Are Active ETFs taking over the world? Maybe not

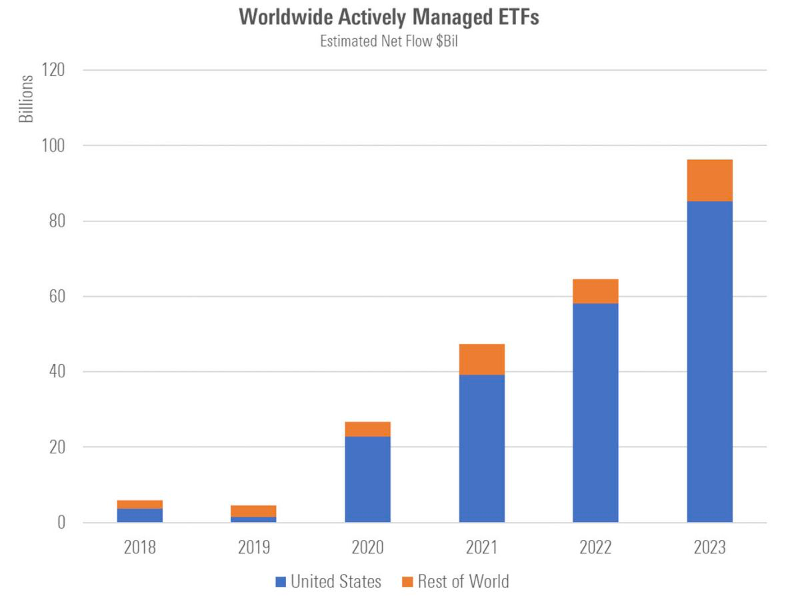

Actively managed equity ETFs grew 48% globally in 2023. Assets in actively managed ETFs in the US grew 37% in 2023, while passive ETFs only grew 8%. Outside the US, actively managed ETFs grew 28%.

These are impressive numbers by anyone’s book, so does it mean world domination is imminent for active ETFs? Maybe not.

Australian investors withdrew approximately A$1 billion (US$651 million) from actively managed ETFs last year, the most popular vehicles being low-cost vanilla ETFs. This mirrors a regional trend as net flows into active ETFs across three other APAC markets namely Hong Kong, Indonesia and Taiwan also fell last year.

ETFs have historically all being above passive, but clearly that narrative is changing.

For an industry that previously ridiculed Active, we think this is pretty funny.

Fund Launches and Updates

EUROPE

MSCI has acquires boutique index provider Foxberry. Foxberry was founded in 2014 and was primarily used by thematic and sustainable ETF issuers. Rize ETF and Legal and General Investment Management (LGIM).

State Street has expanded its Fund Connect ETF portal to clients in Europe and Asia Pacific. Fund Connect ETF is a global online portal designed to facilitate the creation and redemption of ETFs, designed as a single point of access to many issuers.

BlackRock has expanded its thematic range with an aerospace and defence ETF. The iShares Global Aerospace & Defence UCITS ETF (DFND) is listed on Euronext Amsterdam and has a total expense ratio (TER) of 0.35%. BlackRock joins VanEck and HANetf with similar strategies.

Vanguard is set to launch an investment app for its UK customers. The app – currently in development – will allow its customers to invest in the passive giant’s ETFs and other products. The Vanguard UK Personal Investor (UKPI) platform hit 500,000 last April, which has now grown to 575,000 clients holding around £19.8bn in assets on the platform.

Meanwhile Vanguard has also partnered with Directa SIM to offer its Italian listed ETFs on the brokerage’s platform Vanguard now joins AXA IM, Franklin Templeton, DWS, Legal & General Investment Management (LGIM), which have all made recent pushes into the Italian retail market through partnerships with local trading platforms.

AMERICAS

KraneShares has launched two new ETFs related to its flagship strategy, the KraneShares CSI China Internet ETF (KWEB). The pair take defined outcome approaches to KWEB.

Both also include the KraneShares 100% KWEB Defined Outcome January 2026 ETF (KPRO) and the KraneShares 90% KWEB Defined Outcome January 2026 ETF (KBUF). The two strategies launched on the New York Stock Exchange (NYSE).

Morgan Stanley Investment Management has added an active senior loan ETF to its lineup. The Eaton Vance Floating-Rate ETF (EVLN) is an actively managed strategy providing access to loan investing in a tradable format. The fund launched on the NYSE.

Direxion added to its lineup of leveraged and inverse ETFs with the launch of a 2X fund that covers emerging markets but excludes China. The Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares (NYSE Arca: XXCH) offers twice the daily performance of the MSCI Emerging Markets ex China Index. The fund has an expense ratio of 1.18%

American Beacon rolled out the actively managed American Beacon GLG Natural Resources ETF (MGNR). The fund seeks long-term capital appreciation by taking a global perspective on companies operating in the natural resources sector or adjacent areas. The fund’s sub-advisor is GLG LLC, a subsidiary of the Man Group plc.

ASIA-PACIFIC

Taiwan’s Financial Supervisory Commission is planning to finalise proposals to allow active ETFs this year. The announcement means that Taiwan will this year become the latest Asian market to permit listing of active ETFs, after Japan and Singapore.

BlackRock is set to roll out three new factor-based ETFs in Australia. These products will be the iShares MSCI World ex Australia Momentum ETF, iShares MSCI World ex Australia Quality ETF and iShares MSCI World ex Australia Quality ETF.

A podcast series focused on exploring the career journey of industry leaders within the ETF and Digital Assets space. Get to hear their personal story and be inspired. This week we speak to Andrew Jamieson, Global Head of ETF Product at Citi. Link

Flows

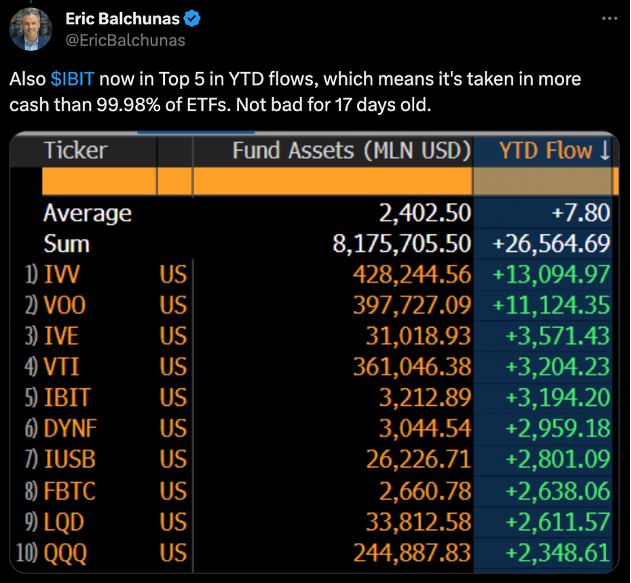

Only 17 days after its launch, the BlackRock iShares Bitcoin Trust (IBIT) has become one of the top five exchange-traded funds (ETFs) of 2024 based on inflows, according to data from Bloomberg Intelligence. link

Taiwan’s onshore fund market hit a record high last year after recording asset growth of 38.7% to end the year at NT$6.74 trillion (US$215.88 billion), as locally listed ETFs overshadowed out-of-favour active strategies.

Net inflows of NT$1.23 trillion into Taiwan’s onshore funds represented an increase of 55% from the previous year, widening the gap between assets in onshore and offshore funds.

Taiwan equities and bond ETFs investing overseas accounted for more than 80% of the net inflows, with the influx of retail investors into bond ETFs being the biggest driver of Taiwan’s fund market last year.

Noteworthy

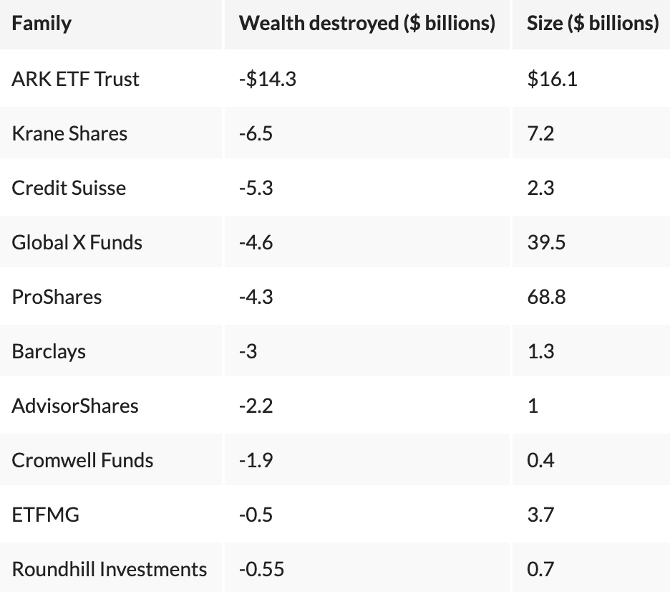

Morningstar calls Cathie Wood the worst ‘Wealth Destroyer’, claiming Ark Invest has destroyed an estimated $14.3 billion in wealth over the past decade, whilst rattling off a list of other culprits.

Bitcoin ETFs launch promotional blitz after Google allows ads.

Asset managers have launched an online advertising blitz for their bitcoin ETFs, taking advantage of a change to Google’s marketing rules on promoting cryptocurrency instruments. Google’s new marketing rules allow ads touting “cryptocurrency coin trusts” to appear alongside search results for queries such as “bitcoin ETF”. They took effect on January 29.

Ads have appeared from asset managers including BlackRock, Fidelity, Grayscale, Invesco and Bitwise touting spot bitcoin ETFs as the issuers try to get their products in front of as many potential clients as possible — retail investors in particular.

Movers and Shakers

Briton Ryan has become head of ETFs at Nuveen.

Jon Maier, Global X’s chief investment officer, and Ronnie Riven, head of finance, have decided to step down from their positions Global X.

From behind the Desk

We read something this week which claimed that less than 20% of people who work in asset management sales roles in Europe were women.

Based on our experience that seems about right.

The stats for Portfolio Manager roles are even worse where the % of female PMs globally is 12.1%. Shocking statistics really.

It seems for an industry which talks a lot about equal opportunities, talk is cheap.

About us

Blackwater is a leading global ETF Consulting, Recruiting, PR and Content Creation firm.

We are specialists in helping companies find the best strategy to enter and navigate the ETF marketplace, enhance their reputation, craft innovative and engaging targeted ETF content and source the very best of talent across the ecosystem.

If you would like to discuss any of the above then please reach out at mike@blackwatersearch.com