ETFs are becoming a Mutual Fund Killer

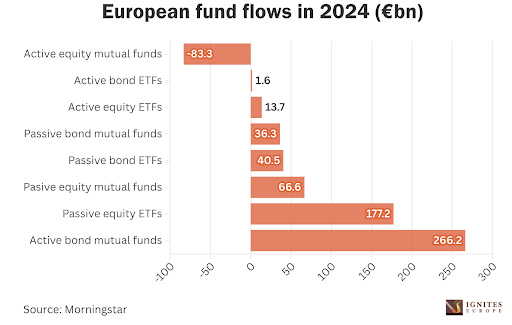

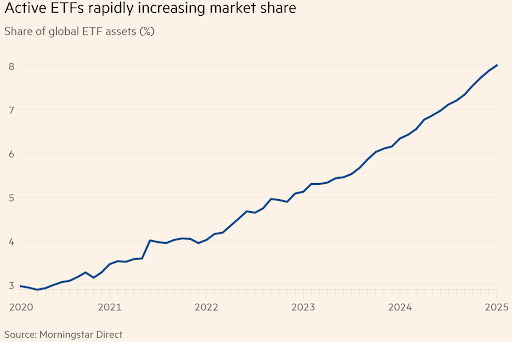

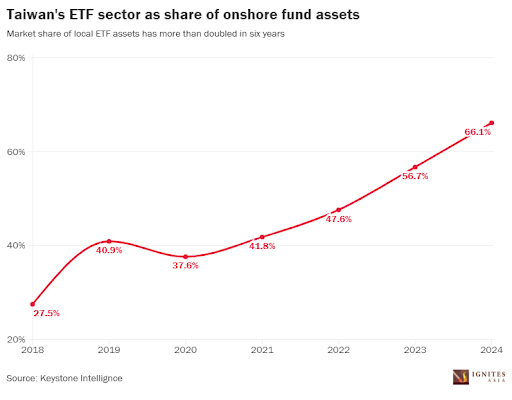

They say a picture paints a thousand words and I think the graphs below demonstrate that pretty well.

ETFs are basically eating the lunch of mutual funds, basically threatening them, at a rate that even the most die hard ETF cheerleader would have been surprised by.

Whichever market you look at, ETFs are threatening mutual funds and taking market share, the result of which is causing mutual fund managers to scramble to come up with an ETF strategy. Some will do it right, but I fear a lot will make decisions based on ignorance and do themselves severe damage in the process.

I think it’s time to strap yourself in.

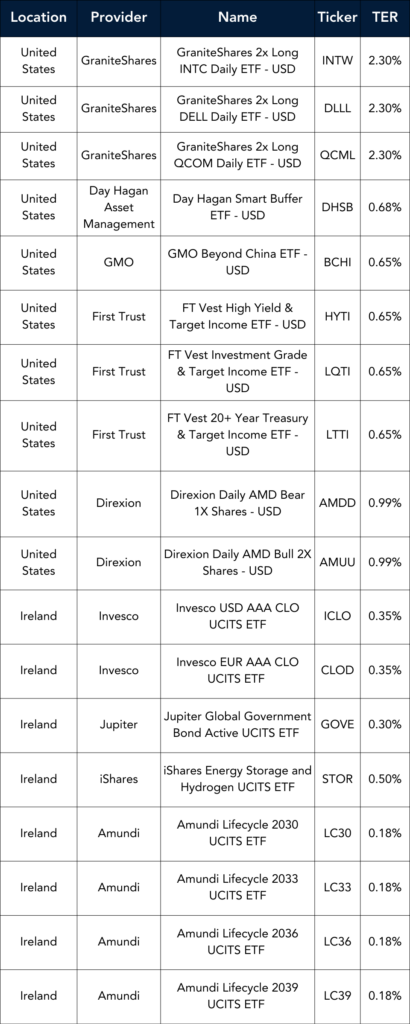

Launches this week

Flows & performance

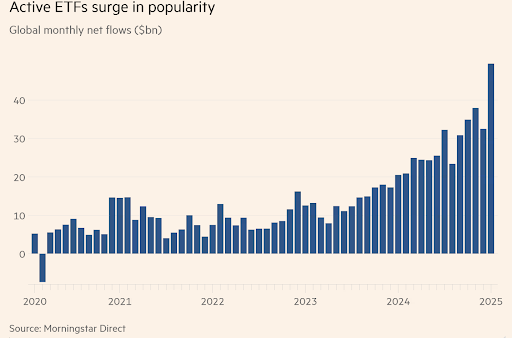

Traditional index-tracking ETFs bagged less than a quarter of the new money flooding into US-listed domestic equity ETFs in January, according to data from Citi.

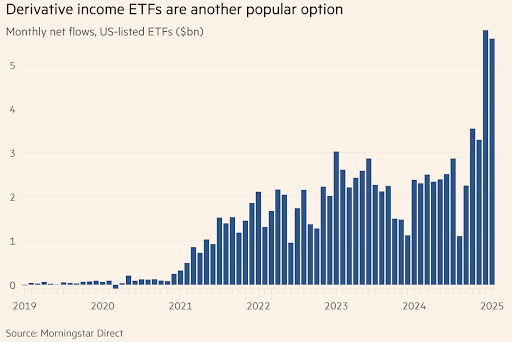

Instead, active ETFs pulled in a record $43bn in January, ahead of the previous record of $34bn, set as recently as November and derivative income ETFs, a category that includes risk-averse covered call funds, also had a record month, with $5.6bn of net new money.

In a major milestone for the firm, T. Rowe Price has passed $10 billion in ETF AUM for the first time. Their largest ETF, TCAF, currently sits at approximately $3.5 billion in AUM.

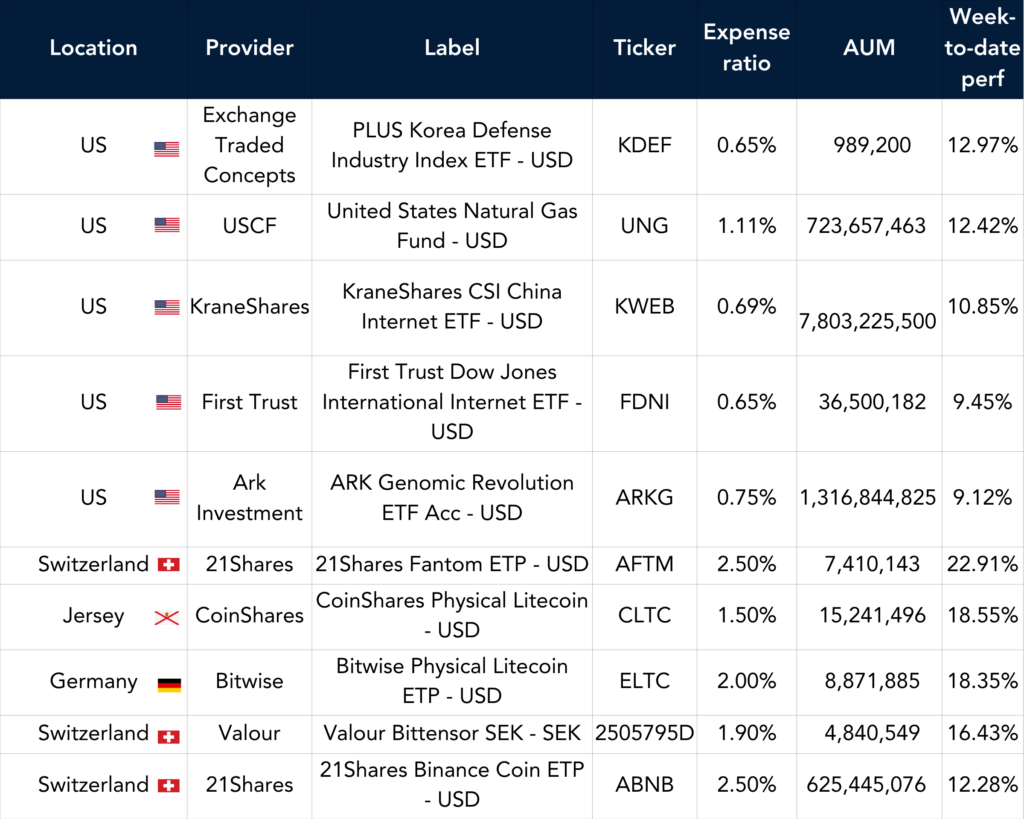

Best Performers US & EU

Listen and Learn

In this week’s episode of Exchange Traded People, we’re joined by Robyn Laidlaw, Head of Distribution at Vanguard. Robyn’s career has taken her across continents and roles, giving her a unique perspective on career growth, leadership, and the evolving ETF industry. She shares why networking is crucial at every stage, how a growth mindset fuels success, and why being a great teammate can take you further than you think.

Things of interest

Euronext NV is in discussions with market participants about potentially moving all of the ETF products listed on its bourses to a single trading venue, namely Amsterdam. The move would include exchanges in Paris, Oslo, Brussels, Dublin, Lisbon and Milan.

According to an SEC filing Goldman Sachs reported that, as of the end of 2024, it held about $2.05 billion in ETFs for Bitcoin and Ethereum, the world’s two largest cryptocurrencies.

The financial firm held about $1.3 billion of BlackRock’s Bitcoin ETF shares and $300 million of Fidelity’s. Exchange-traded funds let investors gain exposure to an asset without needing to buy the asset themselves.

Goldman Sachs also held almost $500 million in Ethereum ETFs. The company’s crypto ETF holdings jumped 50% from the prior quarter, when its holdings were worth about $720 million, according to SEC filings

The rise of Taiwan’s ETF market shows no sign of slowing as locally listed ETF assets expanded 55% last year to US$195.88bn and now account for 66.1 % of all onshore fund assets.

Schroders and Nordea are preparing a move into active ETFs

Schroders is planning to enter Europe’s active ETF market after having registered the Schroder ETFs Icav in Ireland. It is is one of largest fund houses that does not currently offer ETFs, overseeing €186bn of fund assets in Europe as of the end of December, according to Morningstar.

This follows in the heels of Nordea who recently starting preparing a move into active ETFs. Nordea is one of only three European asset managers larger than Schroders that does not currently offer ETFs, along with Union Investment and Pictet.

According to a survey from Carne, the Manco, some 82% of respondents believe investors are moving ETFs from short-term asset allocation strategies to core portfolio holdings. Also of the equity and fixed income fund managers surveyed, 89% of those who do not offer ETFs expect to do so “within the next three to four years”.

Career corner

Movers and Shakers

- Francis Geeseok has joined Rex Financial in Hong Kong to lead their business developments efforts in Asia. He joins from Qraft Technologies.

- Robert Rosso has joined Amplify ETFs as an ETF Specialist in NY. He joins from Advisors AM.

- Craig Anderson has joined DWS as an ETF Specialist in Denver. He joins from Calamos.

On the Move

European Featured Opportunities

- European Marketing Manager – London: The role will see you lead all marketing initiatives across Europe, driving engagement, brand growth, and ETP product adoption (and AUM growth) among professional and retail investors.

US Featured Opportunities

- Business Development Manager – Florida: The position is responsible for supporting the sale of exchange traded funds (ETFs) and mutual funds to broker-dealers, wire-houses, RIAs and institutional clients. The candidate will be responsible for managing their own territory and working in conjunction with our firm partners.

Tip of the week

How to Not Lose Your Sh*t at Work

Some days it feels like you just wanna punch someone in the face but unfortunately, we’re not on the playground anymore so that’s unlikely to work. Instead try this:

-

-

Recognize When You’re About to Snap

You get tight in the chest? Start clenching your jaw? Feel an overwhelming urge to throw your laptop out the window? The earlier you catch it, the easier it is to stop yourself from doing something you’ll regret. -

The Power of the 3-Second Pause

Just because they’re freaking out doesn’t mean you need to. Some people THRIVE on drama—it’s their sport. Don’t play. Keep it cool. -

Don’t Let Other People’s Chaos Become Yours

Just because they’re freaking out doesn’t mean you need to. Some people

THRIVE on drama—it’s their sport. Don’t play. Keep it cool. -

Vent, but to the Right People

Find your trusted person: friend, mentor, partner and let it out. Holding it in forever isn’t healthy, but venting to the wrong person will only make things worse. - Pick Your Battles

Not every fight is worth it. Save your energy for things that actually move the needle. You can’t control other people, but you can control how you react. Keep your emotions in check, protect your peace, and focus on what actually matters.

-

About us

ETF Tourists, Beware: Half-Hearted Strategies End in Tears

Entering the European ETF market isn’t something you can “test the waters” with – success takes commitment, patience, and a long-term strategy. Firms that dip a toe in without a solid plan often face disappointment.

If you’re serious about launching an ETF in Europe, start with the right knowledge. Our free guide breaks down everything you need to know.

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.