Active ETFs: The great con. Are investors being mis-sold?

For over 20 years we have told ourselves that passive was king and active was a broken promise.

Now active is the shiny new thing that everyone wants to own. The problem is “active” is not really that active is it?

There are 3 varieties of active ETFs being offered currently.

- Quantitative rules based strategies

- Benchmark plus strategies

- Stock picking, high conviction ideas

The vast majority launched to date have been in the first 2 categories.

For the unassuming investor (Retail) this might be a surprise to them if they buy an active ETF only to find out there is not that much “activity” happening within it.

Is this right or should we go back to first principles and look to relabel what these funds are actually doing?

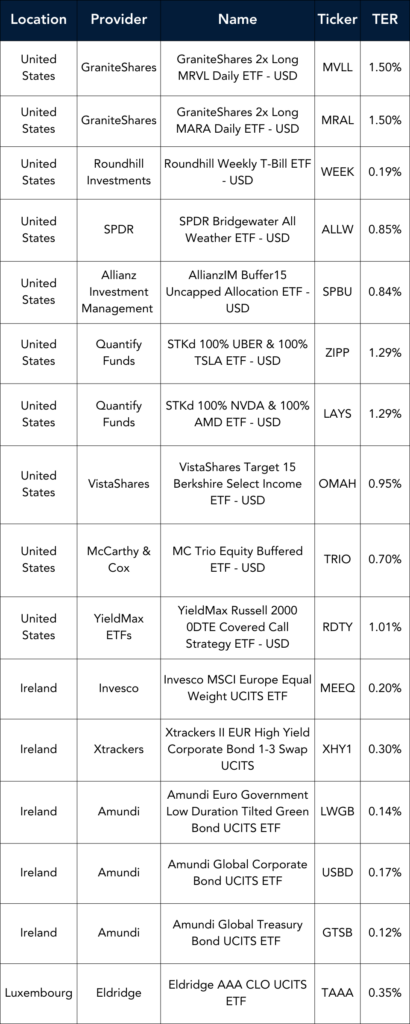

Launches this week

Flows & performance

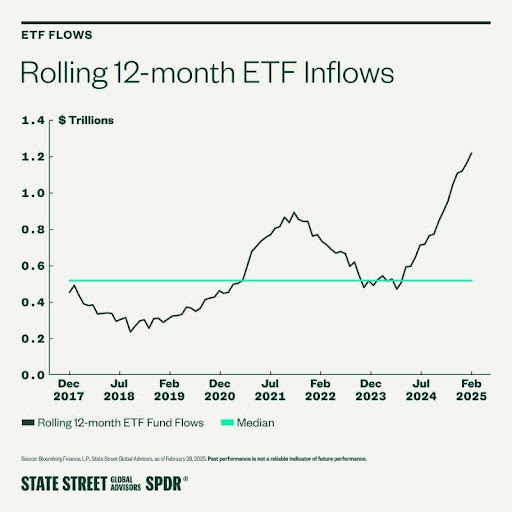

US ETFs’ $111 billion of inflows in February were 185% greater than the average February. Add that to the record January haul, and ETFs now have over $200 billion of inflows through the first two months of 2025.

As this is the strongest start to any year, ETFs are on pace for a record $1.5 trillion of inflows for 2025, based on projections that control for seasonality and recent trends.

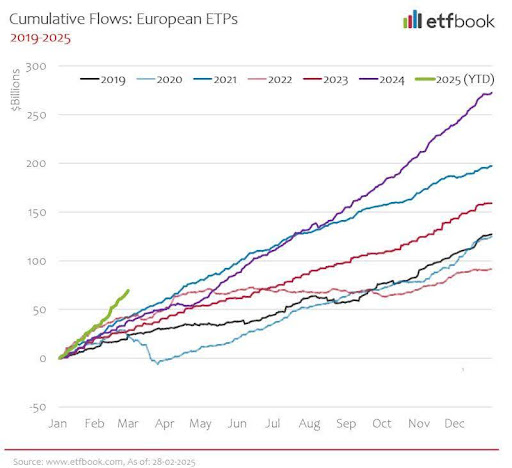

Speaking of promising starts to 2025, European ETF flows in Europe are also on track for their best start ever to a year as shown in the graph below.

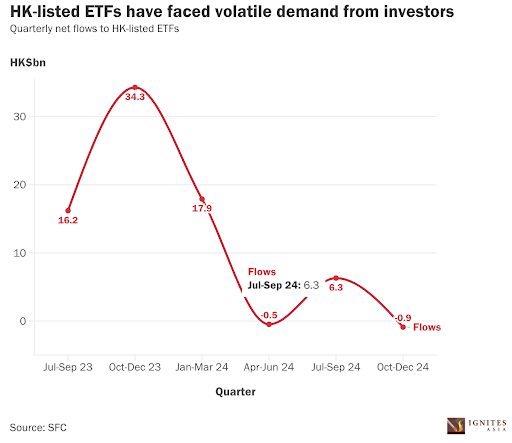

Flows into HK listed ETFs have had a volatile 2024. Almost all of these inflows came in the first three months of the year when ETFs pulled in HK$17.9bn Since then, investor appetite for Hong Kong’s 194 listed ETFs and leveraged and inverse products charted a volatile path.

ETF flows turned negative with outflows of HK$490mn between April and June, but rocketed back up to HK$6.3bn in the following quarter, before falling again.

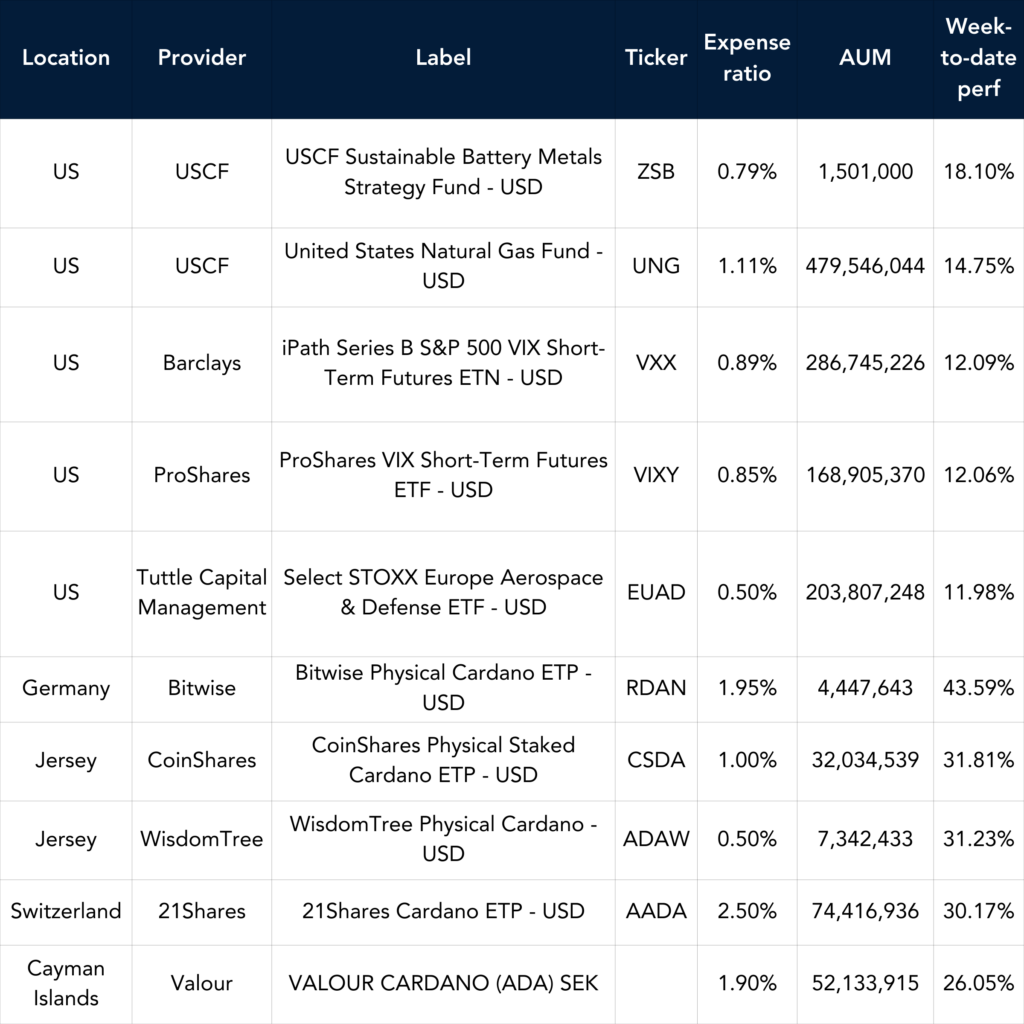

Best Performers US & EU

Listen and Learn

On this episode of Exchange Traded People, we sit down with Si Katara to talk about his journey from computer engineering to the world of ETFs. Coming from a Silicon Valley startup background, Si shares how his fresh perspective helped him navigate the ETF space-like unlocking levels in a video game.

We discuss the challenges and rewards of working in a startup, the importance of great partnerships, and why breaking into a new industry is worth the risk.

Tune in for an inspiring conversation on innovation, impact, and financial freedom.

Graph of the Week

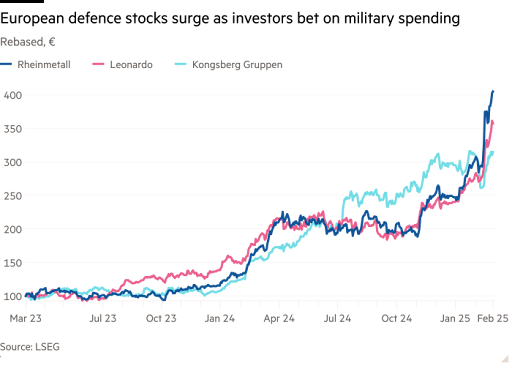

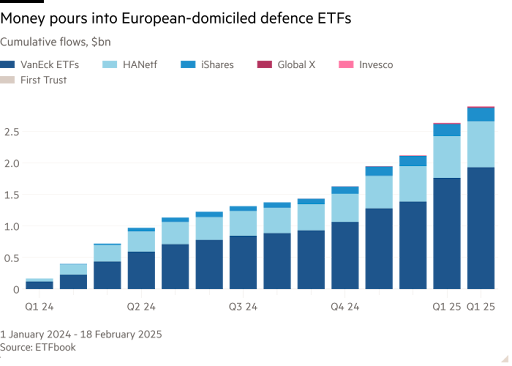

Shares in European defence companies continue to surge, as investors bet that governments will have to shoulder more of the burden for the continent’s security by increasing military spending.

ETF winners from this are the VanEck Defence UCITS ETF (DFNS) which has amassed $3.2 billion since its inception and The Future of Defence UCITS ETF (NATO) by HanETF, which has raised over $1.55 billion in net assets.

Funds in Focus

VanEck is a company flying high these days. Starting off as ThinkETFs in 2008 by CEO Martijn Rozemuller, the company was acquired by VanEck in 2018.

Riding high on the demand for Defence exposures across Europe the company now has aum of over $13bn AUM and 50 products.

Their flagship products are:

- VanEck Semiconductor ETF – $20.8bn

- VanEck Morningstar Wide Moat ETF -$14.5bn

- VanEck Gold Miners ETF -$13.8

More about their story can be found here

Things of interest

Ray Dalio fans have a new way to incorporate the investing guru’s strategies into their ETF portfolio as State Street Global Advisors and Bridgewater Associates have launched the SPDR Bridgewater All Weather ETF (ALLW).

The strategy, which was developed by the hedge fund under Dalio’s leadership almost 30 years ago, aims to provide exposure to different markets and asset classes to create a portfolio that can be resilient across a wide range of market conditions and environments.

A juicy piece from Emily Graffeo at Bloomberg on the success of First Trust. The article highlights how First Trust has grown its business by cultivating strong relationships with financial advisers despite having products with average performance and higher fees vs peers.

However the article reveals that internal emails and a Finra investigation suggest First Trust may have crossed ethical lines by offering lavish perks—resort stays, coaching, sports tickets—to secure sales. Their CEO himself embodies the firm’s aggressive sales culture, spending extravagantly on entertainment and maintaining a luxurious lifestyle, details of which emerged through his ongoing divorce proceedings. Spicy.

An explosive growth for Digital Asset ETPs?

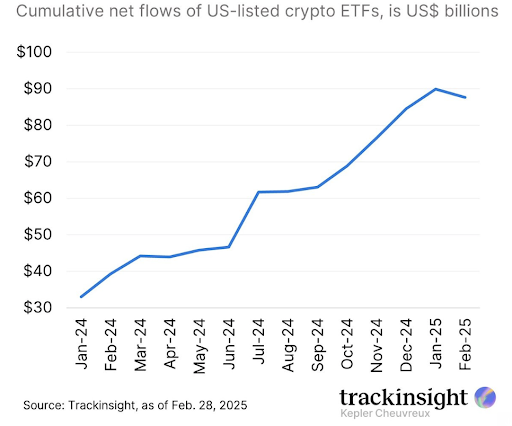

Surging demand for cryptocurrency ETFs will push their combined assets above those of precious metal ETFs in North America by the end of the year, according to forecasts by State Street.

Such a move would install digital token ETFs as the third-largest asset class in the rapidly growing $15tn ETF industry, behind only equities and bonds and ahead of real estate, alternative and multi-asset funds.

However momentum may be cooling as this graph reveals.

PWC has released its latest annual global ETF survey, which predicts that assets under management in ETFs are expected to surpass US$30 trillion by 2029. This projection reflects a compound annual growth rate (CAGR) of over 18.4% over the next five years.

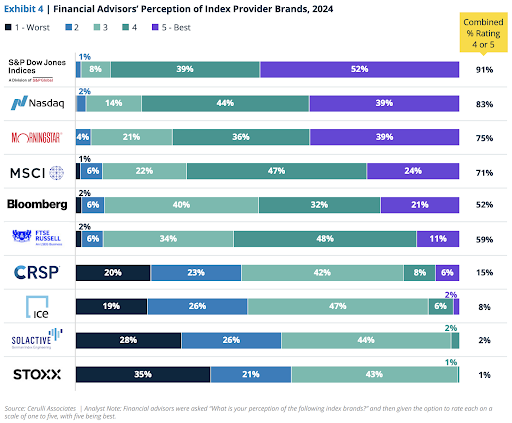

An interesting report from Cerulli reveals the brand strength of Index Providers amongst Financial Advisors in the US. The report goes on to say that with assets in index-based products such as ETFs, mutual funds, and direct indexing separately managed accounts crossing USD16 trillion as of year-end 2024.

The Toronto Stock Exchange (TSX) is marking the 35th anniversary of the first ETF with a special market close event commemorating a Canadian financial innovation that transformed global investing.

The world’s first ETF, the Toronto 35 Index Participation Units (TIPs), launched on March 9, 1990.

Buffer ETFs don’t create much value according to Nicolas Rabener, founder of financial analytics firm Finominal who calls the boom Buffermania. Buffer funds are often marketed as low-risk, alternative, or diversifying strategies.

However, given their high correlation to equities, this characterization is misleading according to Rabener, arguing that these funds have delivered subpar returns over the long haul, in markets whose direction of travel is usually up.

Career corner

Movers and Shakers

- Brendan Cavanaugh has joined Nasdaq as Head of Strategic Development. He joins from Allianz.

- Jean-Christophe Baille Cros has joined Euronext in Paris as Senior Manager – ETF Market Transformation. He joins from Amundi.

- David Hansen has joined Global X in Australia as Business Developer Manager, he joins from SelfWealth.

On the Move

US featured Opportunities

ETF Portfolio Manager & Operations Lead: Be responsible for implementing and managing various ETF portfolios, as well as overseeing operational and trading workflows. The role requires a deep understanding of financial markets, strong analytical skills, and a proven track record in portfolio management and fund operations.

European Featured Opportunities

Head of Benelux and French Speaking Regions: Lead sales efforts, drive asset growth, and oversee client relationships across institutional and intermediary segments in the Benelux and French-speaking regions, while developing and executing strategic distribution plans.

Tip of the week

Is Loyalty Overrated? – Loyalty is a thing we’re all taught to have for our employers, but the second things get tough, they’ll cut you loose without a second thought.

The harsh reality is you are an asset, not a partner. So why do so many people stay loyal to a company that wouldn’t hesitate to replace them?

So what should you do?

✔ Prioritize yourself. Your career is YOUR business—treat it like one.

✔ Job-hop strategically. Employees who switch jobs every 3-4 years earn way more than those who stay put.

✔ Negotiate everything. Salary, benefits, title—don’t just accept what’s given. Demand what you’re worth.

✔ Build your own safety net. The only job security is having options—a strong network, in-demand skills, and the confidence to walk away

Loyalty is only valuable if it’s mutual. If a company genuinely invests in you, great. But if not?

Protect your bottom line. Because at the end of the day, the only person truly looking out for your career is YOU.

About us

Paralysis by Analysis: The Hidden Risk to Your Productivity and Career Growth

In any role in the workplace, making informed decisions is a crucial skill. However, when research and analysis turn into excessive overthinking, it can lead to stagnation, this is known as paralysis by analysis.

It’s a phenomenon that affects individuals, teams, and even organizations, preventing them from taking action due to fear of making the wrong decision.

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.