‘Dammit: ETFs are eating my lunch, AGAIN’

2023 is coming to an end and the ETF juggernaut ploughs on continuing to gobble up all before it, included all of the flows. And it’s happened all over the world.

So, when we think of all the conversations, we have had with mutual fund managers this year and consider all of their responses, it really makes us shake our head in disbelief. The “we do not see this business opportunity” line is frequently rolled out as a reason. Hmmm… yeah good one, guys.

When you consider firms like UK mutual fund manager Liontrust, will be ejected from the FTSE-250 after its share price has dropped more than 50% so far this year, it does make you think “what on earth are you guys playing at”.

When the dinosaurs first peered up into the sky and noticed a big bright light they probably thought: “nothing to worry about here” as well, that is until they were all incinerated.

Denial is a basic human instinct, but probably not one of our better ones.

Fund Launches and Updates

EUROPE

STOXX has entered the digital assets market with unique blue-chip crypto index in partnership with Bitcoin Suisse. The STOXX® Digital Asset Blue Chip index aims to track high-quality assets that represent the crypto universe today. link

Looks like the crypto space is about to get more crowded with news that Valour, a subsidiary of DeFi Technologies, has revealed plans to introduce 20 new crypto ETPs.

The planned offerings include collaborations with foundations like the recent ICP ETP, thematic baskets, short and long-leverage products. The ETPs will be based on active crypto investment strategies and are subject to exchange approval. link

JP Morgan Asset Management has launched an active global equity premium income ETF to act as a buffer for investors during volatile markets.

The JPMorgan Global Equity Premium Income UCITS ETF (JEPG) is listed on the London Stock Exchange and Euronext Milan with a total expense ratio (TER) of 0.35%.

JEPG is a global equity version of the group’s hugely popular US-listed JPMorgan Equity Premium Income ETF (JEPI), a US-equity strategy that has amassed $30bn aum since launching in May 2020. link

Frankfurt-based asset manager MainFirst has entered the ETF space with their first product.

The CASE Invest Sustainable Future UCITS ETF (CSE) is listed on Deutsche Boerse with a total expense ratio (TER) of 0.75%. CSE is an actively managed equity ETF that invests in companies contributing to the shift to a more sustainable and socially responsible world.

BlackRock has expanded its Paris-Aligned Benchmark (PAB) ETF range with the launch of two high-yield bond ETFs.

The iShares € High Yield Bond ESG Paris-Aligned Climate UCITS ETF (HYPE) and the iShares $ High Yield Bond ESG Paris-Aligned Climate UCITS ETF (HYDP) are listed on the Euronext Amsterdam with total expense ratios (TERs) of 0.25%. link

Hot on the heels of BNP Baribas’s tie up last week with Directa, DWS has signed an agreement with FinecoBank in Italy to allow the bank’s customers to invest in its ETFs with zero fees.

The partnership enables the bank’s Italian securities account holders to invest in equity and fixed income DWS ETFs listed on the Borsa Italiana, with no purchase fees or minimum investment amount. link

Global X has launched the Global X 1-3 Month T-Bill UCITS ETF (CLIP) listing on the London Stock Exchange and Deutsche Boese with a total expense ratio (TER) of 0.07%. The product invests in US Treasury bills with remaining maturities of between one and three months. link

Sprott Asset Management and HANetf have announced the launch of the Sprott Copper Miners ESG Screened UCITS ETF, an innovative new fund designed to offer investors access to copper mining companies with a lower carbon footprint.

This marks the third collaboration between Sprott and HANetf, following the successful launch of the Sprott Uranium Miners UCITS ETF and the Sprott Energy Transition Materials UCITS ETF. link

AMERICAS

Pando Asset AG, a digital asset management firm based in Switzerland, last week became the latest issuer to submit an application to the U.S. Securities and Exchange Commission to launch an exchange-traded fund (ETF) tied to spot bitcoin prices.

Pando becomes the 13th company vying for a share of what the cryptocurrency world believes could become a multi-billion-dollar product, SEC filings showed. link

Vanguard has launched Vanguard Core-Plus Bond ETF (VPLS) and announced that Vanguard Core Bond ETF (VCRB) will launch before year end. These two new actively managed bond ETFs offer clients broadly diversified fixed income exposure with low equity correlation and the potential to outperform broad bond benchmarks over the long term.

Vanguard Core-Plus Bond ETF will have an expense ratio of 0.20% and the Vanguard Core Bond ETF will have an estimated expense ratio of 0.10%. link

CastleArk has entered the ETF market with its debut ETF, the CastleArk Large Growth ETF (NYSE Arca: CARK). The actively managed ETF targets roughly 25-30 of the largest and most successful growth companies in the market. link

SS&C ALPS Advisors has partnered with Smith Capital Investors to launch the ALPS | Smith Core Plus Bond ETF (NYSE Arca: SMTH), an active fixed income ETF. link

BMO has launched the Max SPX 500 4x leveraged ETNs, which tracks four times the total return of the S&P 500. It will be the highest leveraged exchange traded product in the U.S. link

ASIA-PACIFIC

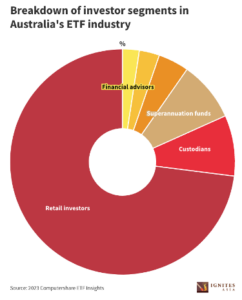

The number of retail investors in Australia’s ETF market has skyrocketed by 230% since 2020.

Retail investors now make up the majority of domestic ETF buyers but hold just 11.5% of total assets in the sector, according to new research from Computershare.

Flows

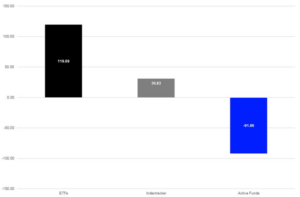

2023 YTD flow comparison between ETFs and mutual funds in Europe.

Source:Refinitiv

The Vanguard Total Bond Market ETF (BND) has become the first bond ETF to reach $100 billion in assets having brought in more than $16n so far this year.

Asia Pacific has not only become the fastest-growing exchange-traded fund market in the world, but investors are also allocating to ETFs all over the world and distribution in the region is expanding to reach a broader range of clients than in the U.S. or Europe.

It is estimated that across the region – from Australia to China to South Korea – annual ETF asset growth rates are between 26% and 30%. This is faster than Europe, the continent with second fastest ETF asset growth with an 18% compound annual growth rate. link

Our newest podcast where we explore the stories behind companies who have achieved success in the ETF ecosystem, trying to uncover what led to that success.

In this episode we hear from Hany Rashwan, CEO and Co-founder of 21.co. Listen to him HERE

Noteworthy

There have already been 478 new ETFs launched in the U.S. this year a new annual record, according to data from Morningstar.

That number is likely to climb still higher, analysts at Morningstar and other firms said. The previous record was set in 2021, when ETF managers rolled out 477 new funds. link

Institutional investors lag their retail peers in adoption and use of ETFs, according to a report by research firm Cerulli Associates.

These institutional investors, like endowments or state and local defined benefit plans, own nearly $1.3 trillion in ETF assets.

Nearly 37% of ETF issuers surveyed for the report said the biggest challenge to broader institutional adoption of ETFs was the preference for other vehicles. Limited ETF education was another big challenge, according to 26% of the survey respondents. link

Movers and Shakers

Lucy Reynolds the chief operating officer of 21Shares has left the firm. Her next move is unknown.

Macquarie has hired Edward Yoon as Head of US ETF/Index Trading & Strategies.

From behind the Desk

We ran a poll on LinkedIn last week asking what is the format of choice for people to consume content.

The results so far have saddened us, see below.

Why?

Because we invest so much time in writing this newsletter, yet it seems to be the least liked means of absorbing content. This thing has consumed over 3 years of our lives and numerous hours, and all for FREE.

But never mind, it’s all been worth it and for the one person out there who gets value from it, you are welcome, sir/madam.

PS: this is the last newsletter of the year, so happy holidays to all!