Can you believe what this guy has just said?

Hendrik Leber, the CEO of asset manager, Acatis in Germany, recently compared ETFs to “the fast food of the financial markets”—inexpensive, simple, but ultimately “unhealthy” for investors. OUCH !

While it’s a catchy analogy, I think Mr Leber has lost his marbles.

Yes, ETFs are low-cost and simple—but that’s exactly why they’ve become the go-to choice for millions of investors.

Passive ≠ Ignorant – Leber argues that ETFs ignore fundamentals, lumping together good and bad companies.

Passive investing isn’t mindless, it’s pragmatic – Active managers have long promised outperformance, yet most fail to beat their benchmarks after fees.

ETFs have opened the market to millions – In the past few years, ETFs have made investing more accessible than ever.

Millions of retail investors have entered the market, benefiting from diversified, low-cost portfolios without needing deep financial expertise.

Democratizing finance is a good thing, right? Or should investing remain an exclusive club for stock pickers?

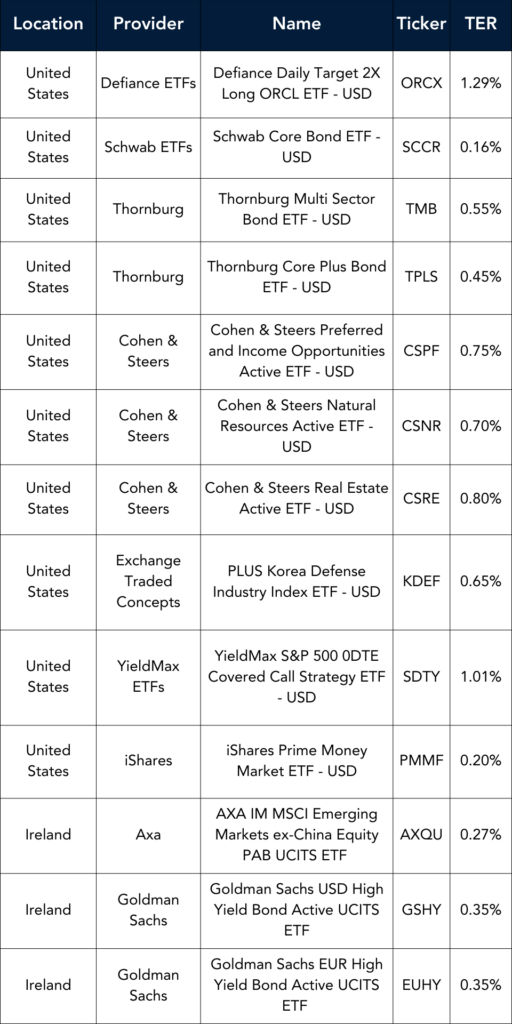

Launches this week

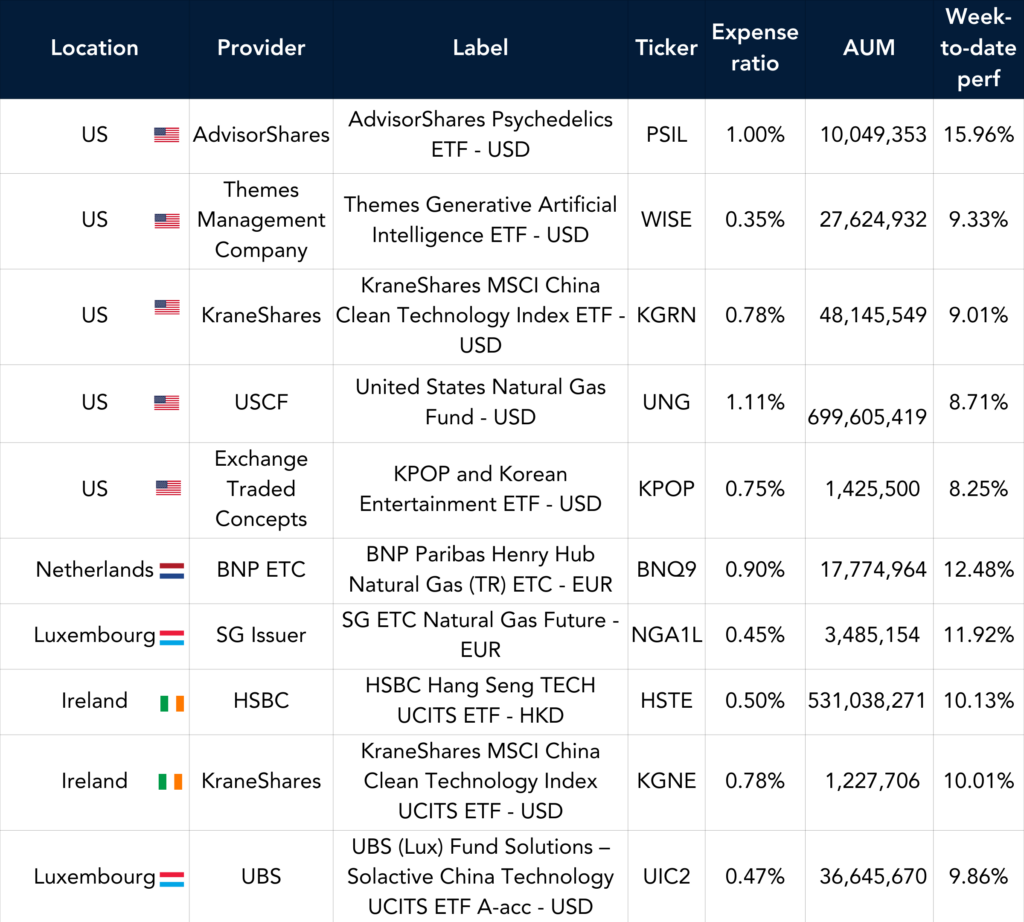

Flows & performance

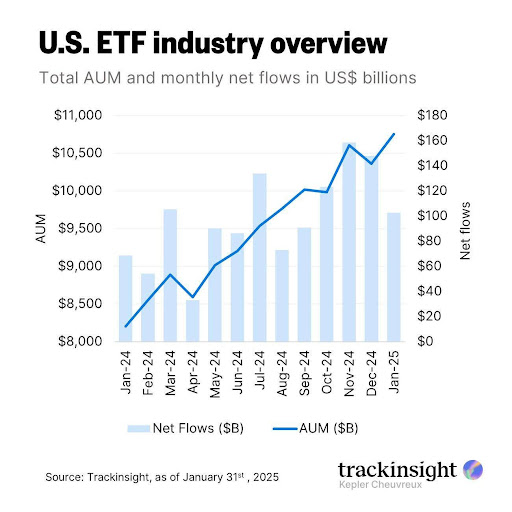

The U.S. ETF industry’s total assets grew to $10.7 trillion by the end of January. It was another strong month, with over $100B in net inflows (vs. $68B in Jan-24).

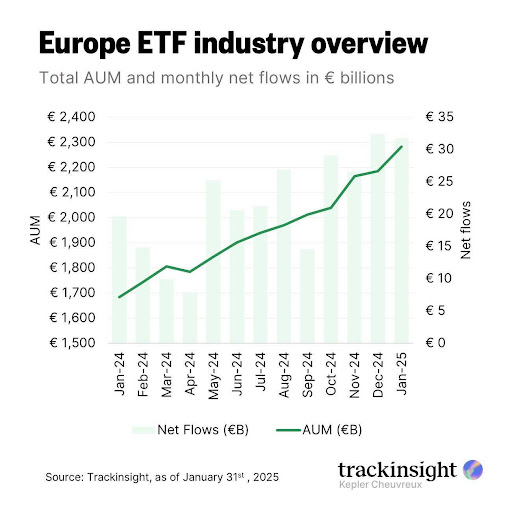

The European ETF industry’s total assets grew to €2.26 trillion by the end of January. It was another strong month, with over €31.7B in net inflows (vs. €19.6B in Jan-24).

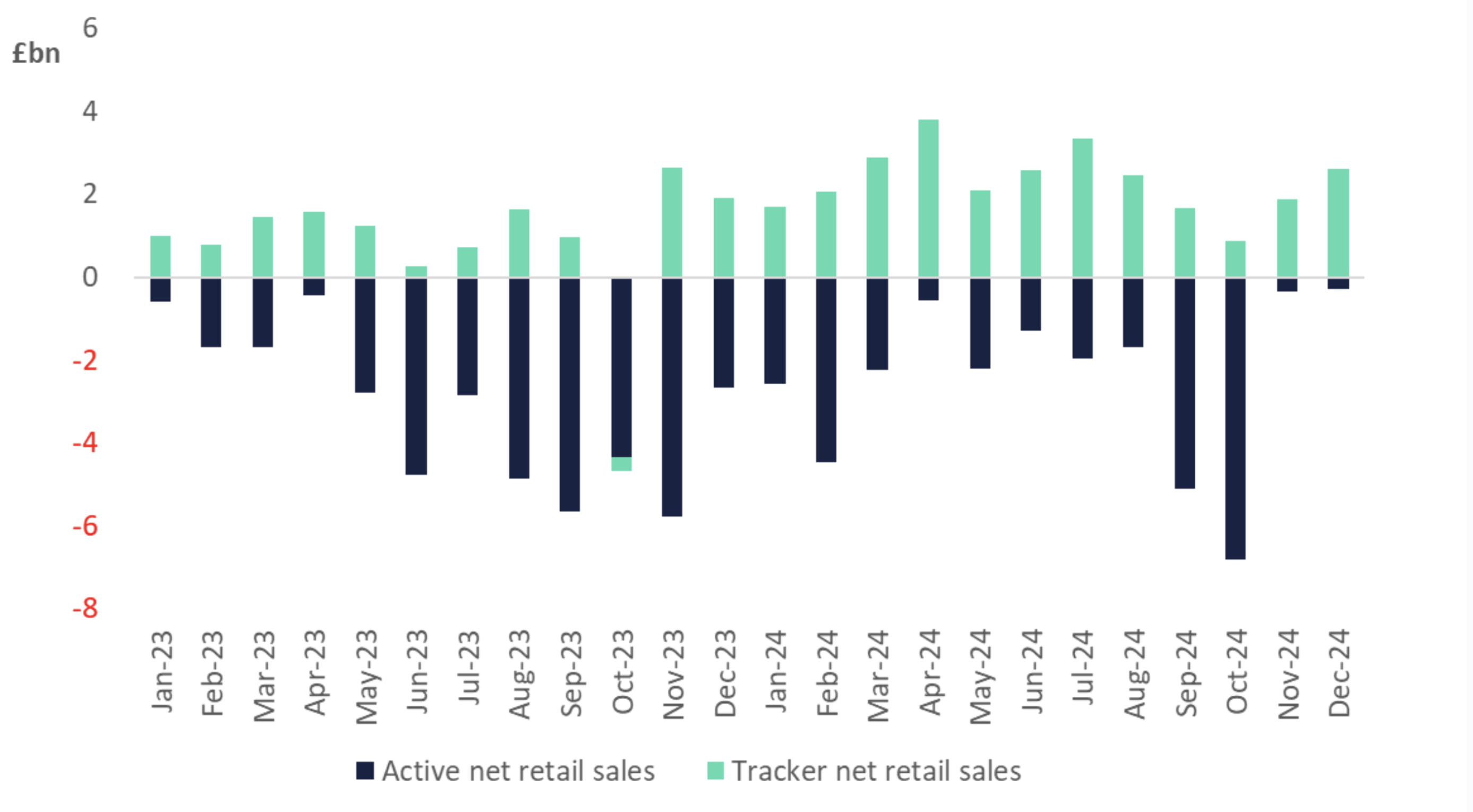

Retail outflows from the UK fund market fell sharply in 2024 amid a surge in demand for index tracking products.

Some £1.6bn was withdrawn from funds sold in the UK retail market last year, a significant decline on net redemptions of £24.3bn and £26.9bn in 2023 and 2022 respectively, according to figures from the UK asset management trade body.

Index tracking funds took in a record £28bn in 2024, exceeding the previous record inflow of £18.4bn. Such products now represent 25 per cent of funds under management, compared with 18 per cent five years ago, the Investment Association finds.

In contrast, actively managed funds endured £29bn of net outflows over the year.

Best Performers US & EU

Things of interest

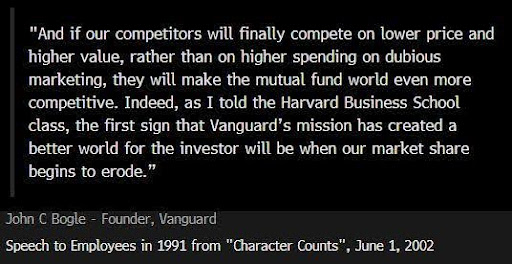

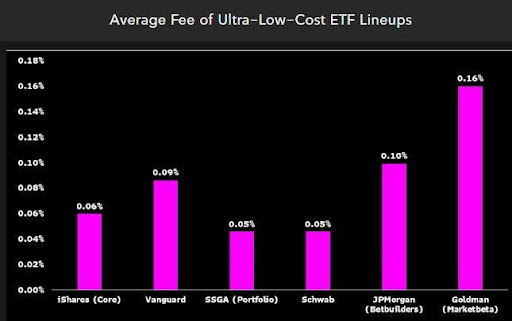

Vanguard has announced “the largest fee cut in Vanguard history” with the firm reducing fees on 168 share classes across 87 funds. The fee reductions are expected to save investors more than $350 million this year alone.

- Overall, 86% of Vanguard mutual fund and ETF assets are in the lowest-cost deciles of their peer groups.

- Average expense ratio for index fixed income ETFs is only 0.037%.

- Active fixed income ETFs have an average expense ratio of 0.105%—the lowest among leading issuers of such ETFs

The Nasdaq 100 is celebrating 40 years of existence. Launched on Jan 31st 1985 the index has delivered a 14% annualized compound return since inception, has an average market cap of $268bn and has had over 500 members. Here’s to the next 40 years.

An interesting snapshot on Bitcoin holders last year following the numerous Bitcoin ETF launches

The launch of new ETFs

New York-based Cohen & Steers Inc has joined the ETF party with three actively managed funds and the $85.8 billion asset manager indicated that it will be committing more resources to these types of products. Led by Dan Noonan the company confirmed that the ETF space is a big focus at the firm.

VanEck is on a mission to grow is European business by expanding its presence into France with the listing of 17 new ETFs on Euronext Paris. The new listings cover semiconductors, natural resources, energy security, blockchain, gaming, and wide-moat investing.

A good spot from Eric Balchunas at Bloomberg, who notes Vanguard are no longer the lowest in terms of prices bringing true a predicting from its founder.

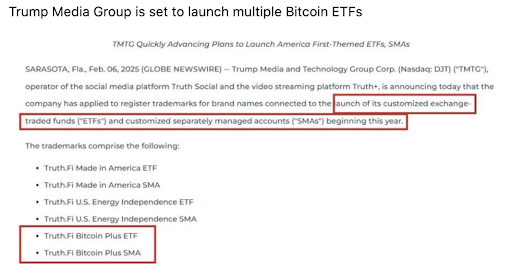

Trump Media Group is set to launch multiple Bitcoin ETFs

Trump Media Files to Trademark New ETF, SMA Suite. The US president’s media company plans to unveil six ETF and SMA products focusing on American manufacturing, energy, and crypto investments.

ETFs are the fast food of financial markets according to German fund veteran Hendrik Leber. In a recent interview Leber, who founded German boutique fund house Acatis Investment in 1994, said that ETFs were “inexpensive and uncomplicated”, but that ETF investors eventually received “tasty, but unhealthy fast food” vs actively management mutual funds which were wholesome and nutritious no doubt.

Surveys and latest findings

According to a recent HANetf survey:

- 94% of investors are set to increase active ETF use.

- Over the next 12 months, 68% of respondents said they would consider switching from a mutual fund to an ETF for their active exposure.

- 38% expect active to be the largest growth area in Europe over the next five years.

It’s funny how all these asset management surveys always show very positive results. Must be coincidental.

ARK Invest has launched its annual research report: “Big Ideas 2025: Unlocking Exponential Growth Through Disruptive Innovation.”

According to ARK’s latest findings, the world is on the cusp of exponential economic growth, driven by five converging innovation platforms: Artificial Intelligence, Robotics, Energy Storage, Public Blockchains, and Multiomic Sequencing. These platforms should drive exponential advances across industries and catalyse a step change in global economic growth.

The report highlights that these platforms are converging to create a catalytic shift in global productivity, driving breakthrough technologies that could radically redefine economic structures, investment landscapes, and societal progress.

BlackRock is set to enter the crypto ETP market in Europe with the launch of a bitcoin strategy. The ETP will likely be domiciled in Switzerland and marketing could begin as early as this month, according to a report form Bloomberg. I wonder how much that is going to shake up the stats quo.

It looks like another large US player is coming to Europe according to media reports and job postings on Linkedin. Dimensional Fund Advisors is looking to hire an ETF Capital Markets specialist in London which can only mean one thing, right? I’m just disappointed they didn’t come to us for help first ☹.

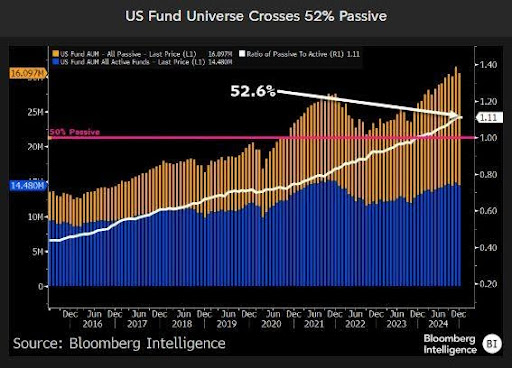

Another good graph from Bloomberg. This one shows that Passive funds in the US now have $16T in assets, which is 52.6% of the whole fund market after picking up 2% share last year. Passive equity is 63% market share but passive bonds is 37%.

Career corner

Movers and Shakers

- Alex Berg has joined Cohen & Steers as the new head of ETF sales. He joins from State Street Global Advisors.

- Armine Matevosyan has joined BNP Paribas in Paris as an ETF Portfolio Manager. She joins from Amundi

- Thomas Bolger has joined HSBC in Dublin as a senior ETF Product Manager

- Brandon DallAcqua has joined GraniteShares in the US as CFO. He joins from Tidal

On the Move

European Featured Opportunities

- ETF Sales – German Speaking – London: If you possess an entrepreneurial mindset and are eager to constantly challenge yourself in the rapidly evolving world of ETFs, this is the place for you. You will have the chance to distribute both our branded suite of sustainable self-indexed ETFs and our recently launched range of actively-managed ETFs, actively participating in the collaborative development of sales strategies for new launches as well as our existing range.

US Featured Opportunities

- Quantitative Trader, Fixed Income – Dublin: A role that will see you work with a leading financial firm that leverages cutting edge technology to deliver liquidity to the global markets and innovative, transparent trading solutions to their clients. Their market structure expertise, broad diversification, and execution technology enables them to provide competitive bids and offers in over 19,000 securities, at over 235 venues, in 36 countries worldwide.

Tip of the week

We are all getting older and there ain’t much we can do to prevent that. (I think)

So are you worried about Gen Z taking over the workforce? You probably should be.

They’re tech-savvy, adaptable, and aren’t afraid to challenge the status quo. If you don’t evolve, they’ll outpace you.

But here are four ideas on how to stay ahead:

-

-

Embrace AI & Automation

If you’re ignoring new tech, you’re already falling behind. Learn how to use AI before Gen Z replaces you with it. -

Commit to Lifelong Learning

The job market is shifting fast. Keep up with industry trends, take online courses, and develop in-demand skills. -

Mentor, Don’t Compete

Instead of seeing Gen Z as a threat, collaborate with them. Teaching younger employees makes you indispensable. -

Stay Adaptable

The biggest career killer? Resistance to change. Be open to new ways of working, or risk getting left behind.

-

About us

The Future of DEI: A Business Imperative or a Fading Priority?

Diversity, Equity, and Inclusion (DEI) in the workplace is at a crossroads. While regulatory forces in Europe push for stronger DEI commitments, political and corporate shifts in the U.S. are leading some firms to scale back. Will DEI remain a core business strategy, or is it at risk of becoming a mere compliance checkbox?

In our newest article, we unpack the evolving global landscape of DEI, exploring how shifting regulations, workforce expectations, and competitive pressures are reshaping corporate approaches. In the ETF industry and beyond, companies must decide: Will they lead with inclusion or fall behind in an increasingly diverse market?

Read on to discover what’s next for DEI and what it means for businesses navigating this complex terrain.

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.