ETFs: The sh*t is about to hit the fan

This week we released the findings of a recent survey we conducted to find out what mutual fund managers in Europe think about ETFs. It was a follow up to a survey conducted in 2021. Some interesting results. Click to find out more about the report here

· 62% of European mutual fund managers are now concerned by the growth of ETFs up from 18% in 2021.

· 46% of European mutual fund managers now see a business case for having an ETF offering up from 27% in 2021.

· The cost of building an ETF business is the main concern European mutual fund managers have when looking at ETFs. 54% of managers cited this as their main concern.

· 92% of European mutual fund managers are planning on launching ETFs or undertaking more due diligence of the space within the next 2 years, up from 9% in 2021.

· 39% of European mutual fund managers think it is inevitable that all asset managers will need some form of ETF offering to remain competitive, up from 9% in 2021.

· 77% of European mutual fund managers see the development of actively managed ETFs as an opportunity for them.

Fund Launches and Updates

EUROPE

Global asset manager VanEck has rolled out a digital asset management platform and NFT marketplace with the goal of making it easier to share ownership and access of self-custodied assets. Called SegMint, the platform uses a model called “Lock & Key,” which allows users to share access and ownership of an asset with others in a safe way while keeping control of it.

HANetf continues to take the scissors to its product range with news of the merger of its cloud technology and tech megatrend ETFs.The merge would see SKYY’s $16.7m assets absorbed into ITEK, taking its total assets under management to $107.8m.

ETC Group has launched an exchange traded product (ETP) on Deutsche Börse XETRA, a total return exchange-traded product that tracks the Compass Ethereum Total Return Monthly Index. The TER is 0.65%

AMERICAS

DWS has rolled out its first actively managed ETF with the launch of the Xtrackers RREEF Global Natural Resources ETF (NRES) on the Nasdaq. The fund has a net expense ratio of 0.45%

Roundhill has followed up on its $160 million Roundhill Magnificent Seven ETF (MAGS) with the launches of the Roundhill Daily Inverse Magnificent Seven ETF (MAGQ) and the Roundhill Daily 2X Long Magnificent Seven ETF (MAGX). Both funds have an expense ratio of 0.95% and are listed on the Nasdaq stock market.

PGIM has added to its family of buffer ETFs with the launch of the PGIM US Large-Cap Buffer 12 ETF – March (MRCP) and the PGIM US Large-Cap Buffer 20 ETF – March (PBMR). Both have expense ratios of 0.50% and are listed on the Cboe BZX Exchange.

First Trust has launched the First Trust Commercial Mortgage Opportunities ETF (NYSE Arca: CAAA) and the First Trust Structured Credit Income Opportunities ETF (NYSE Arca: SCIO). CAAA has an expense ratio of 0.55% and SCIO an expense ratio of 0.95%.

Regan Capital, an adviser firm, has made its first foray into ETFs by launching the Regan Floating Rate MBS ETF (NYSE Arca: MBSF). MBSF has a net expense ratio of 0.49%

ASIA-PACIFIC

Mirae Asset Global X ETFs has rolled out Hong Kong’s first ETFs that deploy a covered call strategy aimed at investors who want to sacrifice potential gains in order to lower potential losses in a down market.

The Global X HSI Components Covered Call Active ETF and Global X HSCEI Components Covered Call Active ETF are also the first covered call ETFs tracking the Hang Seng Index and Hang Seng China Enterprises Index globally. The estimated ongoing charges over 12 months for the funds is 0.75% each.

A podcast series focused on exploring the career journey of industry leaders within the ETF and Digital Assets space. Get to hear their personal story and be inspired. Listen to them clicking HERE.

Flows

Blackrock’s spot bitcoin ETF hit $10 billion in assets Friday, hitting that milestone faster than any exchange-traded fund before it. The iShares Bitcoin ETF (IBIT) hit double digits in assets seven weeks after its Jan. 11 launch, on the heels of a week of record trading and inflows for the group of 10 trading spot bitcoin ETFs, according to Bloomberg Intelligence data.

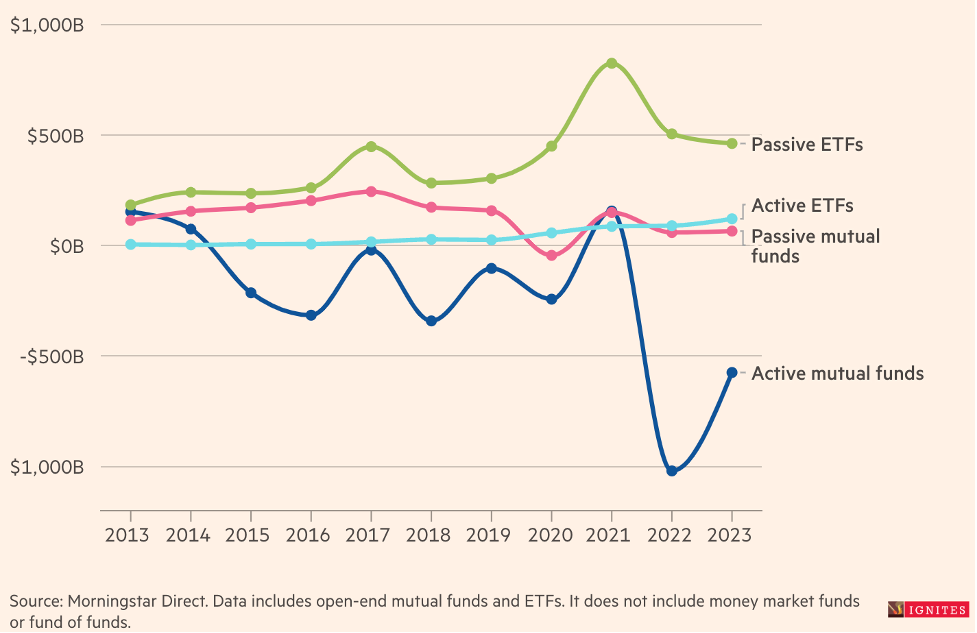

Investors poured $4tn into US ETFs over past decade. Mutual funds saw net outflows of $950bn over the same period, according to a recent Morningstar report.

Noteworthy

The European ETF market is set to hit $4.5trn by 2030 fuelled by new providers entering the market and the rise of retail investing, according to EY research.

The consultancy projected that the market will more than double over the next five years, growing at an annual rate of 15%.

Bank of America’s Merrill Lynch and Wells Fargo are offering spot bitcoin exchange-traded funds (ETFs) to their clients and Morgan Stanley is in the midst of performing due diligence to add spot bitcoin ETF products to its brokerage platform, according to people with knowledge of the matter.

Movers and Shakers

Tim Buckley, Vanguard CEO and chairman, will retire from his position after more than three decades at the company. Buckley, who spent six years as CEO, will step down at the end of the year.

Global head of capital markets at DWS, Keshava Shastry, has left the business, according to people with knowledge of the matter.

Hasham Niazi has joined Global X as Sales Director for Germany and Austria.

HANetf head of European sales Simon Dale is set to leave the business at the end of February after almost three years.

From behind the Desk

Does your job make the world a better place?

Everyone in Asset Management always seems to feel they are being underpaid. But are we being honest with ourselves?

Is there a sense of entitlement around pay in the industry? When compared to doctors, nurses, teaches, engineers etc, we really get paid a lot for something that may be somewhat dubious in the value it adds to society.

So, do you feel you are being overpaid for what you do?

Here are the results of a LinkedIn poll, we took:

Yes – 16%

No – 73%

Maybe – 10%

Don’t forget registration for ETF Stream’s ETF Ecosystem Unwrapped 2024 is now open. Click here to register.

About us

Blackwater is a leading global ETF Consulting, Recruiting, PR and Content Creation firm.

We are specialists in helping companies find the best strategy to enter and navigate the ETF marketplace, enhance their reputation, craft innovative and engaging targeted ETF content and source the very best of talent across the ecosystem.

If you would like to discuss any of the above then please reach out at mike@blackwatersearch.com