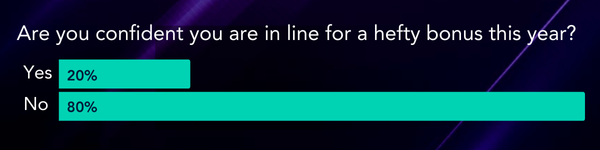

ETFs are booming, so why aren’t you? The shocking truth about bonuses in 2024.

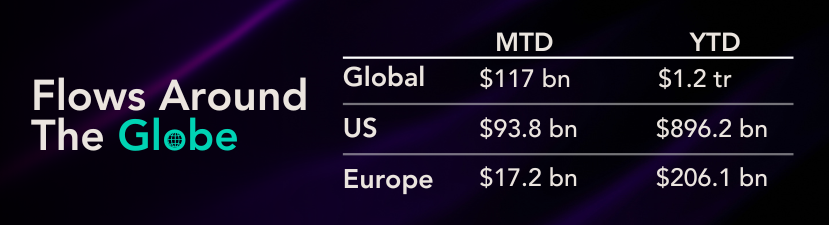

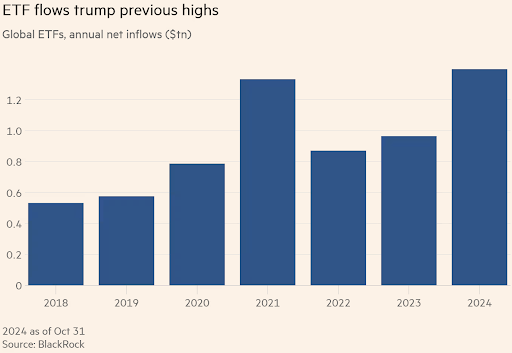

It’s a puzzling paradox: 2024 has seen record ETF flows – over $1.2 trillion globally and counting – but the bonus buzz is eerily quiet. A recent survey we ran revealed that just 20% of ETF professionals feel confident about pocketing a significant bonus this year.

What gives? It’s a classic case of scale trumping sentiment. While ETF assets have soared, headcount and compensation haven’t followed suit. Large firms are achieving economies of scale, squeezing more AUM out of the same teams, while smaller players struggle to even justify new hires.

Amid the boom, the spoils are skewed toward firms, not folks. For professionals, the takeaway is clear: bonuses may not reflect record flows—so negotiate wisely and know your worth.

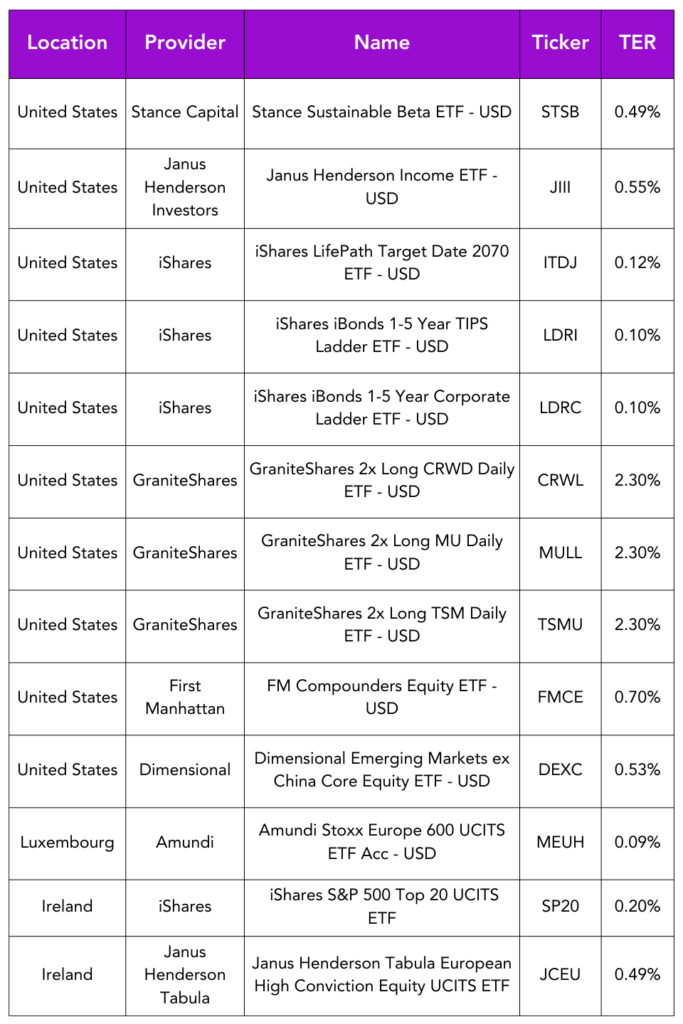

Launches this week

Flows & performance

- ETF flows smash full year record. The $1.4tn pumped into global ETFs in the first 10 months of the year surpasses the $1.33tn racked up in all of 2021.

-

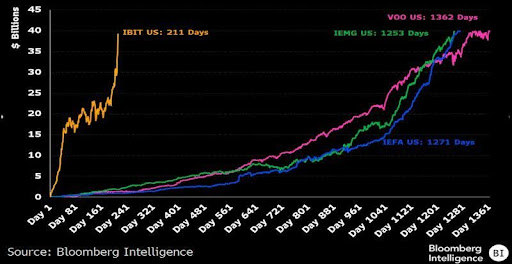

$IBIT has hit the $40 billion asset mark (a mere two weeks after hitting $30 billion) in a record 211 days, annihilating the previous record of 1,253 days held by $IEMG. It’s now in the top 1% of all ETFs by assets and at 10 months old, it is bigger than all 2,800 ETFs launched in the past TEN years.

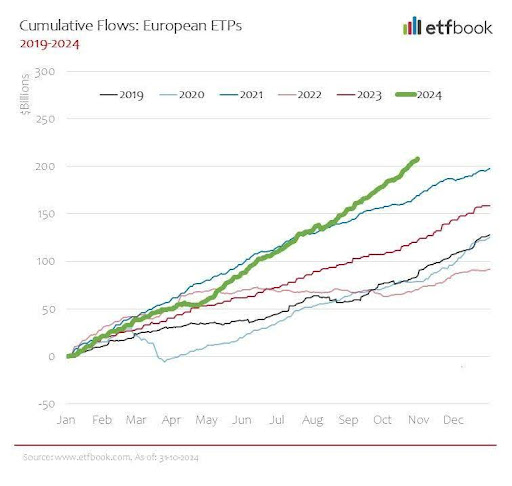

The European ETP market is on track to achieve a new annual record for net inflows, marked by one of its strongest months ever in October, with $31 billion of new net investments, and with more than $209 billion of net inflows YTD.

Fixed income ETFs are making a comeback. After a challenging 2022, these funds are regaining popularity and attracting significant investor interest. While equities might still be the “cool kid on the block,” fixed income ETFs are steadily growing, representing about 20% of total ETF assets.

Things of interest

| BlackRock has flipped a mutual fund to an ETF for the first time, with the giant asset manager’s move reflecting investors’ increasing appetite for actively managed ETFs. The firm turned the BlackRock International Dividend Fund into the BlackRock International Dividend ETF its first U.S.-listed active ETF seeking to invest in high-quality, dividend-paying stocks across international developed and emerging markets. |

Cryptocurrency data provider Kaiko said on Tuesday it is acquiring European crypto index provider Vinter in a bet on growth in the European digital asset market. The deal comes as some analysts expect significant growth in the European crypto ETP market, which remains significantly smaller than the U.S.

Bitwise Asset Management has announced that NYSE Arca has filed a Form 19b-4 to uplist the $1.3 billion Bitwise 10 Crypto Index Fund (BITW) as an ETP, joining a growing trend of crypto asset managers seeking to convert investment vehicles into exchange-traded structures.

| A flurry of exotic cryptocurrency ETFs could be unleashed in the US in the wake of Donald Trump’s election victory, industry figures believe, transforming the sector. The election was a massive win for crypto. It’s a complete game-changer,” said Matt Hougan, chief investment officer of Bitwise Asset Management. |

Career corner

Movers and Shakers

-

-

Christopher Adams has joined Global X ETFs as Chief Marketing Officer. He joins from UBS.

-

ETF industry veteran Rory Tobin has joins UBS Asset Management as a senior advisor to its ETF franchise, where he will work on the expansion of its global ETF and index capabilities.

-

Douglas Yones has joined Direxion as CEO. He was previously at NYSE.

-

Kevin Beadles has joined BNY as a Relationship Manager. He joins from O’Shares.

-

Mike Vavra has joined Susquehanna as ETF Sales and Portfolio Trading. He joins from Virtu.

-

On the move

ETFcareer.com is your gateway to exciting opportunities in the ETF industry. Whether you’re just starting out or looking to take the next step in your career, our platform connects you with leading companies and cutting-edge roles. Discover open positions, explore industry insights, and find the job that aligns with your ambitions.

👉 Don’t wait—your dream role could be just a click away! Visit ETFcareer.com today and start applying.

Tip of the week

Tip of the week

Self-Development: The Real Job Behind Your Job

We often think of career growth as a series of external steps: landing a promotion, changing companies, earning a higher salary. But here’s a truth that’s not talked about enough—real career growth starts with you, and it’s happening all the time, whether anyone else notices or not.

Think of your job as having two layers. There’s the “external job,” which includes tasks, projects, and goals you’re paid to complete. But there’s also the “internal job”—your growth, your skills, your mindset. This part of the job doesn’t show up on a performance review, but it’s the work that transforms you.

So work on your craft, but also work on yourself—your career reflects the person you’re becoming.

About us

Is your firm losing out on talent?

The competition for talent in the ETF industry is fierce. With the industry rapidly evolving, firms need top-tier professionals to innovate, manage risks, and seize growth opportunities. But are you missing out on these skilled candidates because of common hiring mistakes?

Let’s dive into some pitfalls that could be turning off great ETF professionals – and how to fix them.