How do you compensate ETF sales teams?

This is a question we get asked a lot and one which causes a lot of problems for managers, especially mutual fund managers looking to pivot into ETFs.

Compensating ETF sales teams effectively requires a multi-faceted approach to align individual performance with team success, firm goals, and market conditions.

Key strategies include:

– Balancing individual and team-based metrics to encourage collaboration.

– Tying bonuses to Net New Assets (NNA), particularly in smaller firms where tracking can be easier.

– Using discretionary bonuses in larger firms to reward broader contributions.

– Aligning compensation with product margins, incentivizing higher-margin sales.

-Emphasizing relationship-driven models in mature firms to reward long-term client relationships over transactional sales.

Adaptability is key as the ETF market continues to evolve, especially with the onset of active ETFs.

Struggling with how to compensate your ETF sales team?

Our latest report breaks down strategies that align incentives, boost performance, and drive growth. Learn the best practices to attract top talent and keep them motivated.

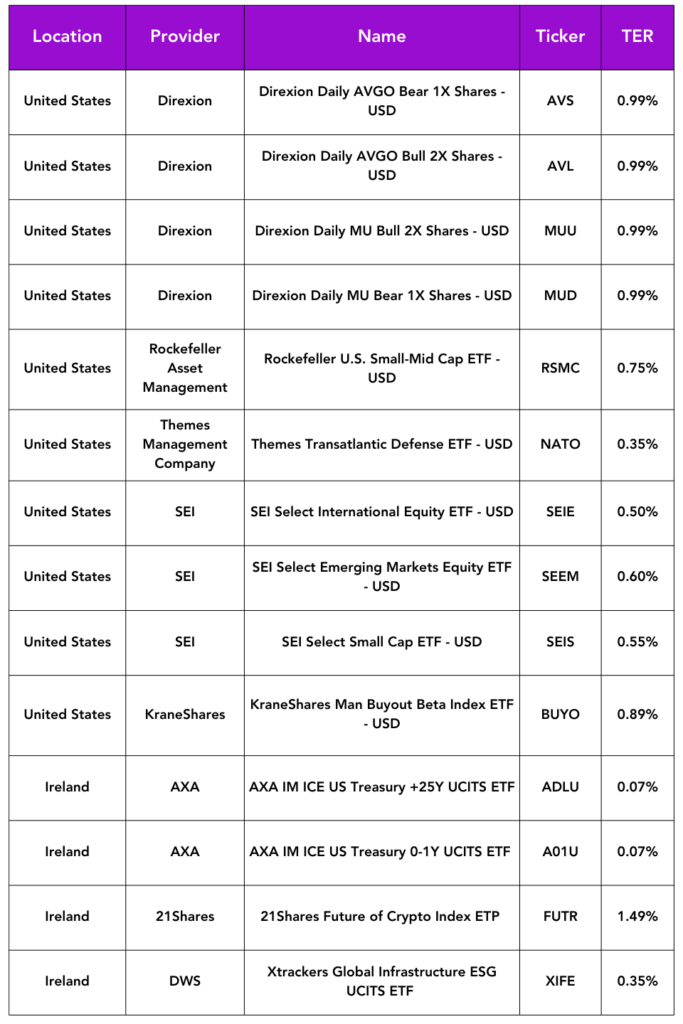

Launches this week

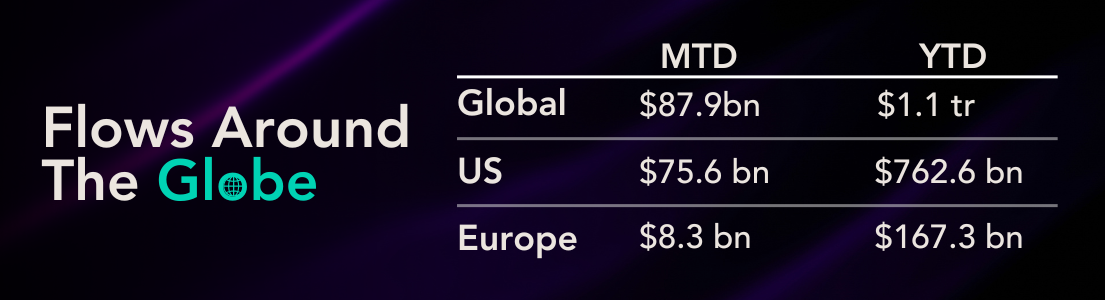

Flows & performance

China stimulus unleashes ETF buying spree in US and Europe. In the final four trading days of September, investors pumped $1.6bn into US-listed ETFs focused on China while similar funds listed in Europe pulled in $753mn, according to data from TrackInsight. This was a sharp contrast to the pattern seen so far this year: in the near-nine months to September 24, US investors withdrew a net $5.1bn from China-focused ETFs while their European counterparts cut their exposure by $331mn.

The newfound inflows, however, remain dwarfed by domestic flows. Asia-Pacific listed China equity ETFs have vacuumed up a net $127bn so far this year, according to data from BlackRock. The vast majority of this is likely to have stemmed from ETFs listed in China itself, in part due to the machinations of the national team.

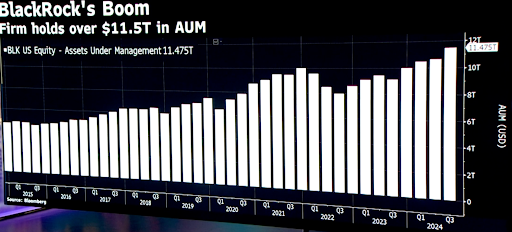

BlackRock posted a record $221 billion in net inflows in the third quarter – including $56 billion in institutional net inflows across active and index products.

CEO Larry Fink touted his firm’s scaled up private markets and tech platforms as factors in its success. He also said digital assets are becoming “more and more of a reality.”

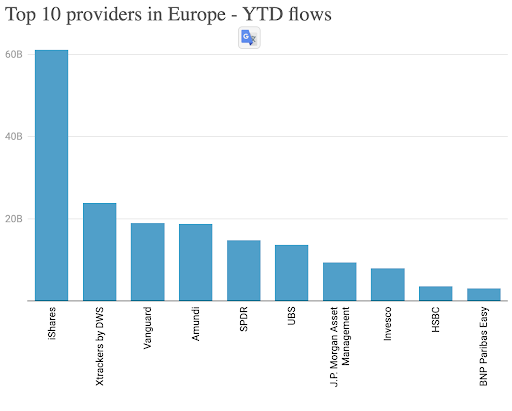

Much of BlackRocks dominance has been driven by their ETF business, surprise surprise, a case in point being the below snapshot of the European ETF market ytd. Nearly 3 times more flows than the next best.

Things of interest

|

|

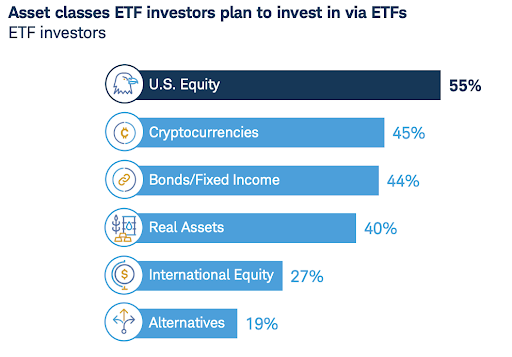

1. Increased Interest in Actively Managed ETFs: ETF investors are increasingly leaning towards actively managed options, especially as they seek to manage market volatility.

2. Focus on AI and U.S. Equities: Nearly half of the respondents plan to increase their investments in AI-driven ETFs and U.S. equities in the near future.

3. Millennials Leading in Fixed Income Investments: Younger investors, particularly millennials, are showing a strong interest in growing their bond and fixed-income investments.

4. Direct Indexing Popularity: There is a growing familiarity and interest in direct indexing, particularly among younger investors, with many planning to explore it within the next year.

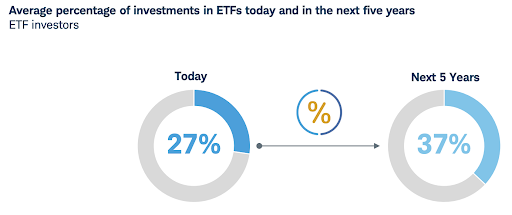

5. ETF Portfolios Continue to Grow: ETFs remain a core investment strategy, with many investors planning to add to their ETF holdings to maintain or grow their portfolios.

|

|

|

Career corner

Movers and Shakers

- Allfunds have hired Patrick Mattar as global head of ETP distribution. He will oversee the launch of their ETP platform launching in 2025

On the move

European Featured Opportunities

- ETF Sales, German Speaking – London: If you possess an entrepreneurial mindset and are eager to constantly challenge yourself in the rapidly evolving world of ETFs, this is the place for you. You will have the chance to distribute both our branded suite of sustainable self-indexed ETFs and our recently launched range of actively-managed ETFs, actively participating in the collaborative development of sales strategies for new launches as well as our existing range.

US Featured Opportunity

- Business Development Manager – Texas: The position is responsible for supporting the sale of exchange traded funds (ETFs) and mutual funds to broker-dealers, wire-houses, RIAs and institutional clients. The candidate will be responsible for managing their own territory and working in conjunction with our firm partners.

Tip of the week

Everyone always says have a diverse network, but how do you achieve that? Here are five ideas:

Attend Diverse Industry Events: Engage in conferences or webinars across different sectors to meet people with varied experiences.

Join Online Communities: Be active in global professional forums or social media groups to connect with diverse perspectives.

Seek Mentorship Across Cultures: Build mentoring relationships with individuals from different cultural and professional backgrounds.

Participate in Diversity Initiatives: Join or organize programs focused on inclusivity at work or in your community.

Cross-Functional Collaborations: Work on projects with colleagues from different departments or regions to broaden your network.