AXA IM jumps into passive ETFs

AXA Investment Managers expands their ETF line-up to include passive products and more mutual fund to ETF conversions.

Fund Launches and Updates

EMEA

Amundi is reclassifying its entire €19bn Paris-Aligned Benchmark and Climate Transition Benchmark ETF range.

The downgrades – which cover 29 ETFs – will see almost all of its roughly 100 Article 9 funds, covering €45bn in AUM, switch to Article 8. ETF Stream

AXA Investment Managers has introduced its first passive ETF in Europe with the launch of the AXA IM Nasdaq 100 UCITS ETF (ANAU GY) on the Deutsche Börse Xetra, TER 0.14%. ETF Strategy

Global X has introduced its first ‘buy-write’ ETF in Europe with the launch of the Global X Nasdaq 100 Covered Call UCITS ETF. The new ETF has been listed on London Stock Exchange, Deutsche Börse Xetra, and the Borsa Italiana, expense ratio of 0.45%. ETF Strategy

HSBC Asset Management has expanded its product suite with the following five new Islamic ESG ETFs:

The HSBC MSCI USA Islamic ESG UCITS ETF

The HSBC MSCI World Islamic ESG UCITS ETF

The HSBC MSCI Europe Islamic ESG UCITS ETF

The HSBC MSCI Emerging Markets Islamic ESG UCITS ETF

The HSBC MSCI AC Asia Pacific ex Japan Islamic ESG UCITS ETF

Invesco will update (effective 30 November) the investment policy of the Invesco GBP Corporate Bond ESG UCITS ETF, Invesco USD High Yield Corporate Bond ESG UCITS ETF and the Invesco MSCI Emerging Markets ESG Universal Screened UCITS ETF to include ESG as an underlying strategy. Investment Week

Legal & General Investment Management has downgraded the L&G Gold Mining UCITS ETF (AUCP) from Article 8 to ‘non-ESG’ Article 6 under the Sustainable Finance Disclosure Regulation. ETF Stream

State Street Global Advisors has more than halved the total expense ratio of its emerging markets ETF. The SPDR MSCI Emerging Markets UCITS ETF will see its TER fall from 0.42% to 0.18%. Investment Week UK

AMERICAS

Fidelity Investments announced plans to convert six actively managed thematic mutual funds listed below into active ETFs:

Fidelity® Disruptive Automation Fund (FBOTX)

Fidelity® Disruptive Communications Fund (FNETX)

Fidelity® Disruptive Finance Fund (FNTEX)

Fidelity® Disruptive Medicine Fund (FMEDX)

Fidelity® Disruptive Technology Fund (FTEKX)

Fidelity® Disruptors Fund (FGDFX)

Fidelity currently manages 51 ETFs with $28 billion in assets and with the conversion, Fidelity adds six transparent active ETFs to its current active equity ETF line-up of nine ETFs, which as of last month, had over $720 million in AUM. Markets Media

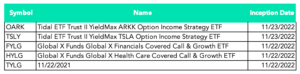

Full list of U.S. launches:

ASIA-PACIFIC

CSOP Asset Management has launched two new ETPs in Hong Kong.

The CSOP US Large Oil & Gas Companies Daily (2x) Leveraged Product (7204 HK) and CSOP US Large Oil & Gas Companies Daily (-2x) Inverse Product (7505 HK) have been listed on the Stock Exchange of Hong Kong in Hong Kong dollars. ETF Strategy

Flows

In South Korea, the total net assets of ETFs reached a milestone of 80.5 trillion won ($60 billion) since first introduced twenty years ago.

ETF assets gained from 74 trillion won at the end of 2021 as more than 6 trillion won worth of new funds flowed in despite a volatile year. So far in 2022, the market has welcomed 23 ETF newcomers and the daily average trade value of ETFs versus the benchmark Kospi was 38.7% at the end of October. Pulse News

Noteworthy

ADX rebranded

The Abu Dhabi Securities Exchange (ADX) has launched its rebranded ADX ETF market pursuant to the introduction of an ETF tracking the FADX 15 which listed November 24.

The launch of ADX’s rebranded ETF platform was unveiled with a bell-ringing ceremony, coinciding with the listing of Chimera FTSE ADX 15 ETF (CHADX15) onto the ETF market, representing the eighth listed ETF on ADX.

In addition to its total traded value surpassing Dhs1.4bn, ADX has witnessed strong year-to-date growth in the ETF market’s trading activity with around 12,500 trades of 243 million units. Gulf Business

South Korea’s retail ETFs

Hong Kong’s CSOP Asset Management is seeking approval from South Korea’s financial authorities to sell its ETFs to the country’s retail investors, in a move that would see it become the first Chinese firm to step into the local ETF space.

CSOP AM has submitted applications to South Korea’s Financial Supervisory Service to register five ETFs and plans to launch the CSOP FTSE China A50 ETF, CSOP SZSE ChiNext ETF, CSOP Hang Seng TECH Index ETF, ICBC CSOP S&P New China Sectors ETF and ICBC CSOP FTSE Chinese Government Bond Index ETF managed by CSOP Singapore.

South Korea is a rapidly growing market with 630 ETFs and approximately $56.3bn of AUM. Financial Times

Additional reads

Crypto crisis shrinks ETF assets in Canada. Bloomberg

Down Under, the local regulator, ASIC, has released updated guidance on the naming conventions for ETPs Investor Daily Australia

TSMC fever helps boost fortunes of Taiwan ETFs ETF Stream

South Korean investors pour money into Japan-listed US ETFs. Financial Times

And congratulations to all of the ETF Stream award winners! ETF Stream

From behind the desk with Andrea Murray

A big thank you again to the team at ETF Steam for inviting us to participate in their annual awards event.

It is an absolute honour to win an award which goes without saying, but one of the things I noticed last year and again this year are the people that go up to accept the award.

You have two buckets – the firms where the leader runs up to accept it or the second where the leader steps aside and allows their team to enjoy the spotlight.

It says a lot about someone and reminds me of this quote which I heard during a virtual conference on leadership in 2021:

“I find leadership the best when you step away from being in front and you let your subordinates lead.

Here’s a metaphor for you and it is an army thing that won’t happen in the finance industry. And that is, typically when you go into combat the person who dies first, when you cross the line of departure, is the leader.

In this situation you never want to die and then leave your troops without the capability to carry on without you.

So, you have got to make your subordinates better than you and you’ve got to make them able to function without you.

You don’t want the mission to fail because you’ve held all the knowledge and skills and abilities to yourself.

The more power and empowerment that you can give away, the stronger your people will become and the better your unit will operate and perform. It’s hard to do, it’s hard to give away power but it sure comes back to you triple-fold – if you can just let go of that ego and say, “I want you to be better than me”. – Dr. Lissa Young, West Point, U.S.