Is Vanguard the Smartest Kid on the Street?

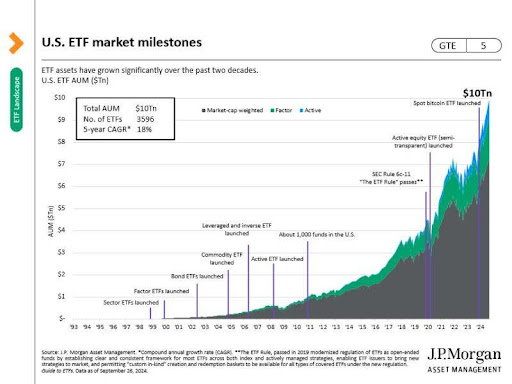

Last week marked a major milestone for the U.S. ETF market, with assets under management (AUM) surpassing $10 trillion. While ETFs typically double in size every five years, this time it took just 3.7 years to reach this milestone.

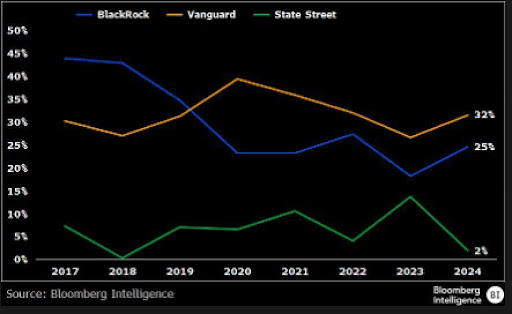

Despite the excitement around Active ETFs, as Bloomberg highlighted, the bulk of the money continues to flow into low-cost, passive strategies, with Vanguard being the primary beneficiary.

This raises an interesting question: How smart is Vanguard? They stick to what they know best, avoid distractions, and steer clear of fleeting trends. As illustrated below, they perfectly embody the core principles of what makes a great company, as outlined in Jim Collins’ renowned book, Good to Great.

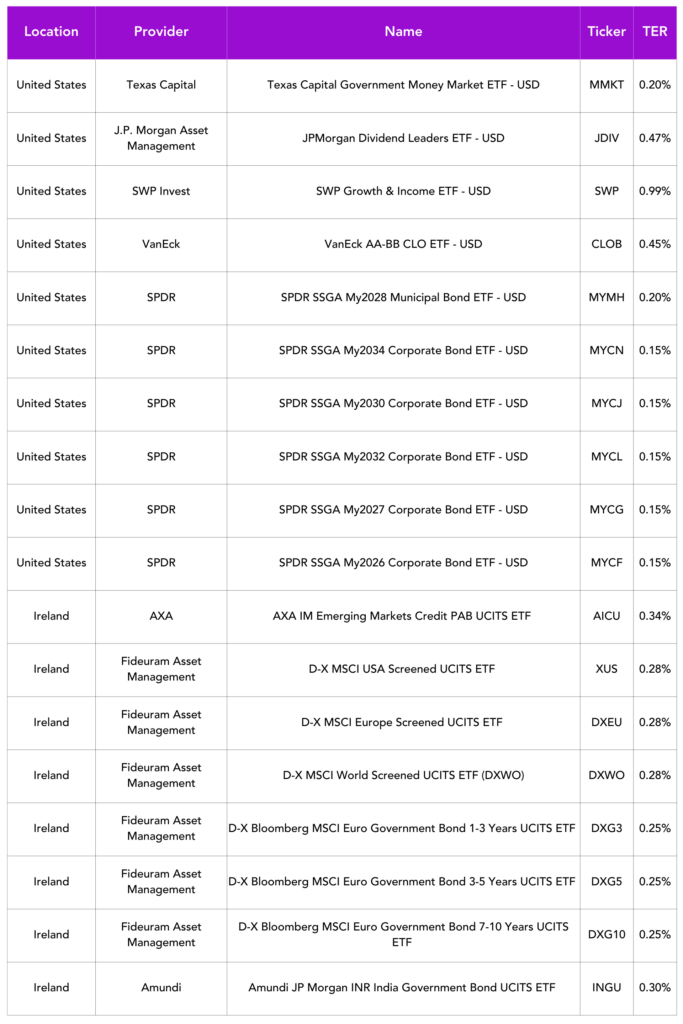

Launches this week

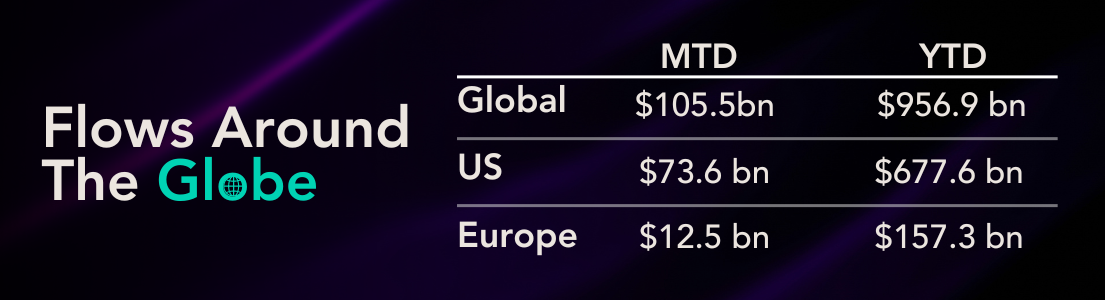

Flows & performance

Assets held by ETFs in the US hit $10 trillion for the first time as the investor-friendly products continue their relentless takeover of Wall Street.

A combination of inflows and market gains carried total assets over the milestone this week, according to data compiled by Bloomberg Intelligence. Investors have poured $691 billion into the funds this year, as US stock gauges have notched repeated records.

Things of interest

I love this recent LinkedIn post from Eric Balchunas at Bloomberg:

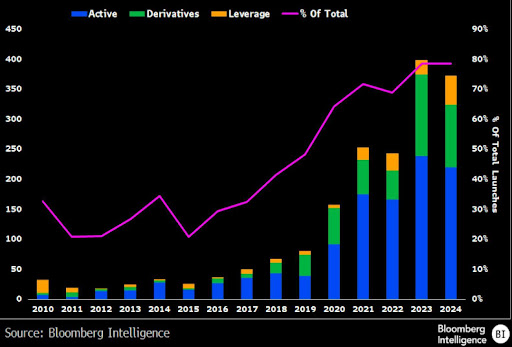

“Vanguard is getting 32% of all ETF flows (and BlackRock 25%) as the bulk of money is still buying cheap beta but at same time 80% of new ETF launches past 2yrs are leveraged, active or use derivatives.”

BNY Plans Crypto ETF Custody as Wall Street Eyes Digital Asset Revenue. With the blessing of the SEC, BNY Mellon will be allowed to hold assets for investors who own its crypto exchange-traded products (ETP), without needing to reflect these assets on its balance sheet. BNY aims to be the first bank to offer cryptocurrency custody services for its bitcoin and ether ETP clients.

ESMA advisory group issues ETF warning ahead of Europe’s T+1 move. Responding to ESMA’s consultation on the Central Securities Depositary Regime (CSDR), the Securities Market and Stakeholder Group (SMSG) said a move to a T+1 settlement cycle on the continent risks exacerbating settlement inefficiencies for the wrapper.

It also recommended ESMA considers special “attenuation measures”, such as the ability to temporarily suspend the penalty mechanism and to “avoid making significant changes to current penalty rates or methodology” ahead of the transition.

Has SSGA become an ETF White label provider? This week Fideuram Asset Management Ireland, a division of Fideuram Intesa Sanpaolo Private Banking, Italy’s largest private bank launched a suite of ETFs and did so by using SSGA to manage the platform, while State Street Investment Services will provide all the administrative services. Sounds like a white label setup, right?

Chinese authorities have announced plans to step up state investment in its rapidly expanding local ETF industry and grow the number of ETFs investing in the tech sector and small and medium-size firms. The move is intended “to better serve investors and national strategy.”

Career corner

Movers and Shakers

- Proshares has hired Daniela Castillo as VP of Marketing. She was previously at Global X.

- Robert Larsen has joined Advisors Asset Management as Head of ETF Distribution. He was previously at Allianz.

- State Street has promoted Ken Shaw to head of ETF solutions for EMEA following the departure of Ciaran Fitzpatrick to JP Morgan.

- Lisa Korbas has joined US Bank as Head of ETF Relationship Management. She was previously at JP Morgan.

- Global X ETFs Australia has named Alex Zaika as its new CEO. He joins from GAM Investments.

On the move

European Featured Opportunity

- Associate Director (Sales) – DACH Region: As the Associate Director you will be primarily charged with raising assets from the DACH region. This will be achieved through consultative relationship building with decision makers at fund management, family office, private bank and other wealth management companies. You will focus on the distribution of our industry-leading crypto asset Exchange Traded Product (ETP) platform and the development of our brand in the DACH region.

US Featured Opportunity

- Portfolio Manager – ETFs & Mutual Funds – Virginia: This role has three areas of responsibility: managing existing investment portfolios, supporting the Product Development team in developing new investment strategies/products and creating and building out the Portfolio Team’s technology and automation infrastructure utilizing Python, SQL and VBA.

Tip of the week

Always know your value. The longer you stay with a company, the greater the risk that your pay may fall below the market rate. In short, loyalty doesn’t always pay. If that happens, the only way to significantly adjust your salary may be to leave and find a new role that offers market-rate compensation.

While this might seem like a drastic step, the next best thing is to stay informed about what your peers are earning and gently remind your employer of this. Remember, they won’t bring it up—so the ball is in your court.

About us

Salary insights unlocked

At Blackwater, we are dedicated to supporting the ETF industry through expert insights, career services, and educational resources.

As part of our mission to keep professionals informed and empowered, we created the 2024 Salary Survey which is now available for purchase.

This comprehensive report offers invaluable insights into salary trends across the globe, tailored specifically for the ETF industry. Whether you’re an employer benchmarking compensation packages or a professional seeking a clearer understanding of market rates, our survey provides the data you need to stay competitive and informed.

Don’t miss out on this essential resource—get your copy today and stay ahead in your career or recruitment strategy!