream

Invesco has launched the Invesco MSCI Emerging Markets ESG Climate Paris Aligned UCITS ETF which has been listed on London Stock Exchange, Xetra, Borsa Italiana, and SIX Swiss Exchange. The fund comes with an expense ratio of 0.19%. ETF Strategy

Legal and General Investment Management (LGIM) has added two ETFs to its Paris-aligned range after changes were made to the index methodology on its US and Europe equity ETFs. The $97m L&G Europe Equity Responsible Exclusions UCITS ETF (RIEU) and the $843m L&G US Equity Responsible Exclusions UCITS ETF (RIUS) now meet the requirements for the European Union’s Paris-Aligned Benchmarks (PAB). ETFStream

The Royal Mint has renamed the Royal Mint Gold ETC to the Royal Mint Responsible Sourced Physical Gold ETC (RMAU) after the strategy became the world’s first ETC to be backed by recycled gold. ETF Stream

AMERICAS

J.P. Morgan finalised their conversion of the actively managed $5 billion JPMorgan International Research Enhanced Equity Fund into the JPMorgan International Research Enhanced Equity ETF (JIRE).

The fund was the fourth and final product in a series of conversions of mutual funds into ETFs that began in April. The converted ETFs have roughly $8 billion in combined assets under management. JIRE comes with an expense ratio of 0.24% and is listed on the NYSE Arca.

Principal switched two of its passively managed ETFs to actively managed –the Principal Quality ETF (PSET) dropped the NASDAQ US Price Setters Index to become actively managed, while the Principal Value ETF (PY) dropped the NASDAQ U.S. Shareholder Yield Index to do the same. ETF.com

Another first for ProShares as they will be launching the ProShares Short Bitcoin Strategy ETF, ticker BITI, this week. Mint

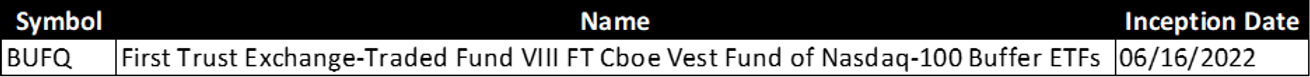

Full List of U.S. ETF Launches:

Noteworthy

Investment firms are racing to provide access to direct indexing (DI) as demand rises for portfolios that are more personalised and tax efficient. Many firms are rushing in, acquiring new fintech partners and building out their DI offerings. “There is a bit of a race on at the moment,” says Daniel Needham, president of wealth management at Morningstar.

Highlights of recent activity include:

Morningstar purchased direct-indexing specialist Moorgate Benchmarks in September

BlackRock acquired Aperio in November 2020

JP Asset management picked up OpenInvest in June 2021

Vanguard made its first acquisition in its history when it bought Just Invest in July 2021

In April, Charles Schwab, launched a DI product for customers, as part of a tax management offering

This year, Fidelity has added 12,000 new jobs as part of a push to expand into new areas such as DI.

In 2020, around $3.5bn was managed through DI. That figure is expected to grow an average of 34 per cent per year for the next five years to $1.5tn, from wealth manager demand alone. Financial Times

The so-called “names rule” recently proposed by the Securities and Exchange Commission could force all funds — not just those that incorporate ESG factors — to re-evaluate their names and strategies.

In late May, the commission floated a rule amendment that would allow US-listed funds to include their investment strategies in their names only if at least 80 per cent of their assets aligned with that strategy.

If finalised as proposed, funds that specifically identify words linked to their strategies would have one year to comply with the Names Rule. Financial Times

The FT recently published an article summarising “the Problem of Twelve” where some think that the end result of the current passive investing trend is that just a dozen or so people could end up enjoying control over most public companies globally.

The FT came up with the following guess on said 12 aka the most powerful people of the investment industry: 1) Larry Fink 2) Tim Buckley 3) Abigail Johnson 4) Ron O’Hanley 5) Henry Fernandez 6) Dan Draper 7) Arne Staal 8) Gary Retelny ISS 9) Kevin Cameron 10) Masataka Miyazono 11) Nicolai Tangen and 12)Peng Chun Financial Times

A recent study found the majority of Scalable Broker clients invest in ETFs with the largest group among them being “Generation Y” at 32%.

ETFs are the clear favourite: Two out of three investors invest in ETFs with the top nine most popular names are all globally diversified ETFs.

Slightly less strongly represented are investors of “Generation X”, who are between 35 and 48 years old (around 27 per cent). Their commission-free savings plan offer with over 2,000 ETFs and stocks is actively used, the firm says. ETF Express

Additional reads

Global X CEO Luis Berruga has revealed the group’s grand plans after it broke into the Australian market with the acquisition of ETF Securities Australia. ETF Stream

ETF Express provided a nice summary on the growth of Franklin Templeton Europe and VanEck Europe. ETF Express and ETF Express

Food-related ETFs for amounting shortages. Financial Times

Larry Fink recently mentioned “as we see increasing interest from our clients, BlackRock is studying digital currencies, stablecoins and the underlying technologies to understand how they can help us serve our clients. Financial Times

Apex Group has been appointed by 3iQ Digital Asset Management (3iQ), one of Canada’s largest digital asset investment fund manager to provide fund administration, listed transfer agency and custody services. Hedgeweek

DFA is breaking new ground as an ETF provider. What took so long? Citywire

JPMorgan Asset Management chief George Gatch predicts that in the long term “ETFs will overtake mutual funds”. Financial Times

How Global Trade, China, ETFs, and Derivatives Exploded Over 30 Years. Bloomberg

The SEC looks at tightening rules for index providers. Financial Times