European ETF flows rebound in October

This past month ETF flows thankfully made up for an ugly September but on the opposite end, a recent Cerulli report claims the ETF industry in Europe is plateauing.

Fund Launches and Updates

EMEA

BlackRock has launched the iShares MSCI USA Swap UCITS ETF (MUSA), listed on Euronext Amsterdam and Euronext Paris with a total expense ratio of 0.07%. ETF Stream

DWS has launched the Xtrackers Tips US Inflation-Linked Bond Ucits ETF and the Xtrackers Eurozone Government Bond ESG Tilted Ucits ETF. Citywire

ETC Group is set to close their proof-of-work ethereum ETP. ETF Stream

Hashdex has launched the Hashdex Crypto Momentum Factor ETP. The new ETP is listed on the SIX Swiss Exchange, Deutsche Boerse XETRA, Euronext Paris and Euronext Amsterdam. ETF Stream

AMERICAS

In Canada, CI Global Asset Management has launched the CI Global Investment Grade ETF (CGIN CN) and CI Global Bond Currency Neutral ETF (CGBN CN) — management fees of 0.50% and 0.70%, respectively. ETF Strategy

In the States, Allianz Investment Management has launched the AllianzIM U.S. Large Cap Buffer10 Nov ETF (NVBT) and the AllianzIM U.S. Large Cap Buffer20 Nov ETF (NVBW).

BNY Mellon Investment Management has launched the BNY Mellon Global Infrastructure Income ETF (ticker: BKGI). The ETF becomes BNY’s 15th ETF and its seventh active ETF offering. PR Newswire

New entrant, Client First Tax & Wealth Advisors has launched its first exchange traded fund, the Adaptiv Select ETF (NYSE Arca: ADPV). The actively managed U.S. large-cap stock selection fund listed on the New York Stock Exchange. VettaFi

Dimensional Fund Advisors listed three new equity sustainability exchange traded funds on the New York Stock Exchange.

The new funds are: the US Sustainability Core 1 ETF (NYSE: DFSU), the International Sustainability Core 1 ETF (NYSE: DFSI), and the Emerging Markets Sustainability Core 1 ETF (NYSE: DFSE). The three new funds bring their lineup of ETFs to 27 with approximately $64 billion in AUM. VettaFi

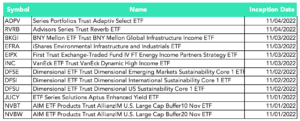

Full list of U.S. launches:

Flows

The European ETF flows thankfully reversed course in October and enjoyed positive net flows over €6bn of assets across equities and fixed income products, according to Henry Jim with the Bloomberg Intelligence team.

A whopping 343 new ETPs have listed so far this year and if this pace of launches continues, Europe will be on track to pass the 400 annual launches for the first time.

For the month of October, US-listed ETFs had $86.5bn of net inflows, their best months since March when they topped $95bn.

And year-to-date, US ETFs have pulled in almost $500bn in new client money well below last year’s tally of $935bn but in line to overtake the record before that of $501bn in 2020.

In comparison, US mutual funds have seen net outflows of $790bn in 2022, far worse than the decline of $59bn last year and $484bn in 2020. Financial Times

Noteworthy

ETFs: slowing growth?

The European ETF industry is facing slowing growth prospects. This is according to a recent Cerulli Associates report which surveyed global ETF providers. We don’t agree, but we didn’t write the report.

Focusing primarily on the European industry, Cerulli found that because ETF assets have hovered around $1.3tn and haven’t moved much since last year, 37% of the respondents said they will look at entering new markets, while a similar number plan to review M&A opportunities, and 31% plan to continue cutting fees. PI Online

ETFs in retail sector

Online broker Trade Republic has added 1,000 ETFs to its platform from issuers including Vanguard, Invesco and VanEck, taking their retail platform’s ETF offering to over 2,400.

Headquartered in Berlin, the firm last month expanding its trading service to 11 new markets in Europe. The firm’s app and desktop service offer free ETF and stock-based savings plans as well as €1 trading on individual assets.

It’s great to see this type of offering from a retail broker and let’s hope to see further ETF acceptance and growth within the retail sector. ETF Stream

Additional reads

Tidal eyes European expansion. ETF Stream

Pre-hedging ETF orders on RFQ platforms is costing investors and creating an uneven playing field. ETF Stream

What Goldman Sachs’ ETF accelerator move means. VettaFi

Dublin-based Waystone completes deal for KB Associates as part of its bid to become the largest Ucits funds provider in the country. Citywire

The launch of a suite of DWS cross-listed exchange traded funds in Hong Kong and Singapore could be game changing for Asian investors. Financial Times

JPMorgan executes its first DeFi trade using public blockchain. Bloomberg

BlackRock, Vanguard, and Charles Schwab are proving pilot proxy voting access to clients. Financial Times

In Australia, Global X commits to crypto ETFs as some rivals delist. AFR

Kaplan Professional and BlackRock have launched in Australia a short course on exchange traded funds (ETFs). Money Management

Hong Kong’s Securities and Futures Commission looks set to allow the launch of exchange traded funds tracking cryptocurrency futures for retail investors. Financial Times

From behind the desk with Andrea Murray

It was impossible to miss the headline news last week that China markets finally enjoyed some positive returns after an ugly run so far this year.

The optimism over easing of Covid restrictions prompted by an unverified post detailing a China reopening plan, sent investors on a buying spree.

The Hang Seng surged 5.3%, its biggest weekly gain in 11 years, and the Shanghai Composite reached a 5.3% weekly gain, according to Reuters.

Some products were apparently up close to 20% over the course of a week helping erase some significant YTD losses.

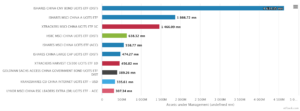

One can imagine that market gyrations have had an impact on AUM and below is a sampling of where some of the Europe listed China equity stand.