Crystal balls, Ether flops, new normal and time for a summer break

What’s the point of a crystal ball when you have ETFs? At least that’s the argument being made by SSGA in a new report on the state of ETFs.

- How many of these predictions do you agree with?

- Mutual Fund Conversions Will Ramp Up

- Active ETFs Will Grab a Bigger Slice of the Pie

- Non-US Markets Will Make Considerable Noise

- Younger Investors Will Continue Increasing Allocations to ETFs

- Model Portfolio Growth Will Broadly Spur ETFs

- Sizable Inflows Beyond Stocks and Bonds

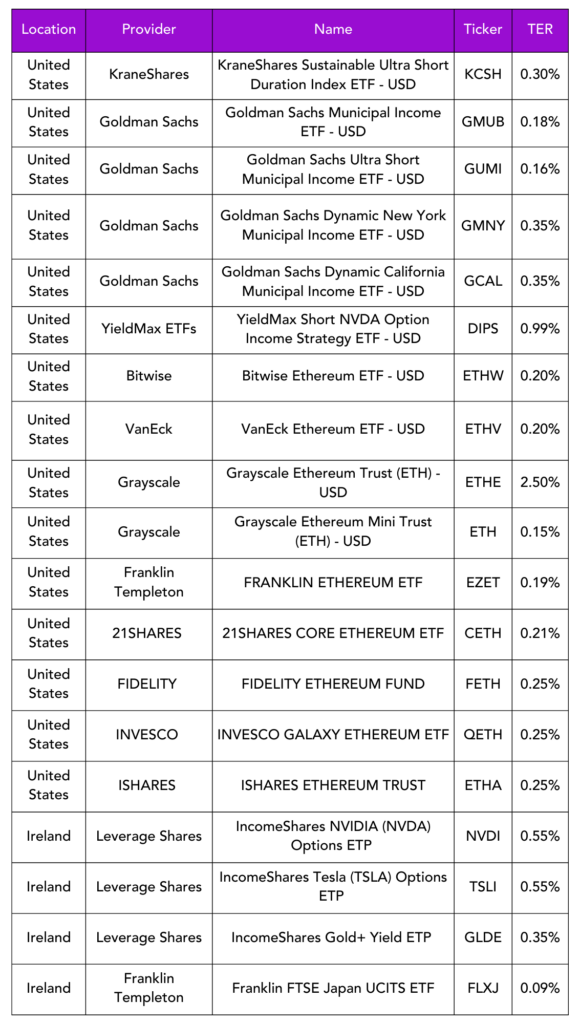

Launches this week

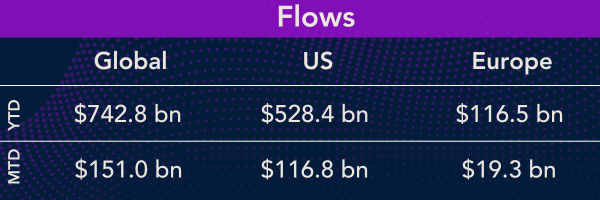

Flows & performance

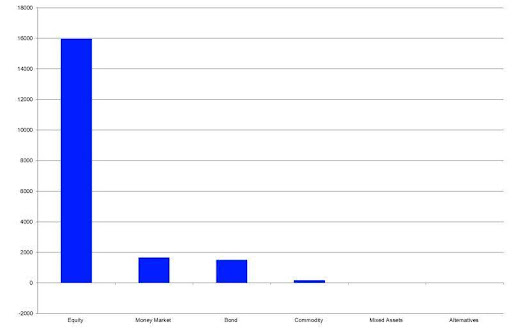

The assets under management in the European ETF industry marked a new all-time high at the end of June 2024. The inflows in the European ETF industry for June were driven by equity ETFs (+€16.0 bn), followed by money market ETFs (+€1.7 bn), bond ETFs (+€1.5 bn), commodities ETFs (+€0.2 bn), and mixed-assets ETFs (+€0.02 bn), while alternatives ETFs (-€0.004 bn) faced outflows.

Ether ETF volumes pushed past $1 billion on the first day of trading in the US, with $106.78 million in net flow. In comparison, the bitcoin ETFs had $4.5 billion in trading volume on their first day, and $600 million in net flow. The BlackRock iShares Ethereum Trust ETF (ETHA) had the most inflow at $266.5 million, followed by Bitwise’s Ethereum ETF (ETHW) at $204 million. Most of the outflow came from Grayscale’s Ethereum Trust (ETHE), which saw $484 million in outflows.

Things of interest

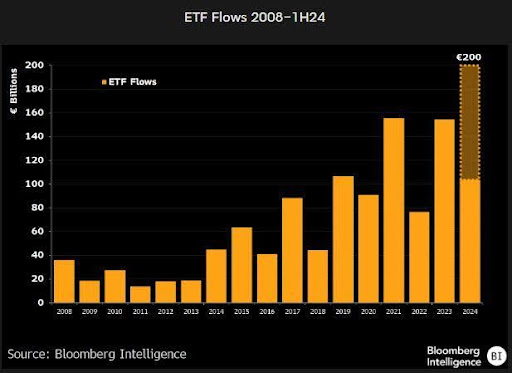

ETFs flows in Europe are at a “new normal” according to Bloomberg i.e. double what they were a few years ago.

State Street have just released a new ETF survey. Key findings are:

- The greatest proportion of institutional investors selected liquidity management and hedging as their primary reason for using ETFs

- 80% of institutional investors are likely to consider actively managed ETFs, while only 4% are not likely

- Millennials are more likely to invest in ETFs than other generational segments

- Investors are using ETFs for their diversification benefits, flexibility in trading, and low cost/expense ratio

- 70% of financial advisors are heavy recommenders of ETFs to their client

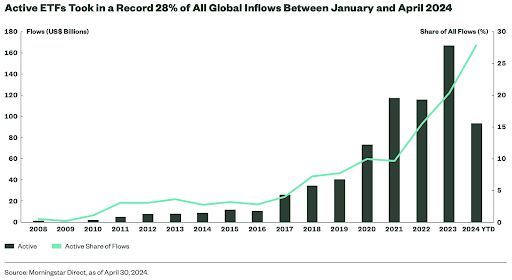

- Active ETFs are set to grab a bigger slice of the pie

Active fund managers in Europe have missed out on €90bn of fees over the past 13 years due to investors’ use of passive funds, according to research conducted by Vanguard.

Vanguard has calculated the savings made by investors in exchange traded funds and mutual funds domiciled in Europe by choosing passive over active each year between 2011 and 2023.

French retail investors using ETFs rose 90% in Q2 according to data published by the AMF. 227k individuals bought ETFs during the second quarter, of which 56k people invested in ETFs for the first time.

Jupiter Asset Management is planning its entry into the European ETFs market via white-label ETF provider HANetf. The firm is set to host an internal discussion group on its ETF plans in the coming weeks, but is yet to file a product. It will look to launch via HANetf once it has agreed the strategy.

Career corner

Movers and Shakers

- Douglas Abbott has joined Vanguard as Head of UK Client Coverage. He was previously at Schroders

- Robeco has poached Dorcas Philips as Head of ETF Capital Markets

- Stephen Foy has joined Tidal as SVP of Trading. He was previously at Invesco

- Alexandra Lynch has joined J.P. Morgan from BlackRock as Head of Global Credit ETF Sales

Tip of the week

Its high summer and the temperature gauge here in Spain is hitting 36 Celsius. Which means it’s time to take a welcomed break.

August tends to be a quiet month (at least if you live in Europe) so make the most of it and focus on your tan rather than your next product launch.

The newsletter will return in September. Happy holidays!

About us

While We’re Away

As we take a short hiatus from our newsletter, we encourage you to tune into our podcasts to glean insights into the ETF ecosystem while we’re away.

ETF Success Stories brings you inspiring narratives from industry leaders who have made significant strides in the world of Exchange Traded Funds. Explore their journeys, insights, and strategies that have led to their achievements.

Exchange Traded People delves into the lives and careers of key figures in the ETF industry. Gain valuable perspectives and tap into personal anecdotes from the movers and shakers who shape the market.

Enjoy these podcasts, and we’ll be back with fresh content soon!