Australia: the forgotten ETF market

The Australian ETF industry is often overlooked, at least compared to the coverage in the US or Europe.

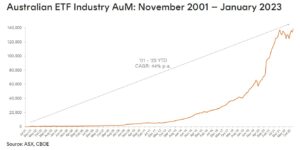

It’s time to pay attention because according to a recent Betashares report, January started with a bang bringing the Australia ETF industry to a record $138.5 billion in AUM across approximately 240 ASX-listed ETFs.

If that doesn’t impress you, at the same time 10 years ago, the Australian ETF market was just shy of $7bn in assets across 79 products. Very impressive growth over ten years and congrats to all of the ETF issuers down under.

Fund Launches and Updates

EMEA

Amundi to launch the Amundi MSCI Europe Small Cap ESG Climate Net Zero Ambition CTB UCITS ETF and the Amundi MSCI Pacific ESG Climate Net Zero Ambition CTB UCITS ETF on Deutsche Boerse on 10 March with TERs of 0.35% and 0.45%, respectively. etfstream

HANetf partners with Algo-Chain to launch six ETF model portfolios. etfstream

Investlinx, Italian advisor enters the ETF space with the launch of the Investlinx Capital Appreciation UCITS ETF (LINXC) and the Investlinx Balanced Income UCITS ETF (LINXB). Both will list on the Borsa Italiana. etfexpress

Axa IM in talks with ETF digital distribution partners and aiming to distribute its exchange traded funds through neo-banks and robo-advisers within a year as it expands its new ETF business across different markets. ignites

AMERICAS

Engine No. 1 launches the Engine No. 1 Transform Supply Chain ETF (ticker SUPP) with a TER of 0.75%. businesswire.com

iShares enters the metaverse space with the launch of the the iShares Future Metaverse Tech and Communications ETF (IVRS) TER of 0.47%. etf.com

Tidal is launching a new ETF focused on the music industry. The Clouty Tune ETF (TUNE) is expected to launch during the second quarter, tracking Solactive AG’s Clouty Tune index. yahoofinance

Flows

ETFGI reports the Global ETFs industry gathered net inflows of $30.96 Billion in January 2023. Assets invested the global ETFs industry increased by 5.9%. Mondovisione

Large Hong Kong-listed ETFs show resilience in 2022 by attracting $10bn in net inflows despite the Hang Seng index being down 15.5%. ft.com

Bonds are back and BlackRock is crushing it. According the FT from March last year to the end of January, there were $146bn net flows into BlackRock’s fixed-income ETFs, while competitors took in $134bn. BlackRock share of the global Fixed Income ETF aum is 40%. ft.com

Noteworthy

RFQ platforms increase market share of European ETF trading after accounting for 50% of total traded value in 2022. etfstream

A recent ETF survey by BNP Paribas Asset Management showed 81% of respondents expect ESG ETF assets under management to remain stable or grow over the next 12 months. pionline.com

However at a global level, is interest in ESG products waning? Our friends at Bloomberg produced the below graph for us. There is a clear trend developing it seems.

Additional reads

Insider traders use ETFs to front-run M&A deals, academics say. Research identifies $2.75bn worth of potential ‘shadow trades’ in US between 2009 and 2021. FT.com

SEC targets built-in marketing fees in fund-to-ETF conversions. FT.com

From Behind the Desk

Party like it’s 1999.

We read last week that the CEO of Nordea Asset Management (a very large European Mutual Fund manager) believes there is” only space for a very small number of European exchange traded fund providers” in Europe, his logic being that these are low margin products and therefore the market can only tolerate no more than one or two European ETF providers.

This, he felt, was an argument against launching their own range of ETFs. As we posted on LinkedIn, such thinking drives us nuts… really dude!.

As our friend John Hyland commented “many mutual fund CEOs still want to party like it’s 1999”. ignites

Those who listen to this week’s podcast guest Alex Vynokur, Founder and CEO at BetaShares, you will know that his home country is Ukraine.

Alex has gone to tremendous effort to support his fellow countrymen and has set up a charity. The work Alex has been doing and the time he has dedicated to this has been incredible, so we would encourage you all to take a look at his work and do what you can to support a fellow ETFer. https://www.theukraineappeal.org/