The biggest problem in ETFs no one is talking about right now

The ETF market is being flooded with new entrants, like bees to honey. Whilst it’s great to see, it is creating a massive problem which many people may not be aware of.

Getting onboarded with liquidity providers

There are hundreds of issuers but there are only a handful of APs and Market Makers, (especially outside the US). It’s like trying to squeeze a hundred people onto a small bus – there’s only room for so many.

The result?

Long lead times of up to one year to get onboarded and liquidity providers becoming more selective in who they work with.

So if you are planning on your own ETF launch, two pieces of advice

1. Start talking to liquidity providers early

2. Be sure to have a really good business case

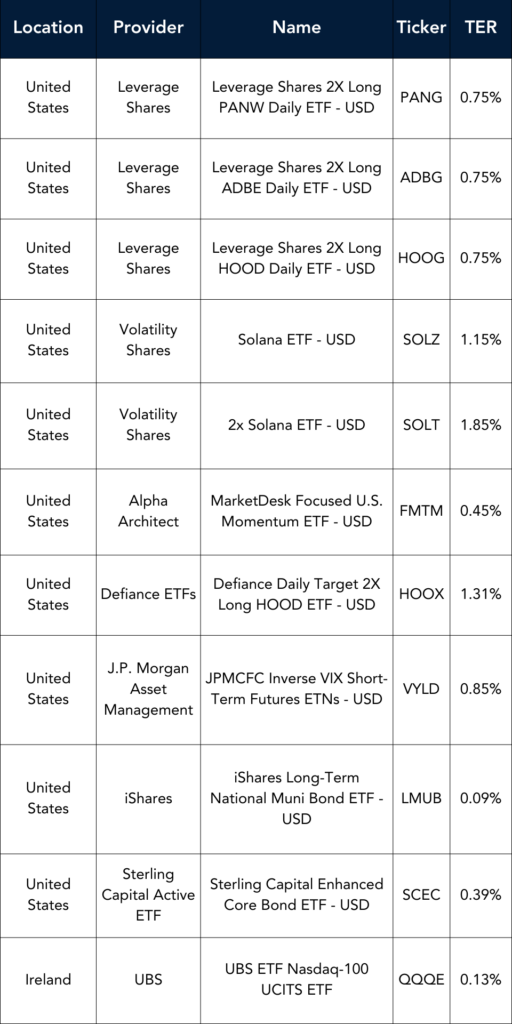

Launches this week

Flows & performance

- Assets invested in the ETFs industry globally reached a new record of $15.50 Tn at the end of February, beating the previous record of $15.45 Tn at the end of January 2025.

- Net inflows of $152.13 Bn during February.

- YTD net inflows of $304.70 Bn are the highest on record, while the second highest recorded YTD net inflows were of $252.60 Bn in 2024 and the third highest recorded YTD net inflows are of $224.30 Bn in 2020.

- 69th month of consecutive net inflows.

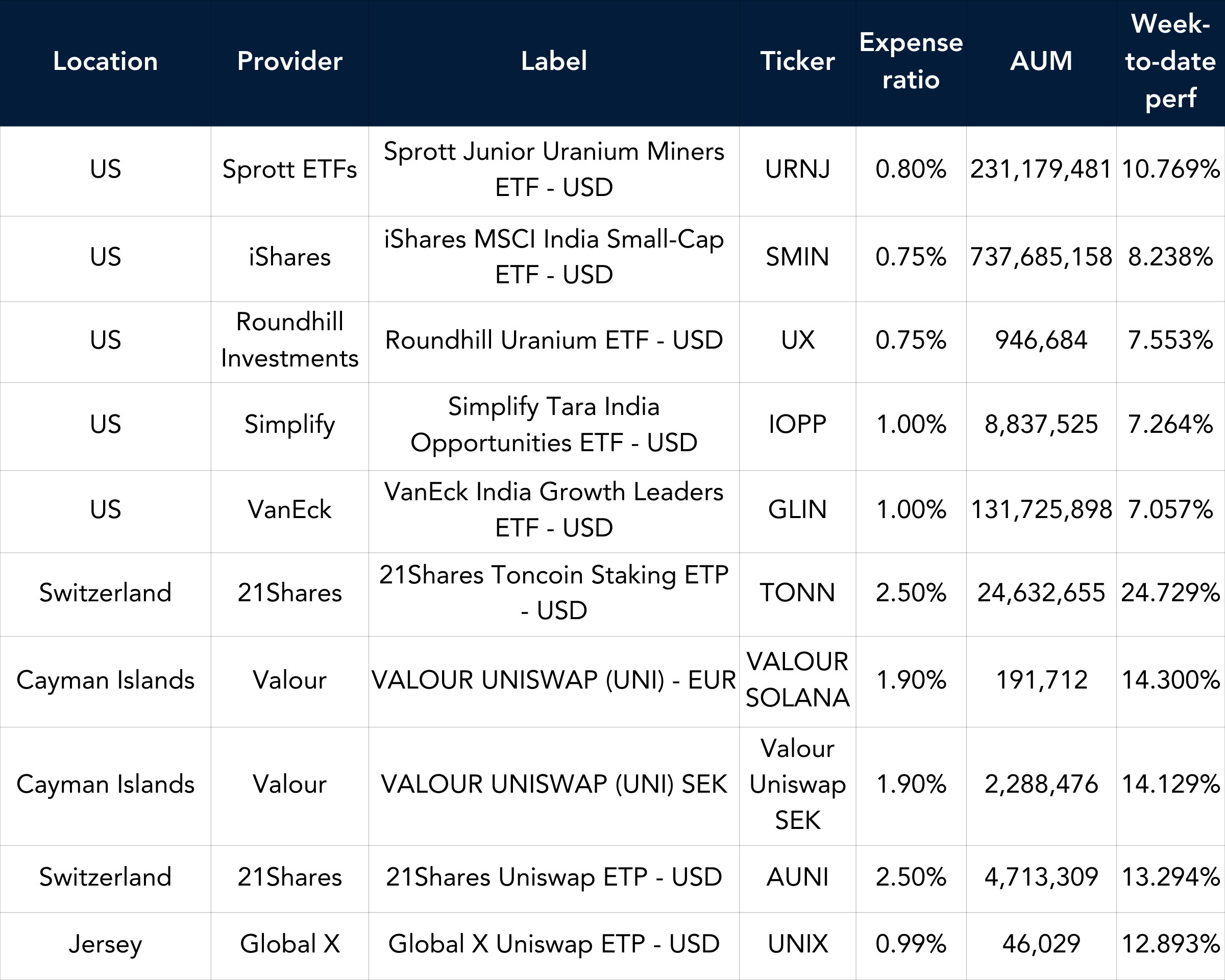

Best Performers US & EU

Listen and Learn

In this episode of Exchange Traded People, Springer Harris, COO of Teucrium ETFs, shares how his passion for business and entrepreneurship led him to the ETF industry. He discusses why the white-label ETF space thrives on collaboration, the importance of making ETF education more accessible, and why the best opportunities come from solving real client problems.

Plus, his biggest career lesson? Always say yes to opportunities.

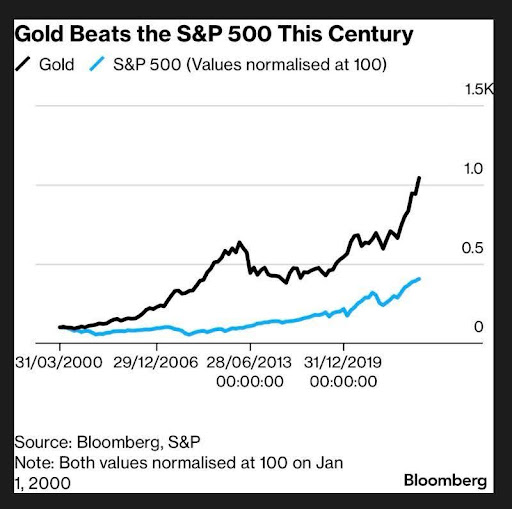

Graph of the Week

Is Gold the new Bitcoin?

Gold is up ten-fold since 2000. That’s much better than the S&P 500, which has risen less than four-fold.

Things of interest

M&G is the latest mutual fund manager to jump on the ETF train with news that they are preparing to launch their first active ETF this year.

The asset manager intends to launch three fixed income products and one equity ETF, based both on strategies it already runs, as well as some new investment approaches. Who is next in line I wonder?

Looks like Graniteshares have run into some logistical issues in Europe. Creation of new shares in their entire ETP range is set to be suspended after its base prospectus failed to receive regulatory approval in time.

From Monday, APs will no longer be able to create shares in the firm’s 118-strong ETP range meaning they could theoretically trade at wide premiums to their net asset values (NAVs). APs will remain able to redeem shares so investors looking to exit will be able to do so at prices close to NAV.

First Trust has terminated a partnership with TCW

First Trust has terminated an $8 Billion ETF partnership with TCW. The First Trust’s board voted to terminate a sub-advisory agreement for four ETFs with TCW last week, according to filings.

The largest of the four ETFs is the First Trust TCW Opportunistic Fixed Income ETF, with about $4.2 billion, which debuted in 2017 and invests in relatively undervalued assets. No reason was given for the breakup.

An FT article from Burton Malkiel attempts to pour cold water on active management.

Are ETF Boards fit for purpose?

At the end of last year the Central Bank of Ireland threw a hospital pass to ETF Funds Boards in Ireland. In an open letter, they stated that there was not enough due diligence and oversight being conducted on APs and Market Makers and gave a deadline of the end of Q2 2025 to rectify this.

The problem is, ETF funds board don’t have the necessary skills to do this. Most Independent Directors that sit on ETF boards do not come from a capital markets trading background and most probably know very little of the mechanics of how APs and Market Makers operate. Giving them 6 months to get up to speed is a very tall order.

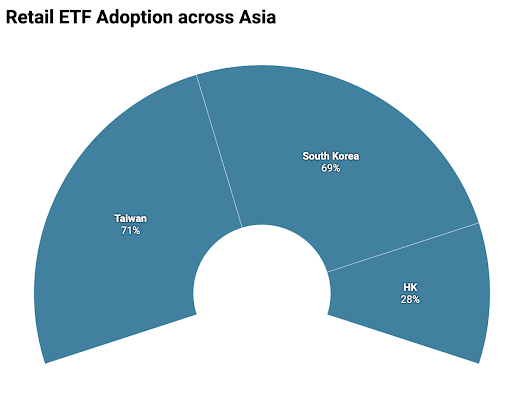

Retail investors in South Korea and Taiwan

If you ever wanted a case study for how to penetrate Retail investors then head to South Korea or Taiwan, where the numbers are simply eye watering.

But according to Citi, the participation of Hong Kong retail investors in the local ETF market could double over the next 12 months, driven by investor education and product innovation.

Several popular leveraged ETFs have erased most of their value

Retail investors are getting burned from using Leveraged ETFs according to an article in the WallStreet Journal. Titled. “Billions Flowed Into New Leveraged ETFs Last Year. Now They’re in Free Fall” the report describes how several popular leveraged ETFs have erased most of their value in a matter of weeks.

Among the worst performers: A fund that offers investors twice the exposure to shares of MicroStrategy, the software company-turned-bitcoin collector, has plunged 83% since touching its November high. Another ETF, which offers similar leverage on Tesla, is down 80%.

Thailand has approved the sale of leveraged and inverse ETFs to retail investors starting this month. The regulatory nod to issue the complex index-tracking products is in line with Thailand’s efforts to strengthen its ETF sector and expand its capital markets.

Career corner

Movers and Shakers

- Jordan Lee has joined Evolve ETF in Canada as VP of Sales. He joins from BMO

- Vinamrata Chaturvedi has joined 21Shares in NY as head of content. She was previously a reporter at Forbes

On the Move

US featured Opportunities

Regional Advisor Associate – New York: Build relationships with advisors across the RIA, registered rep and wirehouse channels, support product level consideration and engage decision makers with investment case research across the suite of solutions we offer. The successful candidate will be responsible for providing a high service level and be an effective gateway to subject matter experts within the firm, in addition to actively engaging with targeted advisor offices.

European Featured Opportunities

European Marketing Manager – London: The role will see you lead all marketing initiatives across Europe, driving engagement, brand growth, and ETP product adoption (and AUM growth) among professional and retail investors.

Tip of the week

Don’t do this if you want a successful career

Very often I get candidates coming to me highlighting their flexibility and ability to perform multiple roles. A Swiss army knife of talent.

As a founder, I love those skills BUT big corporates HATE these skills.

Big corporates are looking for widgets, they are looking for candidates to perform one specific task and so if you are someone who doesn’t fit neatly into a nice square peg, then that’s bad news for you.

So the next time you go pitching yourself to a big company as being multidimensional, think twice before doing so.

About us

2025 Global ETF Salary Survey – Coming Soon

Curious about where you stand within the ETF industry? Our annual Global ETF Salary Survey is about to launch, and we’d value your input.

By contributing, you’ll receive early access to the key findings. Your perspective helps shape an accurate picture of the industry.

Last year’s insights showed:

- The average total compensation in ETFs was $308K

- Bonuses averaged 75% of base salary

- U.S. salaries were 45% higher than those in Europe

- On average, women earned 18% less than men

- Trading roles topped the charts at $393K, while Operations roles averaged $141K

Stay tuned – the survey opens soon.

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.