ETF Careers: What you can learn from the hockey legend Wayne Gretzky

No matter which continent you are on, ETFs are booming right now. Their success has been remarkable and show no signs of slowing up.

It’s no wonder so many participants want a slice of the action. But it’s not just managers who want in. More and more candidates are looking to pivot from investment banks and mutual fund shops into ETFs. And why not?

As hockey legend Wayne Gretzky famously said, “Skate to where the puck is going to be, not where it’s been”.

To meet that demand, we have launched ETFcareer.com, a dedicated platform for all your ETF career needs – jobs board, training courses, and career-focused content.

Come check it out and make sure you are skating in the right direction.

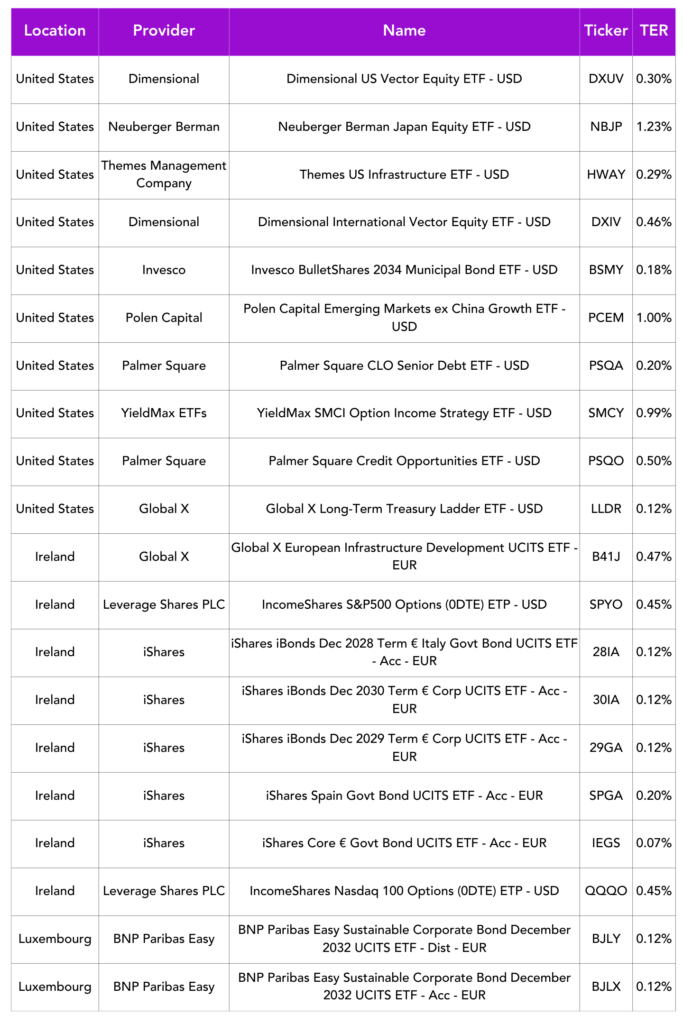

Launches this week

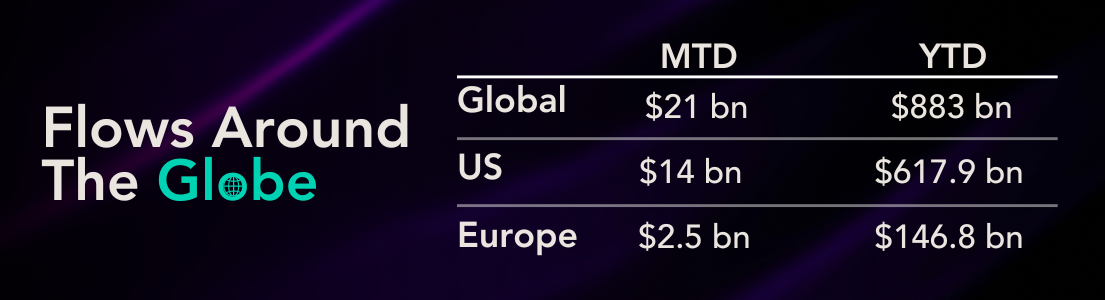

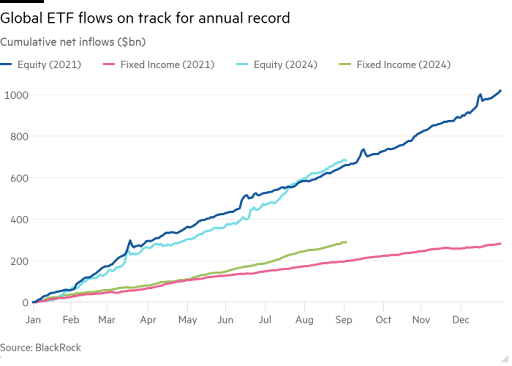

Flows & performance

Global ETF flows on course to soar past previous records. Investors shrugged off market ructions and ignored the usual summer lull to pour $130bn into ETFs according to data from BlackRock.

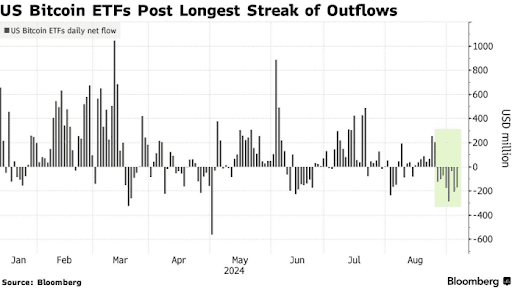

Spot Bitcoin ETFs in the US have been going through a bit of a sticky patch recently losing Bitcoin spot exchange-traded funds (ETFs) lost $1.2 billion over the past 8 days according to Bloomberg.

The Australian ETF industry posted the second highest monthly net inflows on record in August, helping to lift assets under management to an all-time high, according to the latest research from Betashares.

August was the second consecutive month in which monthly ETF sales in Australia surpassed A$3 billion. Australia’s ETF industry has grown by 43.4%, or A$66.7 billion, over the past 12 months.

Things of interest

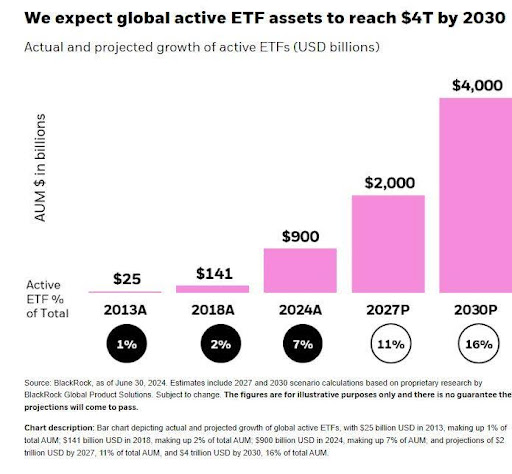

Blackrock is very bullish on active ETFS forecasting a four-fold increase in global active ETF assets by 2030 to $4 trillion in assets.

Why? Investors are choosing active ETFs for the combination of the benefits of the ETF wrapper, like low costs and transparency, and the agility of active management as market volatility, and therefore potential opportunity for alpha, increase.

To continue the theme, Morningstar reports that the number of actively managed ETFs in the US has been soaring and the trend continues, the number could catch up with index-tracking funds within the next few years.

However, they say this boom has not meant a renaissance for traditional stock-pickers. Many of the new active ETFs are so-called systematic strategies, which land somewhere in the middle between active and passive.

Whilst the US and Europe are frothing at the month with active ETFs, Asia seems to be making a more pragmatic position. Nine months after Singapore regulators first approved the listing of active ETFs, the city-state has seen just one product launch back in January, with fund firms waiting for clearer signs of investor interest in such strategies.

Greater China, which includes Hong Kong, Taiwan and mainland Chinese markets, is emerging as the hotbed of ETF growth in Asia Pacific, with investor demand predicted to continue to expand strongly over the next 12 months.

Greater China is currently the fastest-growing ETF market in the APAC region. For the first half of this year, the three Greater China markets have accounted for US$102 billion of net flows, representing 70% of all net new flows in APAC including Japan, according to a new Brown Brothers Harriman report.

Apollo Global Management and State Street are combining forces to launch an ETF that invests in both public and private credit, in the latest effort by large investment firms to sell alternative assets to retail investors to fuel their next leg of growth. Illiquid assets in an ETF? Sounds like a recipe for disaster.

Following on from the above, the below is something I saw on LinkedIn from someone called Steve Curley, and thought it was an absolute gem.

“While there has been some innovation in #ETF space, true innovation is hard to come by and is mostly marketing hype or gimmicks (>50 single stock ETF’s for example).” This quote is from one of the few groups adding value with new and creative ETF’s.

“If you’re trying to put illiquid s—in an ETF (referencing a potential private market ETF launching), it’s never going to work,” says Wesley Gray, chief executive of Alpha Architect, a firm in Havertown, Pa., that helps asset managers launch ETFs. He adds: “We don’t see a lot of true innovations, man. If you want to put triple-levered Zimbabwe swaps in an ETF, that’s not innovation.”

Career corner

Movers and Shakers

- Kevin Gopaul has joined Rex Financial as their new Chief Investment Officer

- Giovanna Cilia has joined Franklin Templeton in Switzerland covering ETF Distribution

- ULTUMUS has appointed Oliver Payne as product strategist from UBS where he was head of ETF trading for EMEA

- Tabula Investment Management has appointed Rhys Petheram as its chief investment officer. He joins after a 17-year stint at Jupiter Asset Management

Tip of the week

Growth happens when you’re out of your comfort zone. Take on that challenging project, learn a new skill, or explore a different field. Don’t be afraid to step into the unknown—it’s where real progress happens.

Keep expanding your horizons, because the more you stretch, the more you grow. Consistent improvement is your best strategy for success.

About us

Searching for you next big talent?

At ETFCareer.com, our mission is to bridge the gap between talented professionals and innovative companies in the ETF ecosystem. We aim to support the growth of the industry by providing a dedicated space for career opportunities and professional development.

If you’re an employer with a growing team, here are a few reasons to consider listing your open positions on ETFcareer.com:

- Niche Audience: Reach a deep and focused pool of candidates with experience and interest in ETFs. Tap into our database of more than 20,000 ETF candidates.

- Enhanced Visibility: Highlight your job postings and company profile to stand out to top talent.

- Comprehensive Candidate Screening: We save you time and money by providing comprehensive candidate screening to ensure you’re only being sent the very best candidates in the talent pool.