Retail ETF investors: The story of the chicken and the egg

The growth of Retail has been well publicised especially in Europe where Germany has become the poster child for Retail adoption of ETFs. But behind the media hype, how much focus do ETF managers really place on retail investors?

For many managers, retail is a classic chicken-and-egg scenario. On one side they know it’s growing but on the other side, ETFs are still largely driven by institutional buyers. Capturing the retail market requires a substantial marketing budget—something many ETF managers lack.

Additionally, retail investing is a volume game, with lots of small transactions, none of which on their own will move the dial. As a result, retail often falls into the category of “nice to have, but not a priority right now.”

So how do you find the balance? Go ask Vanguard.

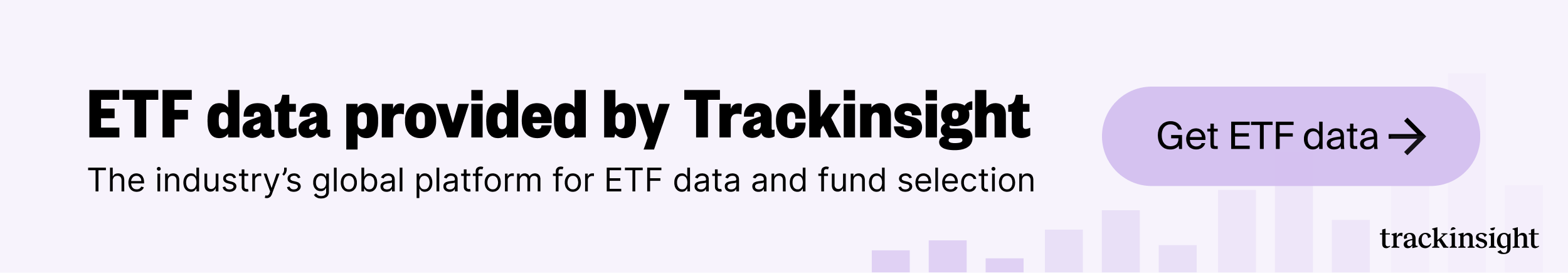

Launches this week

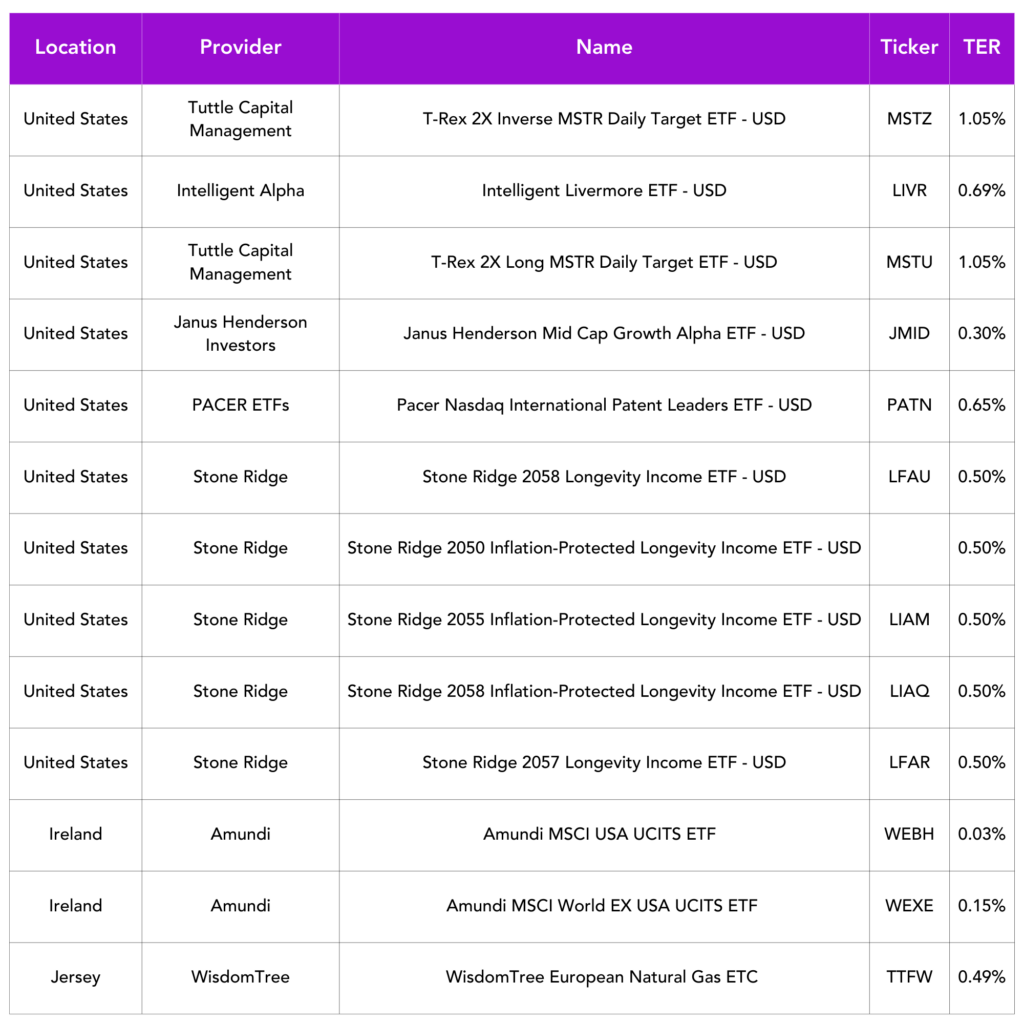

Flows & performance

Grayscale Investments’ Bitcoin Trust (GBTC) continues to face investor redemptions, with total net outflows since its ETF conversion in January having surpassed $20 billion.

JP Morgan Asset Management’s (JPMAM) US research enhanced equity ETF has become the first active ETF to hit $10bn assets under management (AUM) in Europe.

The JPM US Research Enhanced Index Equity (ESG) UCITS ETF (JREU) pulled in $3.6bn in 2024, with assets swelling $1.8bn over the last three months, according to data from TrackInsight.

Things of interest

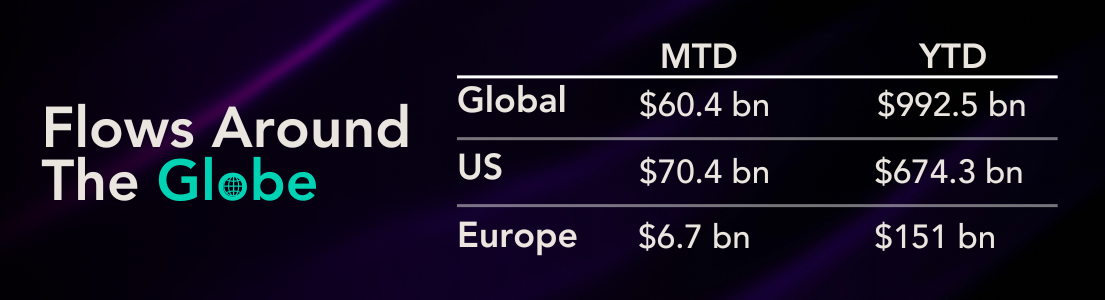

Asset gathering by Vanguard’s European ETF business is accelerating at breakneck speed, with August marking the firm’s strongest monthly inflows since it came to market more than a decade ago.

The firm booked $3.2bn inflows through the month, according to data from Bloomberg Intelligence, equivalent to 15% of asset gathering by all ETFs in Europe and punching well above the issuer’s 7% market share.

This marks an interesting development in the tussle between fund promoters, with Vanguard boasting three times the inflows of top three contenders Amundi and DWS.

According to Vanguard, the firm’s ETF growth has been “especially strong” among retail intermediaries and individual investors in the UK, Germany, Italy, and Switzerland.

Fintech startup Intelligent Alpha is launching a chatbot-powered ETF that promises to harness the brainpower of the investment world’s most illustrious minds — Warren Buffett, Stanley Druckenmiller, David Tepper, and more. the product is built around investment ideas generated by ChatGPT, Gemini and Claude, dubbed the “investment committee,” that are set to be inspired by the thinkings and doings of the famed money managers.

Saudi Arabia’s financial regulator has given the green light to CSOP Asset Management and its local asset management partner to list the first Hong Kong-focused ETF on its exchange. For Albilad Capital, this is its sixth ETF, with the asset manager overseeing 70% of all ETFs in Saudi Arabia, which has seen a 33% increase in the number of these products since 2020 as well as a 240% rise in subscribers.

US White Label provider Tidal has rebranded itself as “The ETF Masters”. Tidal managed over $19 billion in ETF assets across 172 funds.

Career corner

Movers and Shakers

- Kevin Gopaul has joined Rex Financial as their new Chief Investment Officer

- Giovanna Cilia has joined Franklin Templeton in Switzerland covering ETF Distribution

- ULTUMUS has appointed Oliver Payne as product strategist from UBS where he was head of ETF trading for EMEA

- Tabula Investment Management has appointed Rhys Petheram as its chief investment officer. He joins after a 17-year stint at Jupiter Asset Management

On the move

As you’ve heard by now, we’ve launched ETFcareer.com! Each week this section will highlight new ETF career opportunities – and who knows, you could be featured in our movers and shakers if you find the perfect match.

European Featured Opportunity

- Associate Director (Sales) – Geneva/Benelux: As the Associate Director you will be primarily charged with raising assets from French-speaking Switzerland & the Benelux regions. This will be achieved through consultative relationship building with decision makers at fund management, family office, private bank and other wealth management companies. You will focus on the distribution of our industry-leading crypto asset Exchange Traded Product (ETP) platform and the development of our brand in Switzerland, Benelux.

US Featured Opportunity

-

- ETF Product Specialist – Florida: The position is responsible for supporting the sale of exchange traded funds (ETFs) and mutual funds to broker-dealers, wire-houses, RIAs and institutional clients. The candidate will be responsible for managing their own territory and working in conjunction with our firm partners.

Tip of the week

How often are you sharpening your saw i.e. investing in learning and development? It’s something we all need to do but very often “stuff” gets in the way.

The person you need to be most loyal to is yourself, not your job. Continuously investing in yourself will make you a better employee and a better person.

So don’t let the saw go blunt.

About us

Ready to take your ETF knowledge to the next level?

ETF Bootcamp is your all-in-one course designed to dive deep into the European ETF ecosystem. Whether you’re new to the industry or looking to sharpen your skills, our comprehensive training covers everything from ETF fundamentals to the nuances of the European ETF industry.

Gain the insights you need to make smarter decisions, grow your career, and enhance your expertise in the ETF space. Earn CPD points, a certification and a LinkedIn badge upon passing the final exam.

Are you ready to invest in yourself? Register today and let’s get started.