From Memes to Millions: Are Finfluencers the New Wolves of Wall Street?

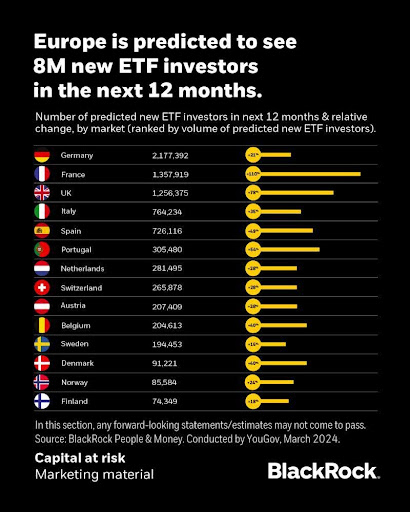

As ETFs continue to capture the retail market, leveraging finfluencers can be a powerful way for managers to connect with younger, social-media-savvy investors. Studies show that platforms like TikTok and Instagram are increasingly influencing investment decisions, with 37% of Gen-Z investors in the U.S. and 38% in the UK citing influencers as key to their choices.

For ETF brands, many of which are relatively unknown to the general public, this presents an untapped opportunity to boost visibility and relevance among younger audiences.

HOWEVER, whilst this may be great for brand building purposes, the issue is finfluencers are not regulated and in a lot of cases are not qualified to advise on investments and/or have no background in investment management. A study in Germany found that only 37% have any formal financial education.

Finfluencers aren’t going away, and ignoring their impact risks leaving ETF brands out of the conversation. So ETF managers will need to find a way to work with these finfluencers, while maintaining accountability and protecting their reputation at the same time. Tricky.

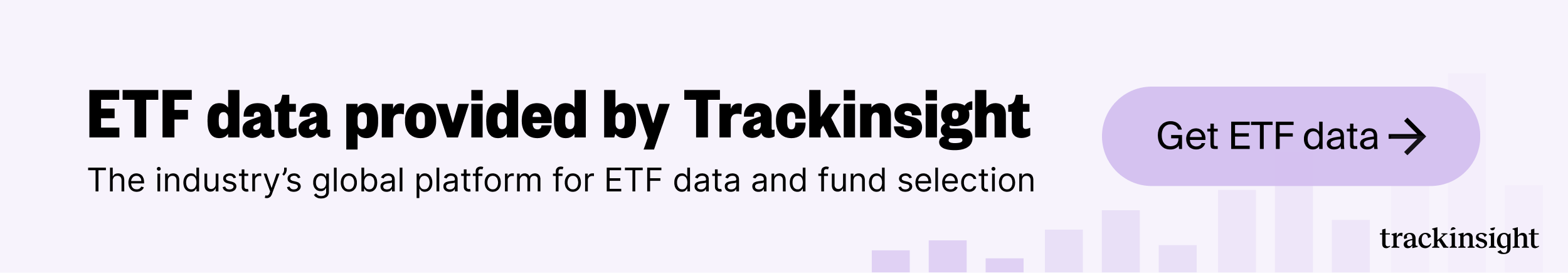

Launches this week

Flows & performance

- 21Shares has officially surpassed $10 Billion Global AUM! 🌎, six years after the launch of their first ETP. Kudos.

Things of interest

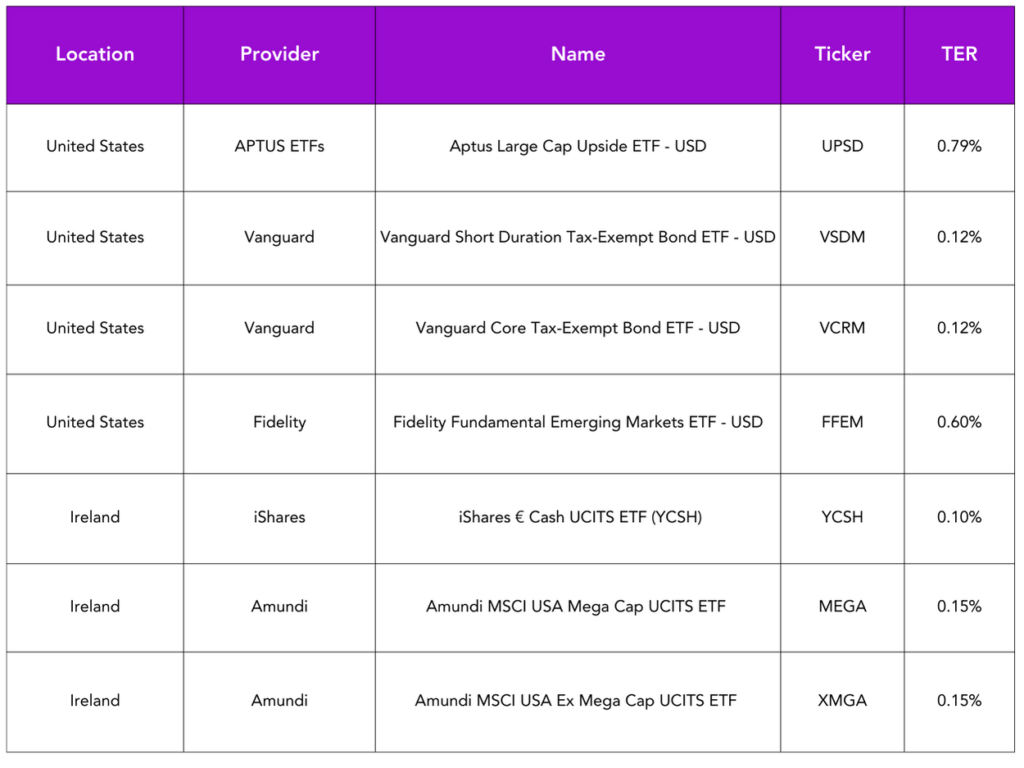

Last week we ran a poll asking people for their thoughts on whether ETFs were a good or a bad thing for investors. Results are pretty compelling.

|

VanEck have launched an investment app targeted at Dutch retail investors.

ETF.com recently ran their first annual Global Investor Survey. Key findings include

- Roughly 75% of advisors are interested in increasing exposure to actively managed ETFs in the next six months

- Close to half of all advisors are reallocating portions of their portfolios to active strategies

- Advisors would like to increase index ETF holdings to nearly half of client portfolios

- Retail investors are most interested in investing in technology and commodities, and least interested in investing in cryptocurrency and ESG in the next six months

Valour, a digital asset investment subsidiary of DeFi Technologies has launched the first ever Dogecoin ETF. Dogecoin, who’s popularity has been bolstered by influential figures like Elon Musk has grow to become the 7th largest crypto asset. The Valour ETP is listed on Sweden’s Spotlight Stock Market and features a management fee of 1.9%.

Strive Asset Management is expanding into direct indexing, accelerating its diversification beyond investment products. The company said it had contracted to use Vestmark’s Vast turnkey portfolio management technology for the direct-indexing foray, and signed agreements with Fidelity and Charles Schwab to list the service on their platforms.

Career corner

Movers and Shakers

- Allfund has hired Luis Berruga as senior advisor to support their ETF build out

- Global X has hired Ignatius Faissal for the role of Head of Product Management. He was previously at HANetf

- LSE has hired Alex Watkins as an ETF Business Development manager. He was previously at Global X

- HANetf has hired Patrik Engström as Nordic sales manager. He was previously at Ark Invest

- BlackRock has appointed Tom Garland co-lead of the ETF development team within ETF engineering for EMEA. He joins from Société Générale

- Ark Invest has hired Carl Henrik Hagerup as Head of Northern Europe. He was previously at 21Shares

Tip of the week

Making your boss look good is always a great way to get on with them and hopefully by default them looking favourably upon you. Here are some ideas to achieve that.

- Understand Their Priorities: Know what success looks like for them and align your work to support those goals.

- Deliver Excellence: Consistently produce high-quality work that reflects well on your team—and by extension, your boss.

- Be Proactive: Anticipate challenges or opportunities and address them before they escalate, showcasing your boss’s leadership in action.

- Promote Their Vision: Speak positively about your boss’s ideas and help bring their strategy to life.

- Be a Problem-Solver: Handle issues independently where possible, so they can focus on higher-level priorities.

- Keep Them Informed: Provide concise updates to avoid surprises and show you’re always on top of things.

About us

Is your firm losing out on talent?

The competition for talent in the ETF industry is fierce. With the industry rapidly evolving, firms need top-tier professionals to innovate, manage risks, and seize growth opportunities. But are you missing out on these skilled candidates because of common hiring mistakes?

Let’s dive into some pitfalls that could be turning off great ETF professionals – and how to fix them.