ETF Failure Alert : The One Deadly Mistake No Issuer Can Afford to Make!

Want to know the ultimate red flag that screams an ETF business is doomed before it even gets off the ground? It’s when a firm thinks it can outsource distribution or lean on “strategic partners” to do the heavy lifting. That’s not a strategy—it’s a surrender.

The ETF game is all about in-house, best-in-class distribution. The top players—BlackRock, Vanguard, and State Street—didn’t build their empires by handing off sales to third parties. They own their relationships, control their messaging, and ensure their ETFs get shelf space and liquidity.

Yet, time and time again, new entrants think they can bypass this golden rule and still succeed. Spoiler alert: they won’t.

If an ETF issuer isn’t investing in a killer internal sales and distribution team, they’re not launching an ETF business—they’re launching an expensive failure.

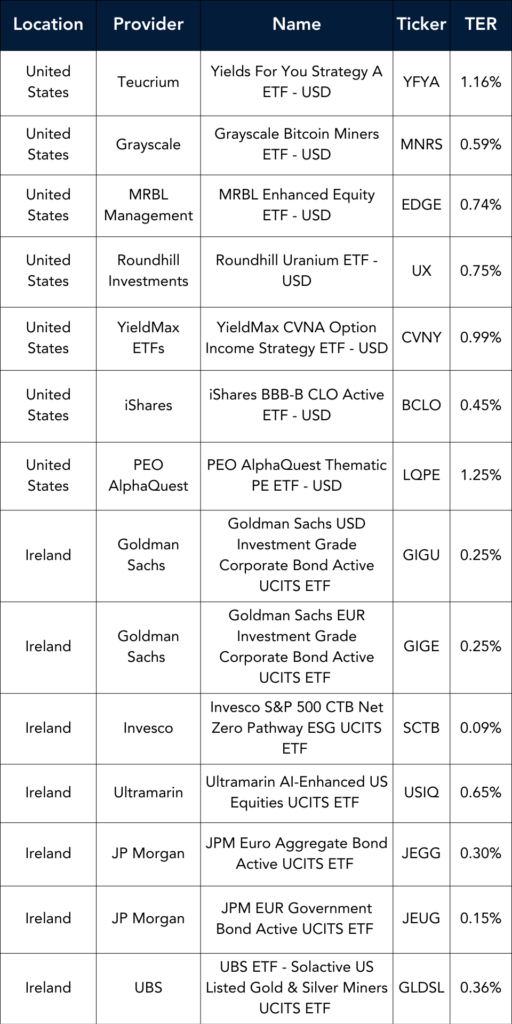

Launches this week

Flows & performance

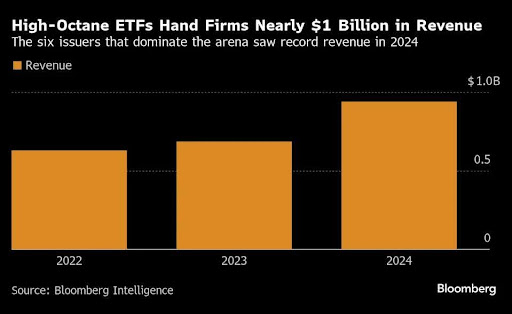

Wall Street’s Levered ETF boom Is near-$1 Billion money spinner. The six firms that dominate the arena are: Direxion, ProShares, Tidal Investments, GraniteShares, Tuttle Capital Management and AXS Investments. They netted around $940 million in revenue in 2024, according to Bloomberg Intelligence.That’s a record 37% jump, beating last year’s all-time high.

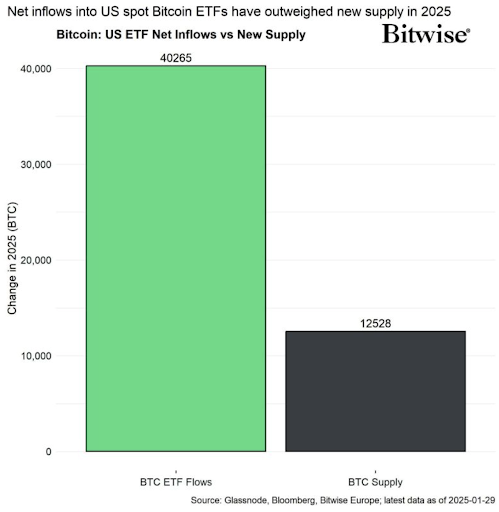

Data from Bitwise show that so far in 2025, inflows into US Bitcoin ETFs alone have consumed over 3x the TOTAL new supply of Bitcoin for 2025. The BTC supply deficit is real and growing.

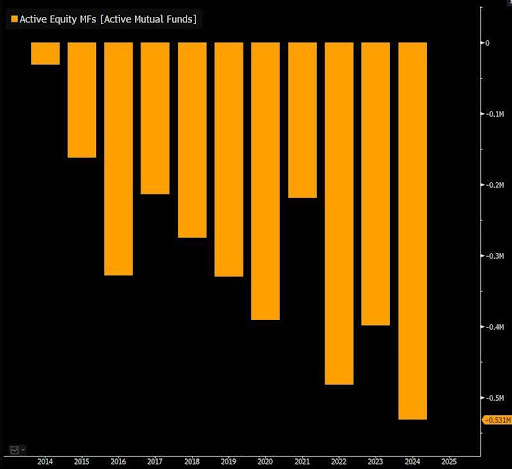

Active equity mutual funds saw outflows of $531b! in 2024, their worst year ever (you know its bad when your fund holds US stocks, which are up 50% in two years, and you see record outflows). That said, their assets actually went UP over $1T (because of bull market subsidy).

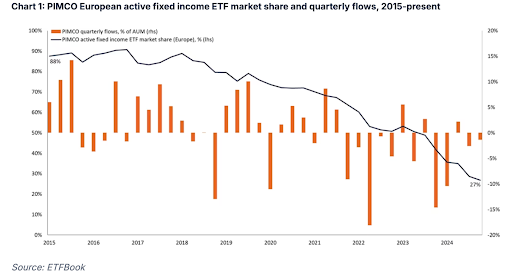

This must be painful reading for the folks at PIMCO. The firm shed almost $750m from its European ETF range last year with its market share of broad fixed income assets sliding to 1.2% at year-end – well below the 2015 high of 5%. Meanwhile its share of actively managed fixed income ETF AUM slumped to 27% at the end of 2024, as the below chart illustrates, a far cry from its dominant 91% position in 2016.

Vanguard triumphs over rivals

Vanguard has beaten off nearest challengers Sydney-based Betashares and US rival BlackRock to become Australia’s best-selling exchange traded fund provider in 2024, after it pulled in nearly A$10bn ($6.2bn) across all its locally listed strategies.

Australia’s ETF sector enjoyed another year of massive growth in 2024 as net new money reached A$30.8bn, double the A$15bn accumulated during the previous 12-month period, based on the latest version of the Betashares Australian ETF review.

Vanguard was the biggest beneficiary of this growth as it took in A$9.5bn in net new money between January and December, representing around 31% of total industry flows.

This reflects a huge 112% jump from the previous year, when it accumulated net inflows of A$4.5bn.

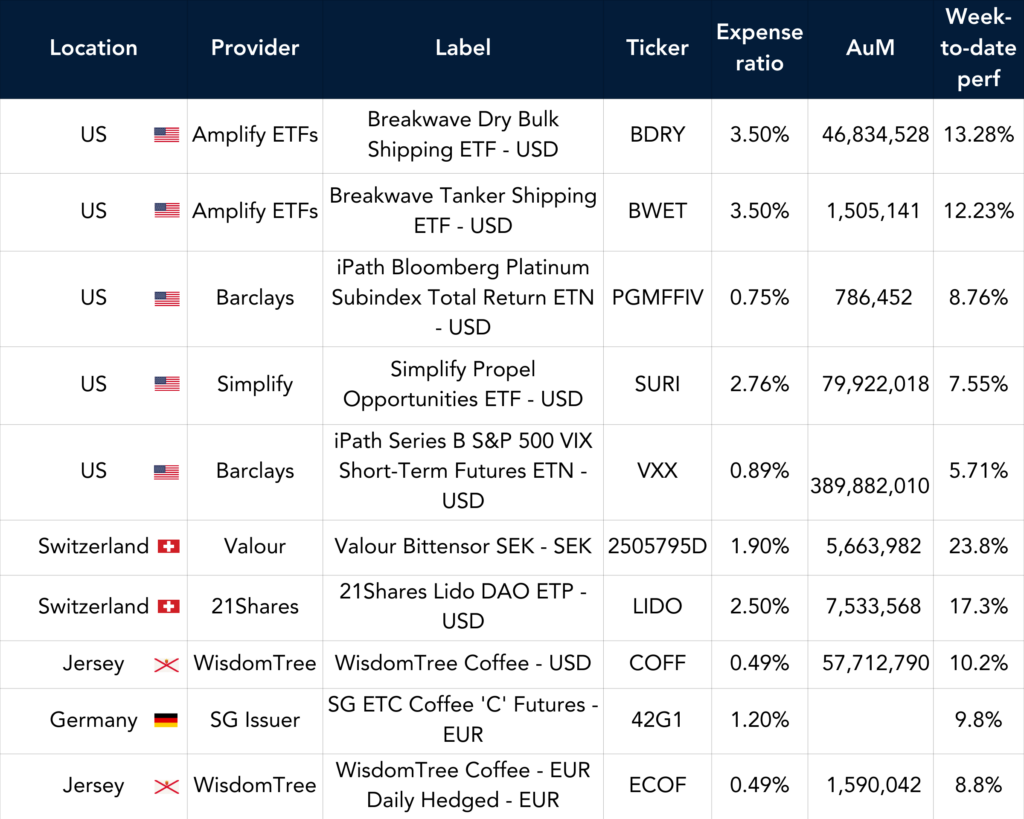

Best Performers US & EU

Listen and Learn

This week on Exchange Traded People, we sit down with Victor Gomez, CEO of BITA, to talk about the driving force behind his success: persistence. Victor believes that small, tightly aligned teams with a strong work ethic can outperform larger organisations – and his journey proves it.

He shares the lessons he’s learned from overcoming challenges, the role resilience plays in building a lasting business, and why persistence is the ultimate differentiator in any career.

Tune in for a conversation on grit, growth, and the mindset behind building something great.

Things of interest

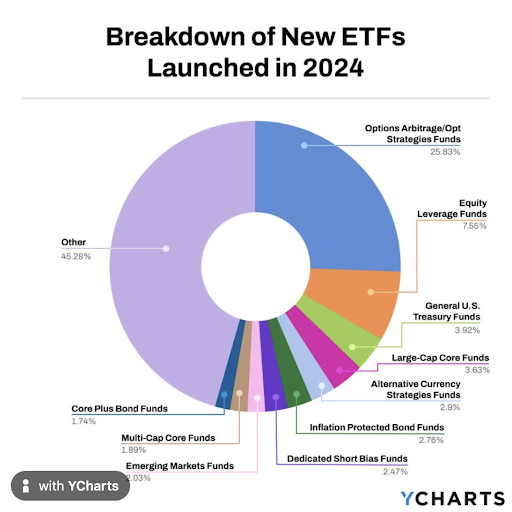

Of all the new ETF entrants in 2024, Options Arbitrage & Opt Strategies ETFs accounted for over 25% of all launches.

This peer group consists of defined outcome (or buffered) and covered call ETFs. They make up a significant portion of new launches due to staggered outcome periods and different buffer “levels” for the strategies.

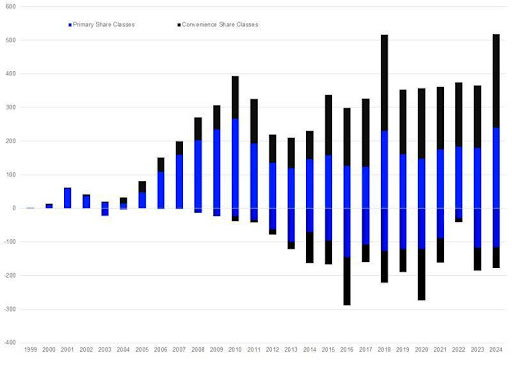

The European ETF industry launched 240 new ETFs (primary share classes) over the course of 2024. This marks the second highest number of ETF launches in Europe after the record year 2010, during which 267 new ETFs were launched.

At the same time there were 116 ETFs merged or liquidated over the course of 2024—the sixth highest number of ETF closures within a calendar year.

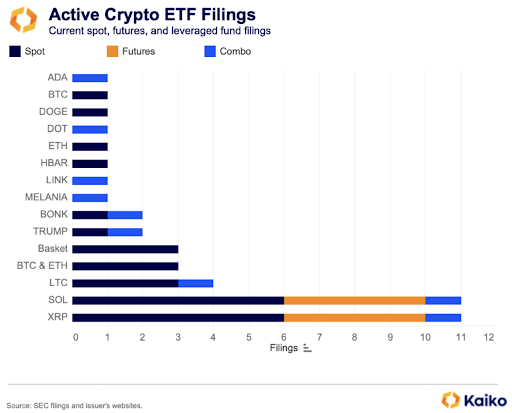

ETF applications are eating the world.

A lot has happened since Gary Gensler last stalked the halls of the US Securities and Exchange Commission. One of the more interesting developments has been the rapid uptick in filings for crypto-related ETFs.

There are now over 45 active applications. These range from converting closed-end trusts into spot ETFs to more ambitious filings which would seek to turn newly minted memecoins into spot ETFs.

AssetCo-owned River Global is to launch ETFs in Europe (at some stage). The firm’s plans to launch ETFs were first announced prior to River and Mercantile rebranding to River Global and as part of AssetCo’s sale of thematic specialist Rize ETF to Cathie Wood’s ARK Invest in September 2023.

The acquisition notice revealed AssetCo and ARK would partner on “several” River and Mercantile ETFs on the ARK Invest Europe platform. Still we wait.

Trump Media plans to launch investment products including ETFs focused on the “patriot economy” in a move that could put it head to head with Strive, the asset manager founded by Vivek Ramaswamy.

Trump Media announced its expansion into financial services last week, contracting with Charles Schwab and hedge fund firm Yorkville Advisors to develop ETFs and separately managed accounts.

It said it would allocate up to $250mn for the venture, named Truth.Fi. In addition to “traditional investment vehicles”, Truth.Fi is contemplating rollouts including ETFs, separately managed accounts (SMAs) and crypto-related securities, hewing to investment themes related to “American growth, manufacturing and energy companies as well as investments that strengthen the patriot economy,” according to the announcement.

Career corner

Movers and Shakers

- Gilles Dubos has joined JP Morgan in Dublin an ETF Operations Director. He joins from Caceis

- Vern Roberts has joined Hamilton ETFs in Canada as a Managing Director. He joins from Global X

- Paul Cahill has joined Allianz in the US as an ETF National Sales Director. He joins from Twenty Four Wealth

- Jason Hyland has joined Advisors AM in Florida as an ETF Specialist. He joins from Franklin Templeton

On the Move

European Featured Opportunities

- ETF Sales – German Speaking – London: If you possess an entrepreneurial mindset and are eager to constantly challenge yourself in the rapidly evolving world of ETFs, this is the place for you. You will have the chance to distribute both our branded suite of sustainable self-indexed ETFs and our recently launched range of actively-managed ETFs, actively participating in the collaborative development of sales strategies for new launches as well as our existing range.

US Featured Opportunities

- Quantitative Trader, Fixed Income – Dublin: A role that will see you work with a leading financial firm that leverages cutting edge technology to deliver liquidity to the global markets and innovative, transparent trading solutions to their clients. Their market structure expertise, broad diversification, and execution technology enables them to provide competitive bids and offers in over 19,000 securities, at over 235 venues, in 36 countries worldwide.

Tip of the week

5 ideas on how to write a better resume/CV

-

-

Write It from the Reader’s Point of View

Tailor your resume to the job description, focusing on what the employer wants to see, not just your experience. -

Focus on Your Achievements

Highlight specific accomplishments with measurable results to show your impact, not just job duties. -

Make It Tangible

Use clear, concrete examples and numbers to replace vague or overused phrases like “results-oriented.” -

Use the Right Keywords

Incorporate relevant terms from the job description to pass applicant tracking systems and catch the recruiter’s eye. -

Keep It Brief

Limit your resume to one or two pages, using concise bullet points to prioritize the most relevant information.

-

About us

New Year, New Financial Goals – Do You Know Someone Who Could Use The Saver’s Guide to Investing?

A fresh year brings fresh financial ambitions. Maybe you’ve set your goals, but what about your friends or loved ones who are still just saving? Helping them take the first step into investing could make all the difference.

Moolah Invest’s Saver’s Guide to Investing breaks down the essentials into simple, actionable steps – perfect for turning smart savers into confident investors.

If someone you care about is ready to start their investing journey, this guide could be exactly what they need to build confidence and momentum.

Share The Saver’s Guide to Investing and help your friends and family make their money work harder.

Join the Blackwater Referral Program & Earn Rewards for Your Network

Unlock a simple way to generate extra income while helping professionals and businesses connect. By becoming an affiliate member of the Blackwater Referral Program, you can leverage your network and earn a percentage of our placement fees.

How It Works

- Refer a Candidate – If you introduce us to a job seeker who we successfully place, you’ll receive 5% of the fee earned.

- Refer a Company – If you connect us with a company that becomes a client, you’ll receive 10% of the fee earned.

It’s a win-win: you help expand opportunities, and we reward you for it. No effort, just rewards.

Start earning today – get in touch to learn more.