Distribution, distribution, distribution

There is no getting away from the fact that success for ETF managers is 100% dependent on having distribution capabilities. Yes, the operating platform, products and people are all key but all take second place behind distribution. If you don’t have distribution, you are dead in the water.

That’s why getting on platforms is so key nowadays as it provides distribution scale. In Europe, as you can see below, lots of managers are doing deals with online platforms to give their products visibilities. You could argue that the platforms are now being the gatekeepers to success.

As the Retail market continues to grow the platforms influence is only going to get bigger.

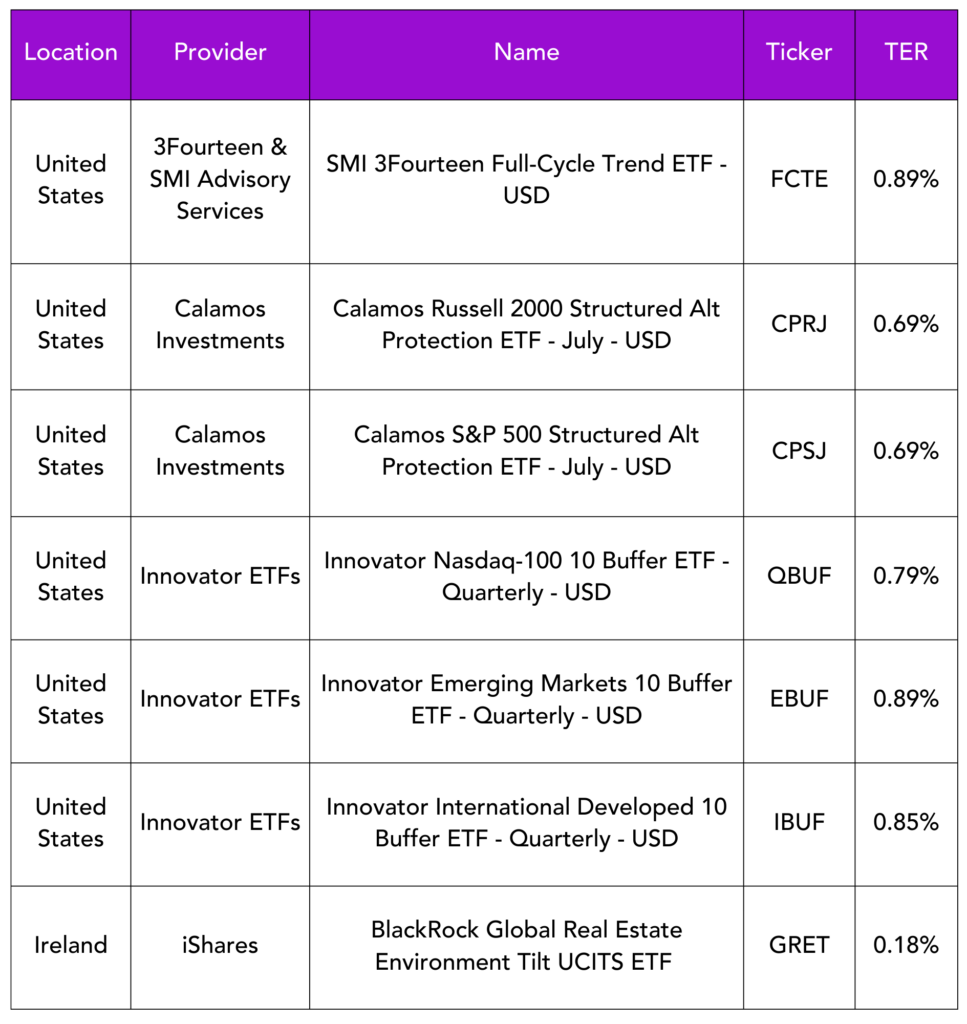

Launches this week

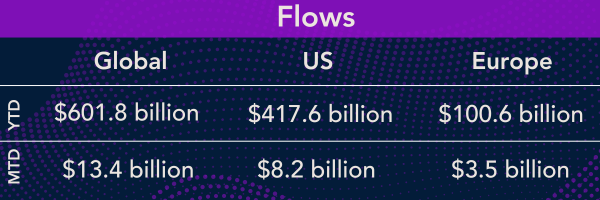

Flows & performance

According to research from Strategas ETF Research, Active ETFs saw more than $120 billion in flow in the first half of this year in the US.

Listen & learn

In the newest episode of the ETF Success Stories podcast we dive deep into the journey of ProcureAM, featuring none other than Andrew Chanin, the founder and CEO of ProcureAM.

In this episode you’ll:

- Discover how the idea to launch ProcureAM was born and the inspiration behind it.

- Learn about the challenges Andrew faced on his path and how they shaped his success.

- Get invaluable advice from Andrew – particularly for aspiring entrepreneurs looking to start their own businesses.

This episode is packed with insights and inspiration that you won’t want to miss.

Things of interest

According to Bloomberg, French insurer Axa is assessing options for its asset management business, Axa Investment Managers, and examining a potential tie-up with domestic rival BNP Paribas Asset Management. Were that to happen, I guess it would mean either the Axa ETF or BNP ETF brand would disappear, along with a number of jobs.

A lot happening on the platform front this week. Franklin Templeton has partnered with Trade Republic and justTRADE to offer its entire ETF range on both neobroker’s German and Austrian platforms. Amundi has partnered with Scalable Capital to offer its ETFs on its German platform and finally WisdomTree partnered with Moneyfarm to offer its thematic and commodity exchange-traded products (ETPs) on its Italian brokerage platform.

Meanwhile Dutch bank ABN AMRO has completed the acquisition of digital wealth platform Bux.

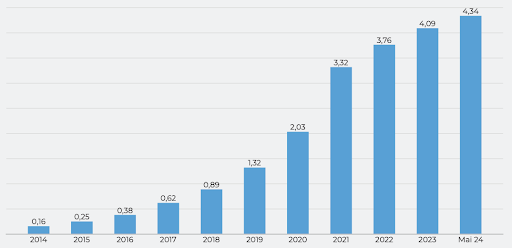

None of this is surprising when you look at the growth of online platforms in Europe, especially Germany, the poster child of Retail ETF adoption.

As recently published by the team at ExtraEtfs, as of the end of May there was:

-

€128.5 billion invested in savings plans in Germany.

-

4.3 million ETF savings plans were executed, see graph below

-

The average savings plan rate was €172.2 euros

-

YTD €3.6 billion has been invested in ETFs through savings plans in Germany

A good piece of analysis from our friends at Trackinsight:

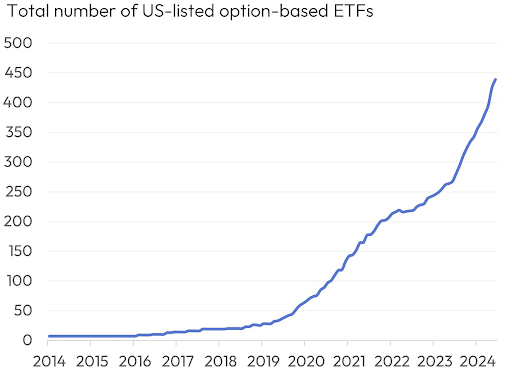

Investors in the US are flocking to options-based ETFs that either leverage option strategies to potentially boost returns (e.g., covered calls) or shield portfolios from downturns (e.g., buffer ETFs), among other strategies. This segment of the ETF market in the U.S. has now close to 450 ETFs with a combined AUM of $136 billion. Over the past year, investors added $47 billion to these ETFs.

Research from Ceruli found that Model portfolios in the US have an approximate 54% allocation to ETFs. Some 31.4% of model portfolio assets are in proprietary ETFs, and 27.1% of model assets are in non-proprietary ETFs.

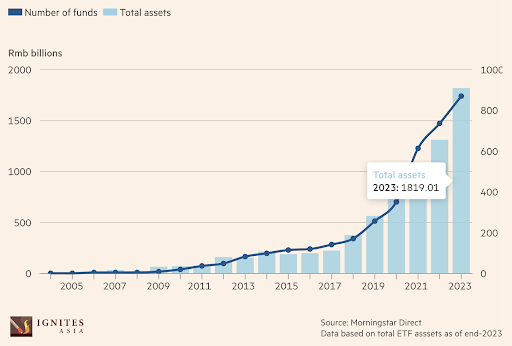

China’s ETF industry has surged in recent years, buoyed by record high inflows into equities strategies and amid a slump in the take-up of active mutual funds, according to Morningstar research. Total annual inflows into China ETFs reached $83.3bn in 2023, the research firm’s latest China ETF Asset Flows report shows, fuelled by an annual growth rate of 40% since 2018.

Career corner

Movers and Shakers

- Jessica Lane has moved from bank of America to Goldman Sachs Asset Management to join the ETF Distribution team in London.

- Jonathan Oliva has also joined Goldman Sachs Asset Management from BlackRock and will be part of the Capital Markets team in NY.

- Awain Khan has joined ARBDN as Head of ETF Portfolio Management and Capital Markets. He was previously at Vanguard.

Salary Trends

What will $100k get you these days? Short answer: very little.

Typically $100k will get you someone with up to 3 years experience although this limit is now being challenged.

Mid ranking Operations based roles may also fall under this bracket

Tip of the week

A career in Asset management is not forever. In fact, most people are probably toast once they hit their fifties; either by choice or by being politely shown the door. So unless you are lucky enough to have saved enough of a nest egg, what are you going to do? Reinventing yourself is never easy but it’s not impossible, so the sooner you start thinking about this the better.

Speaking of reinventing yourself and as a reminder, I am looking to hire an ETF recruiter in the US to help me expand the business there. I only what someone who comes from the ETF industry – someone who can take their industry knowledge and leverage it for recruiting. This is how I’m reinventing myself, so this might be for you.

About us

Tap Into Salary Insights

Elevate your career and business today with the findings from our 2024 Global Salary Survey. Here are a few things you can expect from the report:

- Comprehensive Analysis: Dive deep into salary distributions, bonus structures, and regional compensation trends.

- Strategic Insights: Leverage our expert commentary to craft competitive compensation strategies that attract and retain top talent.

- Stay Ahead: Keep your finger on the pulse of the industry with up-to-date data and emerging trends that impact your career and business.

Need more details? Explore the key findings of the report, available (for free) below.