The research was based on feedback from professional investors based in the UK, France, Germany, Italy and Switzerland and found that 10% of investors in fixed income ETFs feel the current ESG offering is poor, with another 29% describing it as average.

Tabula to increase focus on fixed income ESG ETFs

After a recent firm survey across Europe, Tabula has announced plans to steer their focus towards more ESG focused Fixed Income strategies.

We are getting closer to seeing Grayscale launch more products in Europe and AXA IM may be re-entering the ETF arena.

Fund Launches and Updates

EMEA

Chimera Capital, an Abu-Dhabi-based investment management firm and subsidiary of Chimera Investment, announced the launch of the Chimera S&P US Shariah Value Exchange Traded Fund and the Chimera S&P US Shariah Growth Exchange Traded Fund on the Abu Dhabi Securities Exchange (ADX). Zawya

CoinShares has launched two staked exchange-traded products tracking comos and polygon cryptocurrencies. The CoinShares Physical Staked Comos ETP (COMS) and the CoinShares Physical Staked Matic (CPYG) are listed on the Deutsche Boerse with total exchange ratios of 1.50%. ETF Stream

Franklin Templeton has launched the Franklin Catholic Principles Emerging Markets Sovereign Debt UCITS ETF (EMCV). The fund is set to list on the Deutsche Boerse and Borsa Italiana on 30 June and the London Stock Exchange on 1 July with a total expense ratio of 0.35%. ETF Stream

HSBC Asset Management launched the HSBC S&P 500 UCITS ETF USD (Acc) on the London Stock Exchange. ETF World

DWS Xtrackers has listed the Xtrackers MSCI China A ESG Screened Swap UCITS ETF to the LSE (London Stock Exchange). TER is 0.29% ETF World

JP Morgan Asset Management has listed two new active ETFs on the London Stock Exchange. The JPMorgan Climate Change Solutions UCITS ETF (T3MP) has a total expense ratio 0.55%.

JUKE, the first active UK equities UCITS ETF to market, TER of 0.25% T3MP has also listed on the Deutsche Börse Xetra, SIX and Borsa Italiana, while JUKE has also listed on the Cboe NL. Investment Week

Satrix has launched its 26th ETF, the Satrix Smart City Infrastructure Feeder ETF on the main board of the JSE Ltd. News 24

Tabula Investment Management has closed the Tabula iTraxx IG Bond UCITS ETF (TTRX) and the Tabula European iTraxx Crossover Credit Short UCITS ETF (TECS) as they increase their focus on ESG strategies. ETF Stream

THE AMERICAS

Nuveen has launched the actively managed Nuveen Global Net Zero Transition ETF on Nasdaq (ticker NTZG), expense ratio of 0.55%.

The new fund brings the total number of funds in Nuveen’s ETF suite to 19, with the other 18 funds accounting for $7.9 billion in AUM as of May 31. PIOnline

New York-based Optimize Advisors has launched its debut ETF — the actively managed Optimize AI Smart Sentiment Event-Driven ETF (OAIE US) which has been listed on NYSE Arca with an expense ratio of 1.00%. ETF Strategy

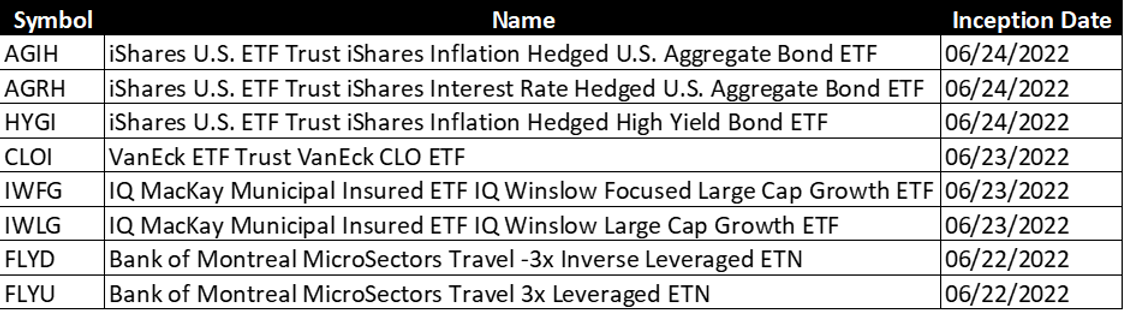

VanEck launched the VanEck CLO ETF CLOI, which provides exposure to the $1 trillion collateralized loan obligation market.

The fund is subadvised by PineBridge Investments, a private global asset manager focused on active, high-conviction investing. CLOI is listed on the NYSE and has a total expense ratio of 0.4%. Nasdaq

IndexIQ said it was launching its first active, semi-transparent ETFs, the IQ Winslow Large Cap Growth ETF IWLG and IQ Winslow Focused Large Cap Growth ETF IWFG.

The new ETFs are managed by Winslow Capital Management a subadviser for New York Life Investments. PIOnline

Schwab Asset Management announced reduced expense ratios of seven ETFs and three actively managed mutual funds. Morningstar

Full List of U.S. ETF Launches:

In Brazil, VanEck, in partnership with Brazilian asset manager Investo, announced the launch of the Investo VanEck ETF MVIS Crypto Compare Smart Contract Leaders Brazil Fundo de Índice – Investimento no Exterior (ticker: BLOK11).

This fund marks the latest expansion of VanEck’s product lineup in Brazil, closely following the mid-March launch of four ETF BDRs. Businesswire

Noteworthy

It’s been a week of surveys with three different provided by BNP Paribas Asset Management, GraniteShares, and Tabula.

A high level summary: Through their recently-launched European ESG ETF Barometer, BNP found that 82% of respondents considered thematic ESG ETFs to be active strategies, even though they are indexed based.

Additionally, the poll showed ESG ETFs to be currently accounting for 16% of all European ETF assets with 91% of survey respondents said they expected that level to remain stable or increase over the next 12 months. IPE News

The GraniteShares ETP study might win the best clickbait subject with their survey stating, “crypto and share traders are investing in bed and at work”.

This underlines how the UK’s interest in trading hasn’t ended with the end of COVID restrictions and less working from home as “Just one in six regular traders have cut back since the end of COVID restrictions and less working from home”. ETF World UK

And finally, the Tabula survey focused on ESG offerings within fixed income ETFs.

The research was based on feedback from professional investors based in the UK, France, Germany, Italy and Switzerland and found that 10% of investors in fixed income ETFs feel the current ESG offering is poor, with another 29% describing it as average. Only 7% think it is excellent. The Armchair Trader

UK-based Dawn Global Management Ltd has expressed plans to provide ETF technical support and training for the launching on Bangladesh’s first ETFs.

Last month, the Dhaka Stock Exchange (DSE) announced today that it is going to allow asset managers to launch ETFs which will invest in certain index and primarily the blue-chip index that is DS-30. TBS News

ETF Express recently published an article claiming AXA IM is ready to re-enter the ETF market.

In an interview, they are quoted as saying: “We can confirm that ETFs is an area we could consider as we see that, as an investment vehicle, ETF can be attractive for our clients next to our existing range of mutual funds”.

AXA IM had left the ETF business in May 2009 after the sale of EasyETF to BNP Paribas Asset Management, with which it had jointly launched it in February 2005.

The March 2022 appointment of the former head of ETFs at Euronext, Brieuc Louchard, as head of capital markets, served as an indication of a possible return of AXA IM to the ETF market. ETF Express

Additional reads

Grayscale Bitcoin Trust lines up Jane Street, Virtu in ETF Bid. Bloomberg

A flurry of twitter activity around the absurdity of a recent article claiming ‘the rise of ETFs are destabilising emerging markets’. Financial Times

Bearish bets are dominating ETF market like 2008. Bloomberg

Smart beta ETF launches sink to 12-year low. Financial Times

ESG funds and ETFs suffered their first monthly outflows in three years, with investors pulling a net $3.5bn from these strategies in May. BlackRock trims ESG fund exposure in model portfolios. Citywire

Just as school is letting out and travel is back to its highest levels (with bonus airport chaos included), U.S. Global Investors, Inc. announced that its airlines ETF, the U.S. Global Jets ETF (JETS), has been approved by Ameriprise Financial, Inc. and is now available to Ameriprise’s more-than 10,000 advisors.

Not surprised by a press release around this given the importance of obtaining platform access. GuruFocus