Can you help us raise an army?

This week I want to raise attention to a new education platform we have started, called Moolah Invest.

Our mission is to help raise the level of Retail education across Europe and make ETFs more recognized as an investing tool.

We aim to fly the flag for ETFs at the individual investor level and:

- Demystify ETFs

- Build a vibrant community of informed ETF investors

- Boost long-term financial well-being across Europe

- Become a trusted voice for Retail

This is an ambitious goal and we need the support of you, the ETF industry, because our success will be your success ultimately.

So please follow Moolah on TikTok, Instagram, LinkedIn and Youtube.

Tell your friends, tell your family. Help us raise an army of Retail ETF investors right across Europe.

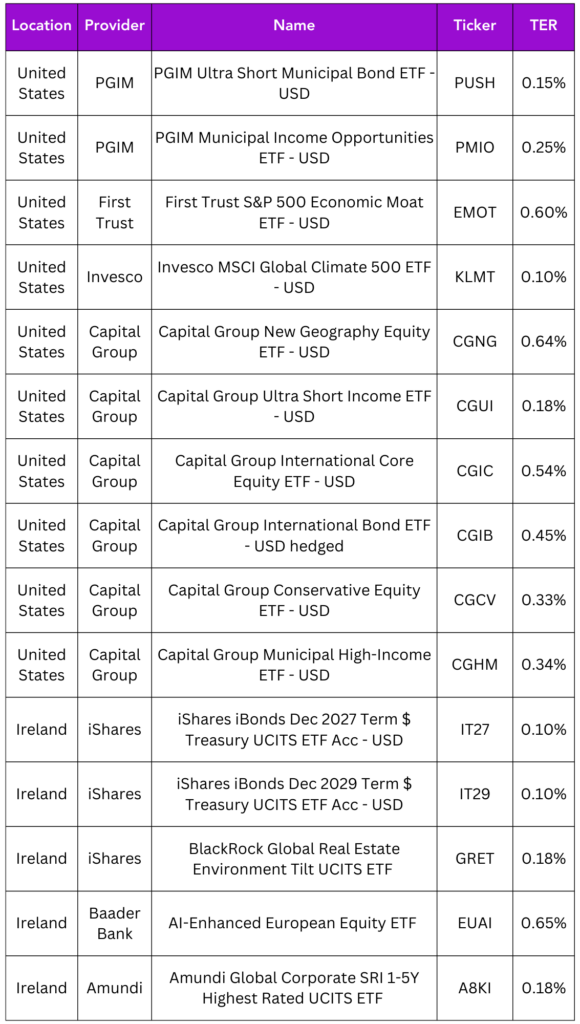

Launches this week

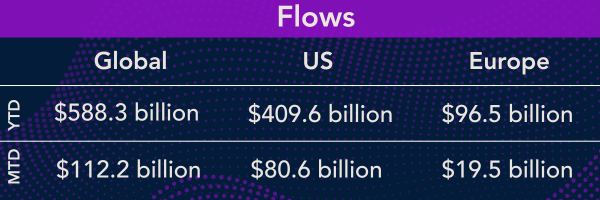

Flows & performance

Ethereum spot ETFs could attract $15B by end of 2025 according to Bitwise chief investment officer Matt Hougan and there is some method in his madness.

Listen & learn

Our most recent episode of Exchange Traded People features Sherif Salem, Partner and Head of Public Markets at Lunate.

In this episode, Sherif delves into:

- His journey into finance, driven by his passion for baseball

- His belief that everything happens for a reason, even if it’s not immediately clear

- A touching story about his grandfather, a founding member of the African Football Federation.

Don’t miss this insightful conversation packed with inspiring stories.

Things of interest

Rex Shares and Tuttle Capital Management have partnered up to launch 44 single-stock ETFs, half of which are leveraged long and half of which will offer inverse exposure to the underlying stocks. The collaborative effort for the branded suite of ETFs known as T-Rex represents the most aggressive push into the single-stock ETF market since it was created less than two years ago with the Securities and Exchange Commission’s approval.

Waystone ETFs has agreed to a deal with Northern Trust Asset Management (NTAM) to take over its Irish ETF platform, becoming a white label provider for the issuer. NTAM has just one ETF, the $287.4m FlexShares Listed Private Equity UCITS ETF (FLPE), which will now sit on Waystone ETF’s Irish Collective Asset Management Vehicle (ICAV).

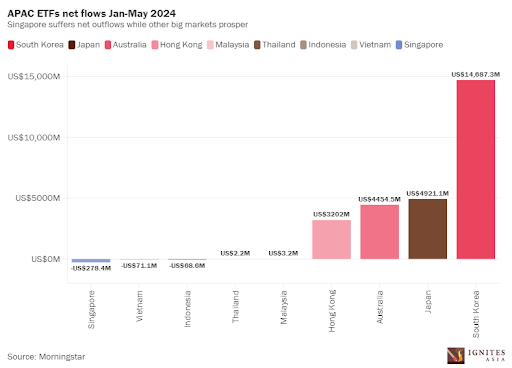

Singapore, the graveyard for Asian ETFs. For quite sometime Singapore has tried to position itself as the ETF domicile of choice in Asia but unfortunately as you can see below it just ain’t working. Even Vietnam has attached more flows.

HanETF has announced that Harbor Capital Advisors is launching an ETF on its platform as it looks to enter the European ETF market. Nothing unusual about this apart from the fact that Harbor is owned by European asset manager Robeco, who is launching their own ETF business later this year so why would they decide to work with a third party rather than Robeco?

Indian ETFs now make up around 13% of the broader mutual funds industry, buoyed by rapid retail adoption and strong trading volume, according to new research from Zerodha Fund House. Local ETFs account for US$83 billion total assets. Indian retail investors have been instrumental in the development of the local ETF sector over the past three years, the study shows. As of December, there are 12.5 billion ETF folios, or individual investor accounts, across equities and debt strategies.

Baader Bank’s AI-driven European equity ETF is the first to launch on the Goldman Sachs ETF Accelerator platform in Europe. Launched last year (I think), the group is keen to stress it is not a ‘white label platform’ but instead “the first institutional service provider for ETFs.

Why are European Pension funds choosing US domiciled ESG ETFs to seed $billion plus investment rather than UCITs ETFs? Invesco has launched an ETF investing in companies globally that aim to reduce their carbon footprint, with a $1.6bn (€1.5bn) investment from Finnish pension insurer, Varma. This is the second example of a large Nordics pension fund seeding a US product following a similar case with a DWS product late last year.

Career corner

Movers and Shakers

- Étienne Joncas Bouchard has joined BMO Global Asset Management as Director of ETF Distribution in Canada

- Steven de Vries, who was head of wholesale distribution for the UK, Europe and Latin America, is leaving the business following a restructure.

Salary Trends

If you are looking for a unicorn then I think you have a better chance at finding one than you have at finding an ETF content creator. Such roles are rare and few and far between. This is kind of surprising considering how important content creation has become in the industry, yet by and large the task is carried out by either product specialists or marketers.

If you are in this role, then expect a comp package of anywhere from $120k – $190k, depending on experience.

Tip of the week

There is more to life than being stuck on the hamster wheel.

Fancy a change in career?

I am looking to hire an ETF recruiter in the US to help me expand the business there. I want someone who comes from the ETF industry, who can take their industry knowledge and leverage it for recruiting.

I realise this maybe a left field idea to most but:

- If you are sick of working for a big firm

- Tired of all the crap you have to deal with

- Want the flexibility to live anywhere

- But still be involved in ETFs

Then this could be for you. Get in touch if you’d like to learn more.

About us

Spotlight on our PR Services: Elevate Your Media Presence

Are you looking to enhance your media coverage and boost the visibility of your ETF products and services? This week, we are highlighting our exceptional PR services designed to do just that. Our comprehensive media relations strategies ensure that your brand gets the attention it deserves.

Imagine your products being featured in top-tier media outlets, gaining the recognition they deserve. Our clients are already experiencing significant exposure and leveraging these opportunities to grow their brands.

Ready to elevate your brand and reputation? Let us help you capture the spotlight and elevate your presence in the investment and ETF media landscape.

Get in touch today to learn more about how our PR services can benefit your ETF business.