Where are all the jobs in ETFs?

As specialist ETF recruiters, we get asked this question ALL the time “seeing that the ETF market is going from strength to strength, there must be lots of new job opportunities out there, right?”

The honest answer is no, not really. Why?

Well, a few reasons actually:

• As we all know ETFs is a scale game and the same applies with people. AUM growth does not correlate to headcount growth.

• All the big players are well established so hiring tends to be on the fringes or for replacements

• Headcount cost is the greatest expense all managers have and the smaller players feel this the most. Sometimes they simply cannot afford to hire

• Mutual fund managers entering the space are trying to leverage existing resources as much as possible. No point hiring a brand new sales team when you already have one, right.

Despite the challenges in ETF hiring, the need for specialised talent is as crucial as ever. As the market evolves, so do the demands on your business—and having the right team in place is key to staying competitive.

Building a Successful ETF Sales Team

For key insights and strategies, access our most recent report, where we explore proven approaches and actionable steps to create a winning sales force in the ETF space.

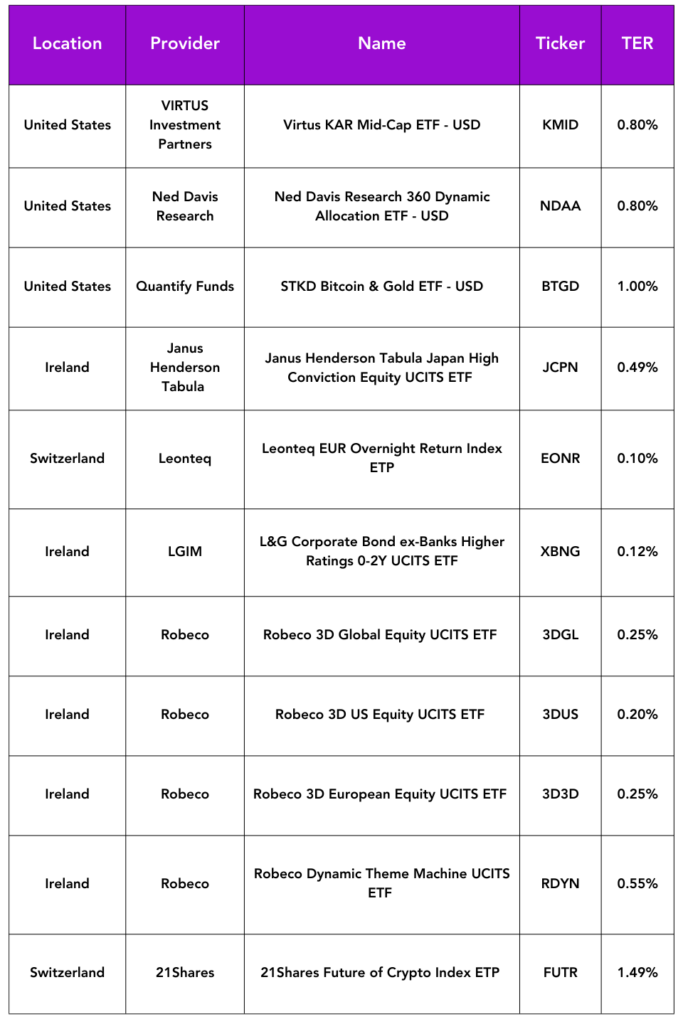

Launches this week

Flows & performance

|

SPDR S&P 500 ETF Trust SPY, the oldest and largest U.S.-based ETF, reached the $600 billion assets under management milestone Thursday, according to data from ETFDB.

Crypto asset manager Bitwise Asset Management announced that the company recently surpassed $5 billion, up 400% in 2024.

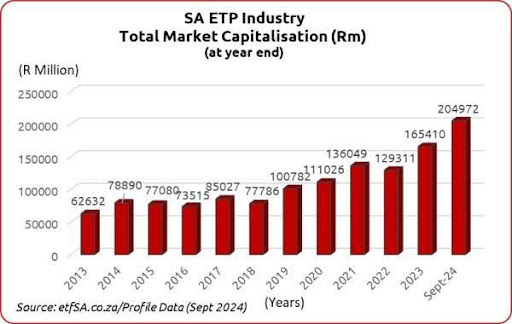

It seems ETFs are on fire all over the world, even in South Africa. The total market capitalisation of the South African ETP industry amounted to R204,97 billion (approx. 12bn USD at the end of September 2024. This amounts to an increase of 24% since the end of 2023.

Things of interest

New data from YouGov commissioned by BlackRock explores attitudes to investing by Europeans. The 2024 BlackRock People & Money Survey also examines why people across Europe feel they are not able to invest. The survey explores the attitudes of current investors and potential investors across 14 European countries.

-

Women of all ages, Generation Z and Millennials (aged 25-34) have driven the growth of investors across Europe in the last 12 months.

-

In the UK, more Millennials and women are now investing than ever before.

-

Not having enough money is holding back people in the UK from investing.

-

The majority (54 per cent) of young people (18 to 24s) said that they do not understand or have the know-how to start investing.

-

The majority (56 per cent) of Generation Z and Millennials give a lack of knowledge or understanding as the main reason for not investing.

-

Across the Nordics, there is now high investment participation with one in two people investing.

-

The UK has seen the largest increase year on year of new investors, with a 21 per cent increase

-

Southern Europe still has room to run, with investment penetration at 28 per cent in both Spain and Portugal, as well as 29 per cent in both France and Italy.

-

More non-investors have started investing in the UK this year than any other market surveyed

-

Regardless of age, across Europe, online investment platforms clearly dominate,

-

In markets with lower ETF investment participation rates such as like France (8 per cent), Italy (15 per cent), and Spain (13 per cent), a significant proportion of ETF investors prefer consulting an adviser at their bank (48 per cent, 36 per cent, and 31 per cent, respectively).

-

In fact, when considering any “in-person” method to trade ETFs (meeting with an adviser at a bank or an independent financial advisor), France ranks highest, with 60 per cent of people preferring in person, as opposed to 31 per cent across Europe.

-

The growth of cryptocurrency ownership has been most pronounced among women.

The one thing that these results tell me is that more financial education is needed. And that is why we set up Moolah Invest earlier this year. Whilst you may be financially literate, your friends and family may not be so please share this with them. Not only will it help them, it will help the entire ETF industry.

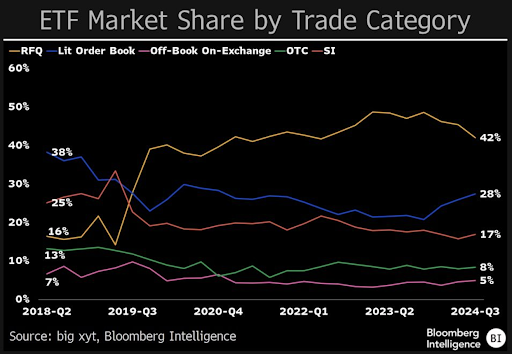

ETFs are meant to be on exchange but looks like the traders in Europe never got the memo. 42% of all ETF trading is now conducted on RFQ platforms and only 17% on the exchanges themselves.

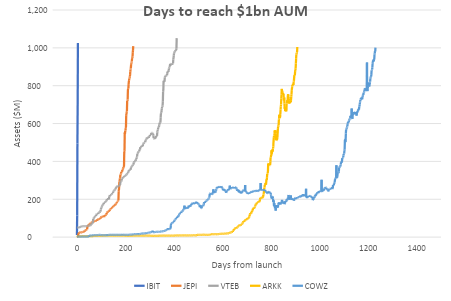

| What’s the Decade’s Most Successful ETF Launch? That question has been answered by Aniket Ullalat, CFRA Research. JPMorgan’s Equity Premium Income wins the prize based on its ability to grow and maintain its aum in the shortest period of time. |

Career corner

Movers and Shakers

- Andrew Moore has joined American Century as head of EMEA ETF capital markets. He joins from JP Morgan Asset Management.

- Ex CEO of Global X Luis Berruga has joined Bitwise as a strategic advisor

On the move

European Featured Opportunities

- Quantitative Trader, Fixed Income – Dublin: A role that will see you work with a leading financial firm that leverages cutting edge technology to deliver liquidity to the global markets and innovative, transparent trading solutions to their clients. Their market structure expertise, broad diversification, and execution technology enables them to provide competitive bids and offers in over 19,000 securities, at over 235 venues, in 36 countries worldwide.

US Featured Opportunity

- Head of Retirement Distribution – Northern Virginia: As the Head of Retirement Distribution, you will be responsible for the distribution of our investment products (including mutual funds and collective investment funds) and investment advisory services (including sub-advisory services) to qualified opportunities such as DC/DB plans, pension plans, cash balance plans and sub-advisory mandates across all plan size markets in partnership with all channels of financial intermediaries including banks, wire house broker-dealers, regional broker-dealers, registered investment advisors, and consultants.

Tip of the week

What to do when your time is up?

Recently I spoke to someone of a certain age and a certain seniority who was finding it difficult to find a new role and was slowly coming to the conclusion that maybe their time in the ETF industry was over.

At some point it’s going to happen to most people so what do you do, especially if you are not ready to retire?

I could list a thousand things but my strongest advice would be to identify that one thing you really like doing and are really good at and leverage the hell out of it. The world is big and there will be someone out there who sees value in what you can offer.

About us

Mastering Europe’s Fragmented ETF Market

Understanding Europe’s ETF landscape can be challenging. Our latest article, “Navigating Europe’s Fragmented ETF Market,” breaks down the complexities and opportunities that exist in the region’s diverse markets.

If you want to dive deeper into the European ETF ecosystem, check out ETF Bootcamp—our comprehensive educational course designed to equip you with the knowledge and skills to thrive in this evolving market.