Show Me the Money! Will ETF Workers Get Their Share of the Boom?

With record-breaking inflows, relentless growth, and a flood of new players entering the market, the ETF industry is definitely in a sweet spot. White-label providers are springing up like mushrooms and the overall optimism has many in the industry thinking, “It’s payday time!” . As Jerry Maguire would say it’s time to “show me the money”.

Surely, the bonuses will be rolling in like never before, rewarding the hard work that went into this stellar year. But, is this high-flying forecast realistic?

Despite the bumper profits and expanding business, some companies might still hold back when it comes to sharing the wealth. In an industry known for efficiency, it wouldn’t be surprising if firms focused on reinvesting rather than splurging on employee bonuses.

So, is a new Ferrari in the garage for everyone? Maybe, but let’s not start shopping just yet. I’m running a survey to check the pulse of what everyone is thinking so pls click and have your say.

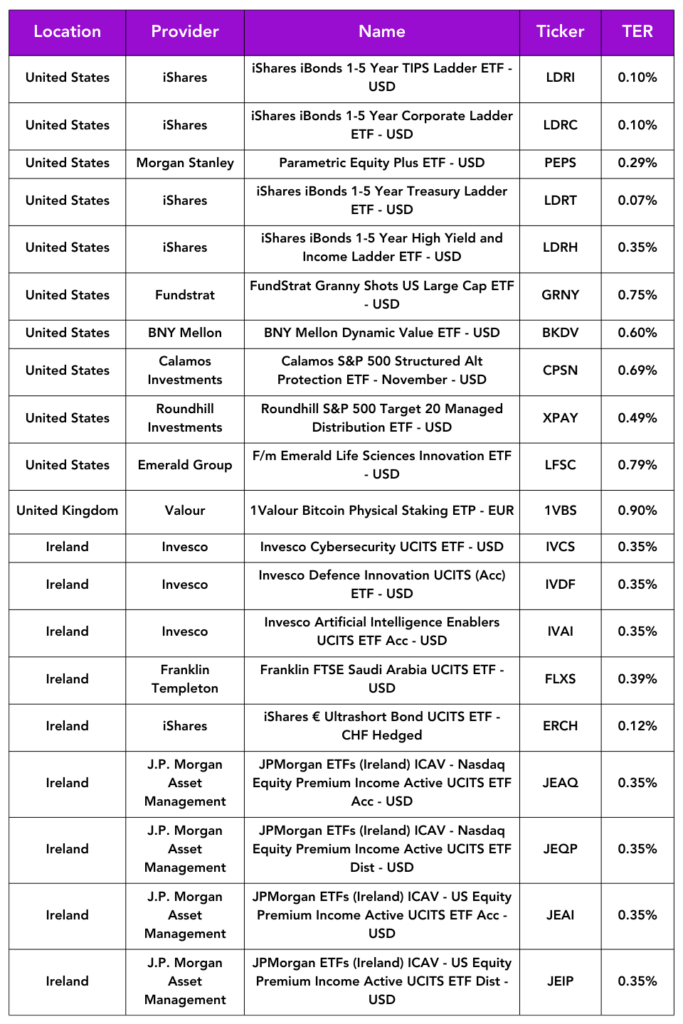

Launches this week

Flows & performance

- A monster month of inflows in the US kept ETFs on track to potentially surpass $1 trillion in net inflows in 2024.

-

Just over $118 billion flowed into U.S.-listed exchange-traded funds during October, pushing year-to-date inflows up to $812 billion.

-

If inflows for November and December are anything like October, total inflows for the year will top the 13-figure mark for the first time ever.

-

Aggregate assets under management for U.S.-listed ETFs stood at $10.1 trillion at the end of October. The bulk of October’s inflows went into the usual suspects—large, liquid broad market ETFs.

-

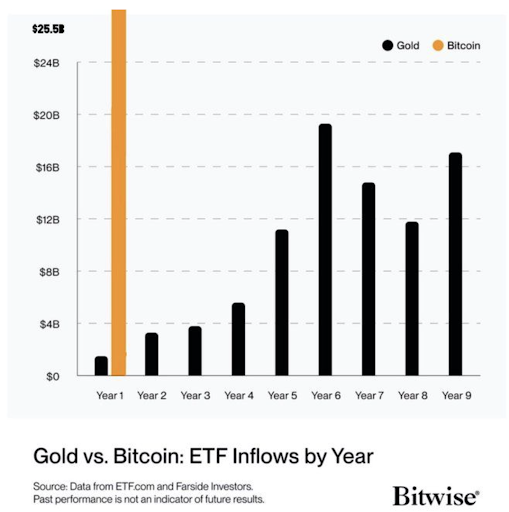

Global Exchange Traded Products (ETPs) with underlying digital assets reached a new all-time high of $100.5 billion in October 2024, marking a 13.2% increase from September.

-

The total digital asset market value grew by 8.9% to $2.54 trillion.

-

Bitcoin (BTC) ETPs saw their AUM grow by 15.4% to $83.2 billion, while Ethereum (ETH) ETPs increased by 1.4% to $10.3 billion despite a 3.5% price decrease in ETH.

-

Year-to-date, ETPs’ AUM rose by 102.9%, significantly outpacing the underlying crypto assets growth, largely due to Bitcoin Spot ETFs which accumulated net inflows of approximately $24.2 billion since their January launch.

Interesting graph from Bitwise below. As the say, a picture paints a thousand words:

Things of interest

The Central Bank of Ireland is giving away Christmas presents early this year. First it was the climb down on the naming convention for ETF share classes and now word is that they may be changing their mind on the need for daily disclosure. More details here.

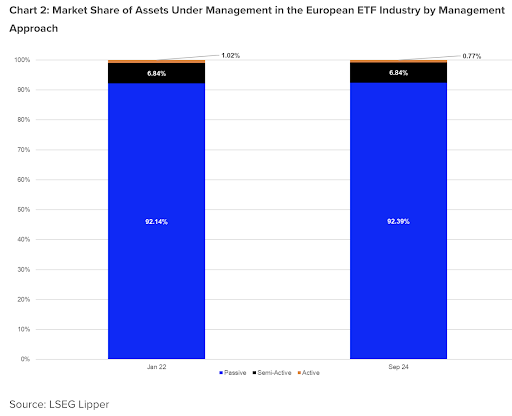

| Is there too much noise about the growth of Active ETFs in Europe? That’s the argument being made by Refinitive in their most recent analysis. |

Heavyweight manager Schroders is considering entering Europe’s fast-developing active ETF market according to rumours. That rumour is nearly as old as me now so I am sure it will come true some day.

A spokesperson said the company was “constantly reviewing what is optimal for our clients and most effective for managing their investments” as the asset management sector “evolves and the type of fund structures expands. Schroders is “looking” at the active ETF structure and would weigh up whether to launch such products if it “makes sense for our clients”, the person added.

The Hong Kong Stock Exchange (HKEX) has disclosed plans to digitalize and automate the physical subscription and redemption mechanism for exchange-traded products (ETPs) through an online platform by 2025. This initiative is contingent upon the readiness of the system and obtaining regulatory approval.

HKEX aims to integrate this platform into the primary market’s subscription and redemption mechanism for ETPs. The platform will utilize Distributed Ledger Technology (DLT) and smart contracts to connect major ETP market participants. This integration is expected to enhance the overall efficiency of the ETP market and promote sustained growth in secondary market activities.

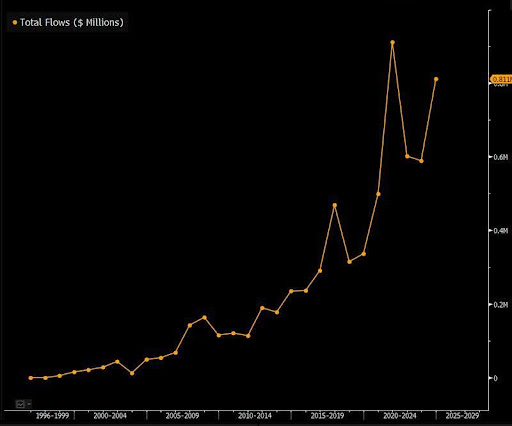

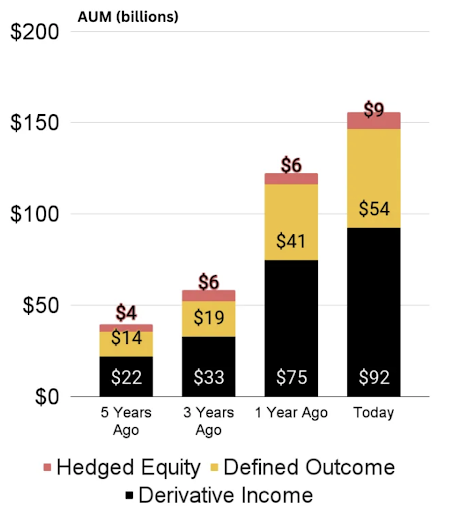

Options powered ETFs in the US continue to growth as demonstrated by the below graph but still very much in their infancy as nicely articulated in this article.

Career corner

Movers and Shakers

-

Stephen Farrell has joined JP Morgan from State Street in Dublin as an ETF Product Manager.

-

Daniel Lifshey has joined T.Rowe Price from Nuveen as a Director of ETF channel marketing.

-

Chris Wolak has joined Global X in Australia as head of portfolio management. He was previously at UBS.

On the move

European Featured Opportunities

- Senior Product Marketing Manager (ETPs) – London: As the Senior Product Marketing Manager you will take ownership of developing and executing product marketing strategies for a range of innovative crypto ETPs (Exchange Traded Products). This role acts as the bridge between key departments, including sales, research, compliance and product development, while collaborating closely with marketing experts across content, design, motion, events, and website management.

US Featured Opportunity

- Product Specialist – Georgia & Surrounding States: This role is responsible for supporting the sale of exchange traded funds (ETFs) and mutual funds to broker-dealers, wire-houses, RIAs and institutional clients. The candidate will be responsible for managing their own territory and working in conjunction with our firm partners.

Tip of the week

Tip of the week

Curiosity killed the cat? Not if you work in ETFs.

In a fast-evolving industry like ETFs, staying relevant means more than just doing your job well—it’s about being curious and proactive in learning. Take time each week to explore a new topic, skill, or trend, whether it’s a deep dive into emerging markets, the latest fintech tool, or improving your soft skills.

Curiosity keeps you adaptable and positions you as someone who’s not just ready for change but driving it. Remember, in career development, those who ask questions and seek out knowledge often find themselves at the forefront of opportunity.

About us

Wondering how top ETF firms are structuring sales team compensation?

Explore our latest report which uncovers the strategies that attract and retain the best talent in the industry. From salary structures to performance incentives, discover the insights every financial leader needs to drive team success.