ETFs vs A Bruce Springsteen Concert

ETFs are increasingly reminiscent of a Bruce Springsteen concert—both are exhilarating experiences that keep improving over time.

Just as Springsteen captivates audiences with his high-energy performances and an ever-evolving setlist, ETFs are revolutionizing the investment landscape.

And like a Springsteen show, everyone wants a ticket to the ETF show as demonstrated by Citi’s announcement that they plan to launch a white label services, following in the heels of Goldman Sachs and Allfunds.

And as demonstrated by the flows this year, investors are drawn to the excitement and flexibility that ETFs provide, akin to fans revelling in the nostalgia and thrill of a live show from The Boss. Ultimately, both deliver unforgettable experiences that keep audiences coming back for more.

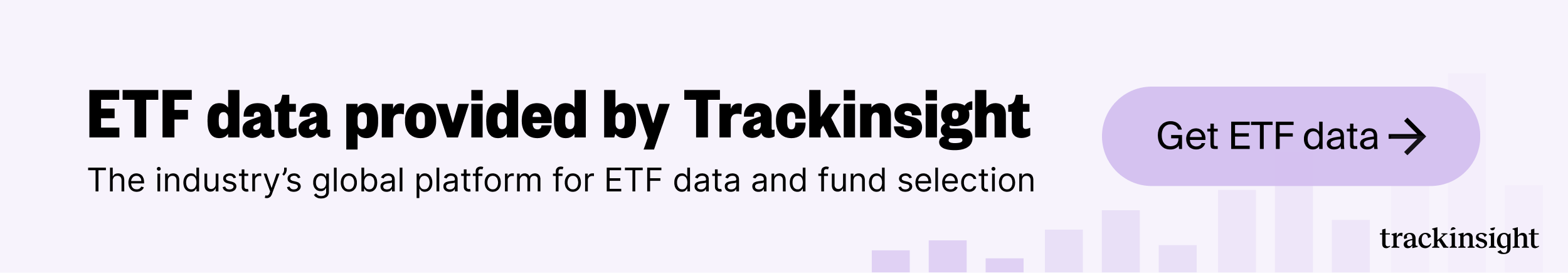

Launches this week

Flows & performance

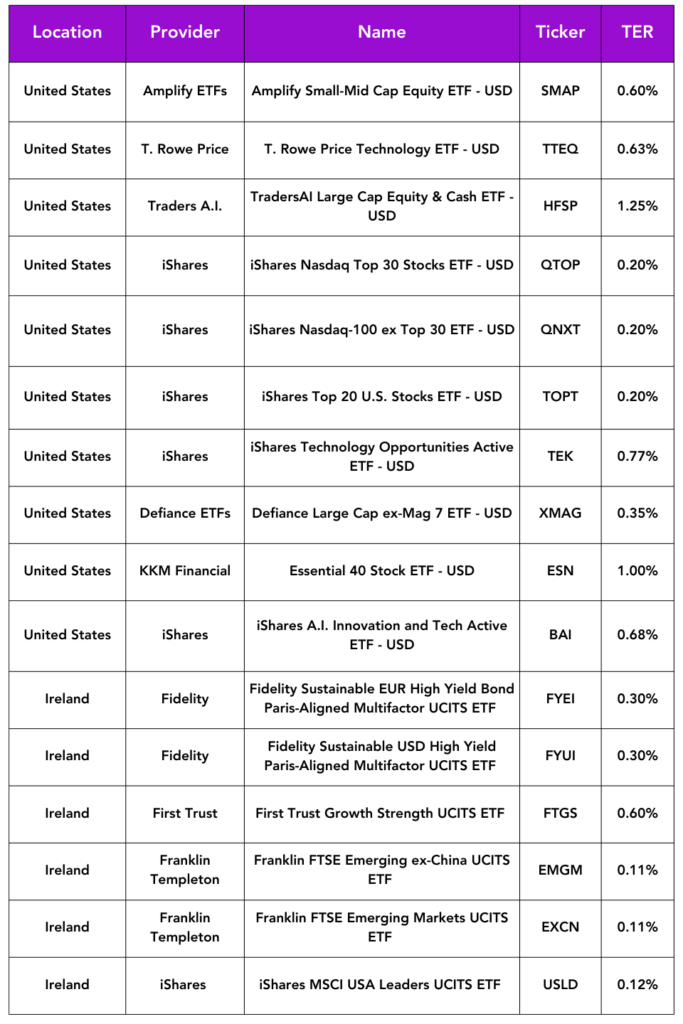

Assets invested in the global ETFs industry reached a record of US$14.46 Tn at the end of September 2024 according to ETFGI.

The global ETFs industry gathered US$164.74 billion in net inflows in September, bringing year to date net inflows to a record US$1.24 trillion.

Morningstar reports that the first nine months of 2024 were a period with strong inflows for the European ETF industry. The increase in assets under management of €353.5 bn over this period was driven by the performance of the underlying markets (+€186.3 bn), while the estimated net sales contributed €167.2 bn to the growth of assets under management.

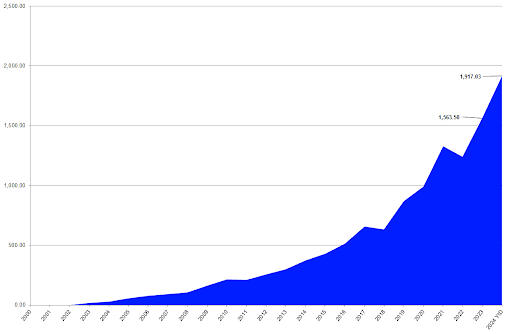

Australia’s booming ETF industry recorded a nearly 50 per cent growth in assets over the past 12 months helped by robust flows into global equities-focused passive strategies, data shows.

Total assets across Australia’s 394 ETF products rose to a new all-time high of A$226.6bn ($152.4bn) as of end-September, up 48.6 per cent from A$152.2bn at the same time last year, according to Global X.

It’s winter for thematic ETFs right now. Investors are leaving ETFs tied to specific themes, such as artificial intelligence and video gaming, as they flock to funds linked to broad stock-market benchmarks that are hitting record highs. The result being that Thematic ETFs face a third-consecutive year of outflows, losing $5.8 billion in 2024.

Things of interest

Institutional adoption of ETFs by asset owners such as pension funds and insurance companies has accelerated in Europe since 2020, according to BlackRock’s analysis of its own iShares ETF ownership. There has been a compound annual growth rate of 29% since 2020 in the value of iShares held by the largest European institutions.

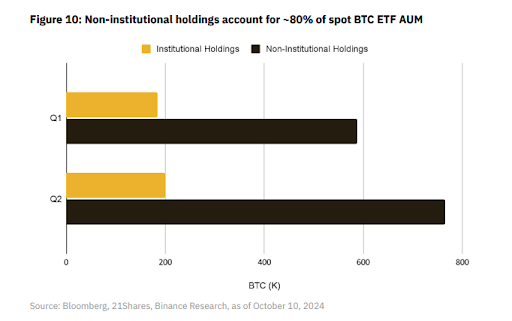

Retail investors are responsible for most of the demand for spot Bitcoin ETFs, according to new research from crypto exchange Binance. Binance analysts shared that non-institutional investors accounted for nearly 80% of the total assets under management (AUM) in spot BTC ETF.

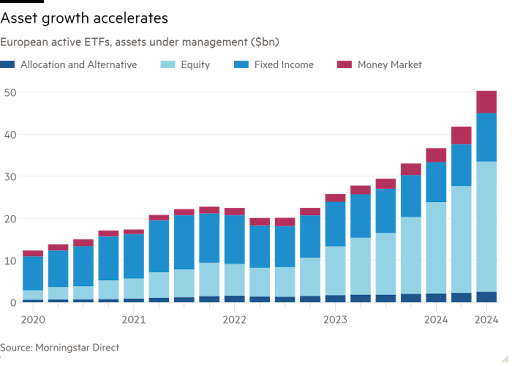

The Active ETF European market is starting to take off, with active ETFs accounting for 8.4 per cent of net inflows to all ETFs in the third quarter, according to data from Morningstar Direct, well ahead of their 2.2 per cent share of assets. Their total assets have topped $50bn for the first time, having doubled in the past 18 months.

In a speech last week, the Central Bank of Ireland confirmed they will be converging their approach with other fund domiciles regarding share class naming and in future, the UCITS ETF identifier can be included at the level of a sub-fund or a share class level. Such a move will make it easier for mutual fund managers to launch ETF share classes of their existing funds so the impact could be substantial.

Also highlighted in the speech was the need for more work around financial literacy. I guess the CBI should check out Moolah Invest.

|

|

|

This week WisdomTree celebrate 10 years of business in Europe. The company now stands at $30bn aum and 114 staff. Congrats to Alexis Marinof and all the team.

|

Career corner

Movers and Shakers

- Austin Hansen has joined the DWS ETF Sales team in the US. He joins from Victory Capital.

- Adam Bahram joins CI Global AM in Canada as an ETF Strategist. He joins from TD AM.

On the move

European Featured Opportunities

- Senior Product Marketing Manager (ETPs) – London: As the Senior Product Marketing Manager you will take ownership of developing and executing product marketing strategies for a range of innovative crypto ETPs (Exchange Traded Products). This role acts as the bridge between key departments, including sales, research, compliance and product development, while collaborating closely with marketing experts across content, design, motion, events, and website management.

US Featured Opportunity

- Product Specialist – Georgia & Surrounding States: This role is responsible for supporting the sale of exchange traded funds (ETFs) and mutual funds to broker-dealers, wire-houses, RIAs and institutional clients. The candidate will be responsible for managing their own territory and working in conjunction with our firm partners.

Tip of the week

Tip of the week

Navigating the ETF world requires more than technical know-how; it demands continuous growth and strategic thinking. Stephen R. Covey’s The 7 Habits of Highly Effective People offers timeless principles, especially the vital Habit 7: Sharpen the Saw.

In an industry shaped by new regulations and shifting investor preferences, staying stagnant isn’t an option. Here’s how to sharpen your skills as an ETF professional:

- Stay Informed: Keep up with the latest trends, like active ETFs and evolving ESG regulations.

- Network: Share insights with peers to foster innovation.

- Invest in Development: Programs like ETF Bootcamp equip you with the tools to navigate the European ETF market.

Lifelong learning isn’t just a nice-to-have; it’s essential for staying ahead.

About us

| ETF Career vs. eFinancialCareers: Why ETF Career is Your Best Bet for ETF Jobs

Looking for your dream role in the ETF space? It can feel like searching for a needle in a haystack—especially if you’re browsing generic job boards. Enter ETF Career, the platform built exclusively for ETF and asset management professionals. Why ETF Career?

|