European ETF market set for big shake up in 2025

Buried in the H1 financial results of Allfunds, the giant funds distribution platform, was news of their intention to launch an ETF platform in 2025.

Amongst the jargon in the report is the sentence “this new platform aims to revolutionize the distribution of Exchange-Traded Products”. REVOLUTIONIZE is a big word but in this case, it could be spot on.

Allfunds have massive distribution capabilities and what’s the biggest pain point of any new or existing ETF manager. DISTRIBUTION.

They have not used the term “White Label” but essentially that (I guess) is what they will be offering, which I suppose might be bad news for the incumbents.

If Allfunds can really open the distribution door for ETFs in Europe then this could indeed be a game changer for the market.

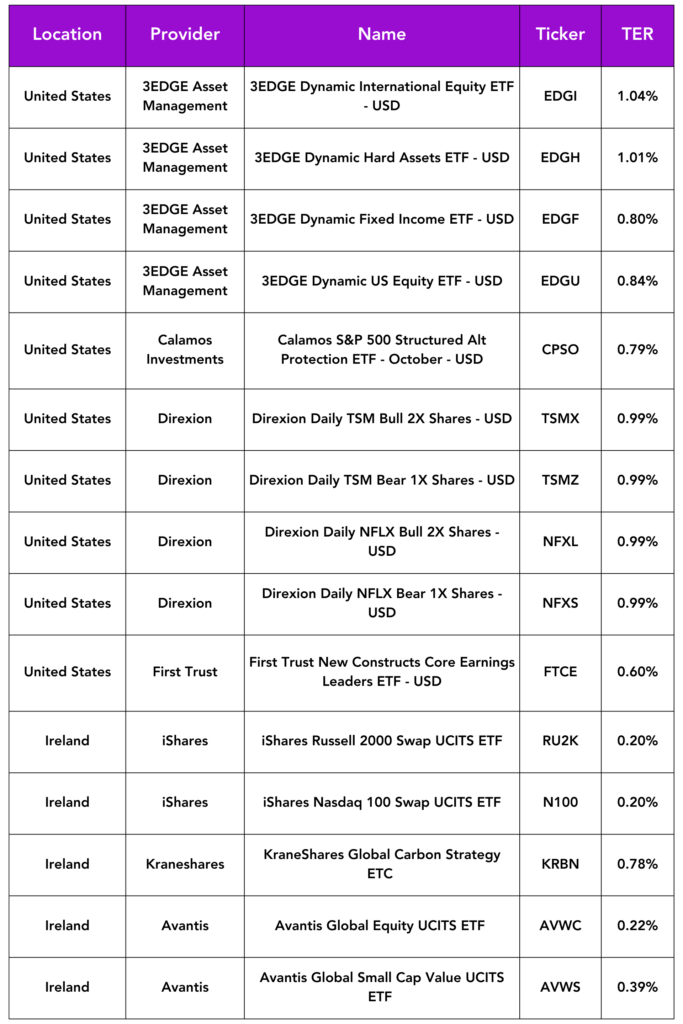

Launches this week

Flows & performance

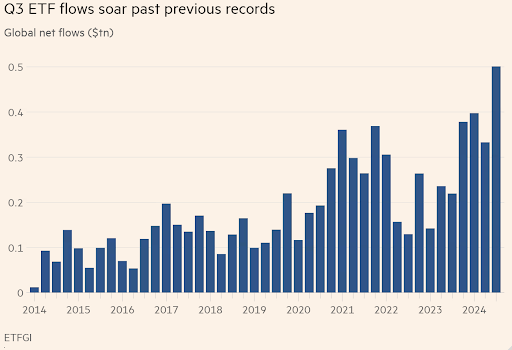

Quarterly flows into global exchange traded funds have smashed previous records with investors throwing half a trillion dollars worth of new money into the vehicles over the past three months.

Data from ETFGI, a consultancy, indicates that $501bn of net new money had already flowed into ETFs by the end of trading on September 27, which means that with one trading day to go until the end of the third quarter flows had already soared past the previous record of $398bn set in the first quarter of this year.

Taiwan equities ETF assets soar nearly 80% this year. Market’s equities-focused ETF assets hit NT$2.63tn at end-September, up from NT$1.47tn at end of last year.

The 63 equities ETFs listed in Taiwan collectively saw an increase of over NT$1.15tn in assets under management this year, data from the Taipei Exchange showed.

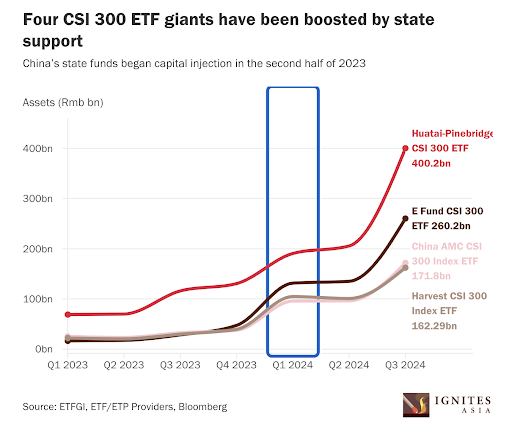

China’s stimulus reboot and stock market rebound have sent assets in its ETF sector racing above the Rmb3tn (US$427.4bn) milestone, with experts predicting no let-up in institutional and retail demand.

State-backed investment over past year has led to four huge CSI 300 ETFs dominating market, which some experts liken to Japan’s huge ETF buying programme.

Things of interest

“Allfunds will launch a cutting-edge end-to-end ETP platform in the first quarter of 2025. With new asset managers entering the market and launching new products, an open architecture ETP market is emerging.

This presents an exciting opportunity for our client base, both distributors and fund houses. As the ETF market continues to expand, this new platform aims to revolutionize the distribution of Exchange-Traded Products. In a multi-product distribution environment (mutual funds, alternative investments and ETPs), the convenience of a one-stop-shop solution becomes crucial.

This innovative approach breaks down silos and creates a streamlined, efficient, and user friendly experience for our clients. The ETP platform will efficiently provide clients access to a wide variety of ETPs, improve liquidity, and optimize distribution for both existing and new asset managers in the ETP space.

Allfunds can also target new distribution channels that are using ETPs as the main preferred wrapper of choice, offering a unique opportunity to grow share of wallet as major wealth distribution channels that purchase ETPs already work with Allfunds.”

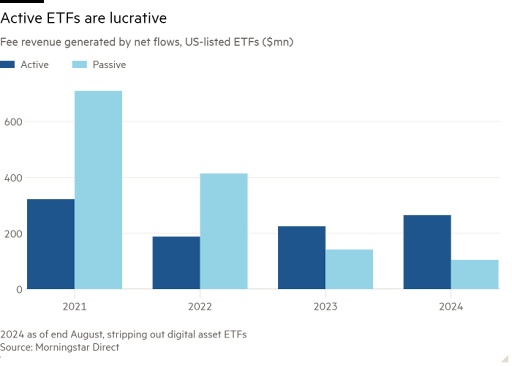

Actively managed funds have taken more than 70% of the management fee income accruing from net flows into US-listed ETFs so far this year according to the FT.

After initially ceding the fast-growing ETF market to passive funds, active managers are fighting back. Having embraced ETFs en masse, active ETFs have accounted for 28% of net flows into US-listed ETFs this year, well ahead of their 8% of assets. And thanks to their far higher fees, this has translated into active ETFs grabbing 72% of the management fee income emanating from the $588bn of fresh money piling into US ETFs in the first eight months of the year, according to calculations by Morningstar.

American Century has made its European debut with two active ETFs capturing global equities and small caps. In line with the US strategy, they have launched under the brand Avantis Investors the firm’s quantitative investment unit.

ARK Invest Europe has partnered with trading and investing platform eToro to launch a ‘smart’ portfolio of ETFs covering technology and innovation.

The ARK-FutureFirst portfolio contains seven ARK ETFs capturing technology, healthcare and sustainability, including three of ARK Invest’s ETFs that launched in April this year.

“How Jane Street rode the ETF wave to ‘obscene’ riches”. Interesting article on the FT about the growth of Jane Street. Last year was the fourth straight year that Jane Street generated net trading revenues of more than $10bn. Its gross trading revenues of $21.9bn were equivalent to roughly one-seventh of the combined equity, bond, currency and commodity trading revenues of all the dozen major global investment banks last year, according to Coalition Greenwich data.

In the first six months of 2024 net trading revenues rose another 78% year-on-year to hit $8.4bn. Not too shabby at all I’d say.

Bitwise submitted a filing to the U.S. Securities and Exchange Commission for an ETF tied to the price of Ripple’s XRP. XRP is the seventh-largest cryptocurrency by market capitalization at $33 billion.

Career corner

Movers and Shakers

- Miriam Breen has joined BNP Paribas as head of BD for UK and Ireland. She joins from LGIM.

- Optiver has expanded its European sales team with the hire of Pasquale Capasso. He joins from Invesco.

- Brian Hoey has joined Inspire ETFs as an ETF Sales Specialist. He joins from Advisors AM.

- Mark Collet has joined BlackRock in Australia as an ETF Capital Markets Specialist. He joins from Global X.

On the move

European Featured Opportunities

- Associate Director (Sales) – Geneva/Benelux: As the Associate Director you will be primarily charged with raising assets from French-speaking Switzerland & the Benelux regions. This will be achieved through consultative relationship building with decision makers at fund management, family office, private bank and other wealth management companies. You will focus on the distribution of our industry-leading crypto asset Exchange Traded Product (ETP) platform and the development of our brand in Switzerland, Benelux.

- Associate Director (Sales) – DACH Region: As the Associate Director you will be primarily charged with raising assets from the DACH region. This will be achieved through consultative relationship building with decision makers at fund management, family office, private bank and other wealth management companies. You will focus on the distribution of our industry-leading crypto asset Exchange Traded Product (ETP) platform and the development of our brand in the DACH region.

US Featured Opportunity

- Index Methodology Research Lead – New York: This is an opportunity for you to become part of the world’s leading exchange as part of its fast-growing index business. The role entails working in a team of experts supporting existing indexes to maintain competitive positioning and help drive overall growth in assets of tracking products, while also contributing to the creation of new financial products.

Tip of the week

How many times have you relied on other people for help during your career? We can all remember that one person who went out of their way to help us when we needed it.

So when the shoe is on the other foot, don’t forget to give back. We all need a hand at some stage and often the more you give you more you get.

About us

The war for talent

The market for ETF roles right now is buoyant both in Europe and in the US. There is a real war for talent which is primarily comp driven – if people want talent with experience they are going to have to pay for it. Junior roles are the same, negotiating over US$100K and bringing just 2-3 years experience with them.

Our team has crafted a number of resources to make candidates more competitive, and to provide firms market compensation trends. Dig into our suite of opportunities below: