that global bond ETF assets will hit $5 trillion in less than 10 years and a recent report predicts that global bond ETF assets will hit $5 trillion in less than 10 years. A recent report from BlackRock predicts that global bond ETF assets will hit $5 trillion in less than 10 yearsA recent report from BlackRock predicts that global bond ETF assets will hit $5 trillion in less than 10 years

A recent report from BlackRock predicts that global bond ETF assets will hit $5 trillion in less than 10 years

How far can Bond ETFs go?

A quiet week for ETF launches in Europe but a number of new entrants seen in the U.S.

A recent report from BlackRock predicts that global bond ETF assets will hit $5 trillion in less than 10 years and the removal of Tesla from an ESG index creates a twitter firestorm.

Fund Launches and Updates

EMEA

BlackRock listed the iShares UK Property UCITS ETF EUR Hedged (Acc) on Xetra and via Börse Frankfurt. ETF Express

Lyxor listed the Lyxor MSCI World ESG Leaders Extra (DR) UCITS ETF – Dist on the SIX Swiss Exchange. TER 0.15%. ETF World

AMERICAS

21Shares, which has made waves in Europe with its crypto ETP offerings since 2018, is marking its US entrance with the launch of two new funds — the 21Shares Crypto Basket 10 Index Fund and the 21Shares Crypto Mid-Cap Index Fund. The company is looking to also launch ETFs. Bloomberg

Harbor Capital Advisors has added the Harbor Dividend Growth Leaders ETF (GDIV) to its lineup by converting an existing mutual fund with a nine-year track record and roughly $150 million in AUM. Listed on the NYSE, GDIV is an active ETF sub-advised by Westfield Capital, expense ratio 50bps. VettaFi

JPMorgan Asset Management converted its actively managed JPMorgan Realty Income Fund into the JPMorgan Realty Income ETF (NYSEArca: JPRE) over the weekend. Nasdaq

Principal Global Investors launched the Principal Real Estate Active Opportunities ETF (Ticker: BYRE), the firm’s first actively managed, semi-transparent ETF on the New York Stock Exchange. Businesswire

SEI announced the launch of its first ETFs, a suite of four large-cap, factor-based strategies designed to support a goals-based wealth management approach. The new funds are listed below. PR Newswire

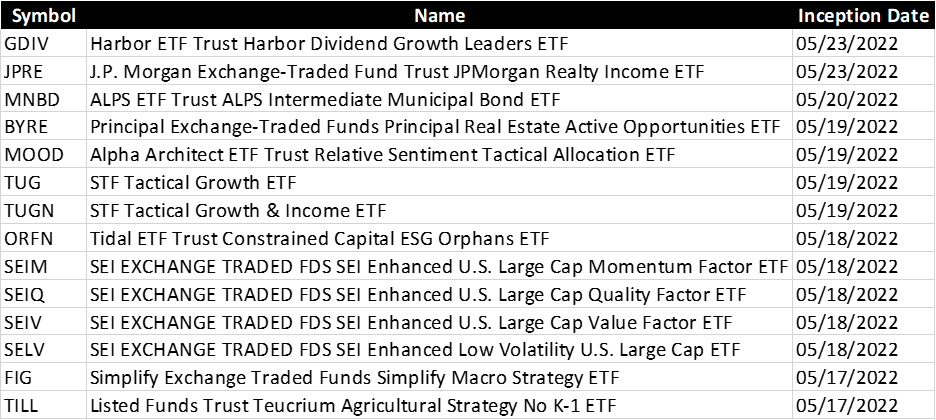

Full List of U.S. ETF Launches:

ASIA-PACIFIC

In Australia, VanEck has plans to launch the VanEck Global Carbon Credits ETF (Synthetic) on the Australian Securities Exchange. Subject to final regulatory and ASX approvals, it should begin trading in coming weeks under the ticker code XC02, charging a management fee of 0.75%. AFR

In Taiwan, UOB Asset Management launched the United Metaverse Technology and Services ETF which is based on a Solactive index, on the Taiwan Stock Exchange. Solactive

Fund Flows and Trading Volume

U.S.-listed ETFs took in more than $21.5 billion in new assets in the week ending May 20, the largest haul since early April. Investors added net inflows of just over $7 billion on Friday despite the S&P 500 momentarily dipping into bear market territory in intraday trading before rallying to nearly flat to close the week. ETF.com

Noteworthy

A twitter firestorm swirled last week when Elon Musk realised that Tesla was removed from the widely followed S&P 500 ESG Index.

The index provider sited the removal occurred because of issues including claims of racial discrimination, crashes linked to its autopilot vehicles, and Tesla’s lack of published details related to its low carbon strategy, among others.

Musk tweeted that “Exxon is rated top ten best in world for ESG by S&P 500, while Tesla didn’t make the list! ESG is a scam. It has been weaponized by phony social justice warriors.” Reuters

BlackRock’s iShares will close its $18m MSCI Russia and $108m MSCI Eastern Europe ETFs, joining Jupiter, Danske, and Nordea which recently shut Russia-exposed funds because of the Ukraine conflict.

BlackRock said Russian securities would remain in the funds “until such time as it is possible, practicable and appropriate, in the manager’s view, to liquidate each of the positions in an orderly and managed way”. Reuters

Also BlackRock predicts that bond ETF assets globally will hit $5 trillion by the end of 2030, fueled by four trends, one of which involves increased use among institutional investors. Pensions & Investments

Charles Randell, chair of the Financial Conduct Authority has cautioned against a rush to add crypto markets to the agency’s remit after the government launched an ambitious bid to make the UK a crypto hub.

“It’s critical that . . . there are strong safeguards to ensure that all interests — not just the interests of people making money from pushing crypto products, but also the interests of the people whose savings will be put at risk — are heard,” Randell said, in a speech on Friday. Financial Times

Grayscale launched a bold ad campaign ahead of SEC’s Bitcoin Trust ETF decision. If you are not familiar with Washington, D.C.’s landmarks – the ad where this photo was taken was in Union Station which is literally a stone’s throw from the SEC building. Very cheeky placement. Axios

Additional reads

The boom in ETF assets helped index providers collect a record $5bn in revenue in 2021. FT

HSBC AM’s climate ETFs face questions after responsible investment head Kirk goes rogue. ETF Stream

Commodity funds are making a comeback after years out of favour, as institutional investors seek hedges. FT

Regulators worldwide have been increasing their scrutiny of ESG declarations. FT

Investors who bet against ETFs tracking Russian assets in the build up to the Ukraine invasion made the right call but they’ve been paying the price ever since — $2.6 million in borrow fees have accumulated since Russia ETFs were suspended. Bloomberg

Large institutions are increasingly using bond ETFs to manage their portfolios. FT

State Street announces expansion of Fund Connect ETF portal in Singapore Market Screener

And we are looking forward to seeing many of you at the ETF Stream ‘ETF Ecosystem Unwrapped’ conference this week.

If you haven’t registered, details can be found via this link. ETF Stream