Are you ready to go back to school?

Summer break is over and we are back with a bang. Rather than sitting on a beach we have been busy with a number of new initiatives I am excited to share.

First up is ETF Bootcamp – all you ever wanted to know about ETFs but were afraid to ask.

Many professionals only master their specific niche, leaving significant gaps in their broader knowledge, which is why we created Bootcamp – to fill in the gaps.

Why Choose ETF Bootcamp?

Comprehensive Coverage: From the history of ETFs to their future, our course covers everything you need to know. We’ll explore ETF success factors, various types, regulations, trading mechanics, and how to thrive in the European ETF market.

Expert Insights: Learn directly from industry leaders who have shaped the ETF landscape. Gain insider knowledge to propel your career forward.

Practical Knowledge: Understand ETF distribution and investment strategies. Our course provides all the tools you need to excel.

Certification and Recognition: Upon completing the course, earn CPD points, a certificate, and a LinkedIn badge to showcase your expertise.

We’ll be opening registration for the course soon. Join our interest list to be the first to know.

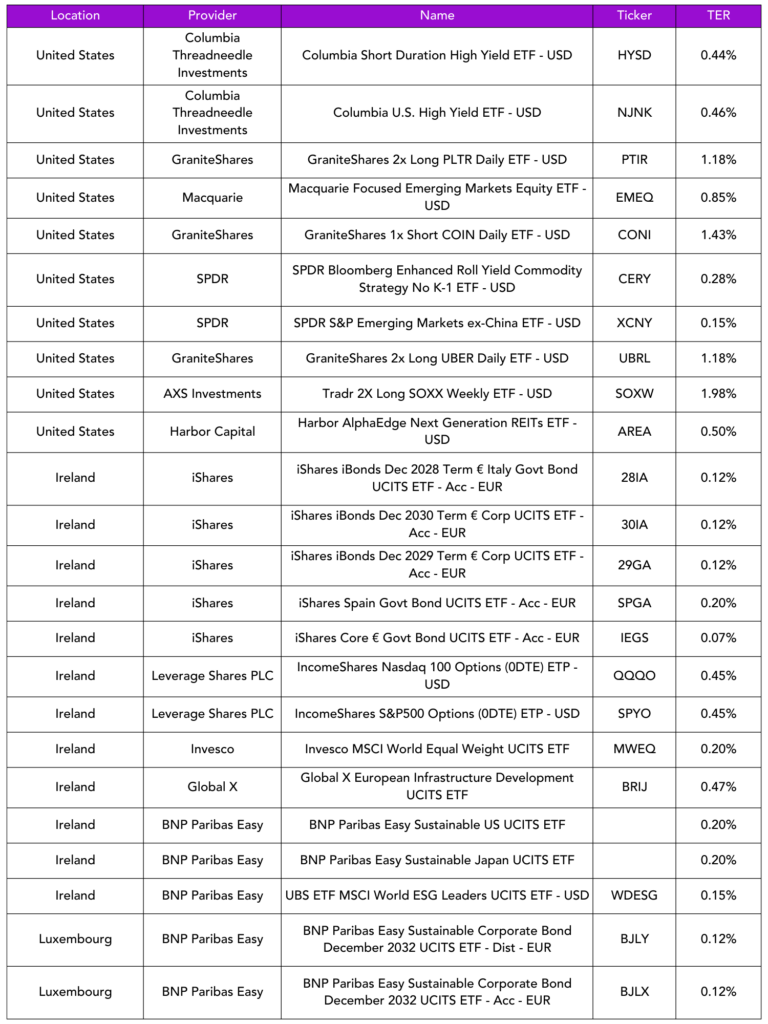

Launches this week

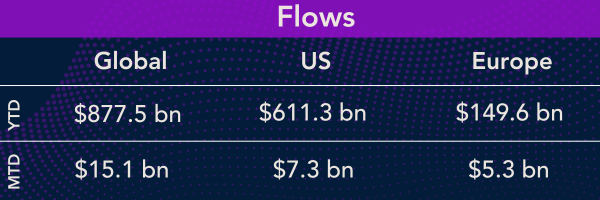

Flows & performance

ARK Invest in Europe has been getting some bad press having “failed to capture investors attention” since its entry into Europe earlier this year. Jez guys, it’s been 4 months. What are you expecting? Raising assets takes times, there are no magic wands out there (I think).

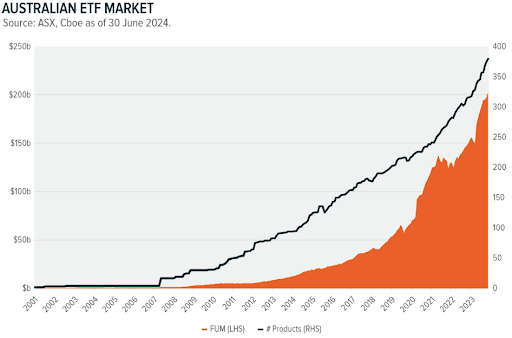

Global X is predicting that ETFs in Australia are expected to hit $1 trillion in AUM by 2030. The market has grown by 37.3% over the past year to $206.2bn AUM.

Things of interest

Jupiter Asset Management is nearing its European entry. The firm has filed for regulatory approval of the Jupiter Global Government Bond Active UCITS ETF and will look to launch the strategy on the platform of white-label issuer HANetf.

Fair Oaks Capital is to launch Europe’s first CLO ETF. The Fair Oaks AAA CLO UCITS ETF (FAAA) is an ETF share class version of an existing Luxembourg-domiciled Fair Oaks fund, the Fair Oaks AAA CLO fund.

Hmmm does anyone remember the Ashmore ETF share class in Luxembourg?

US based crypto fund manager Bitwise Asset Management has acquired ETC Group, marking the group’s entry into Europe. Following the acquisition, all of ETC Group’s products will be renamed under the Bitwise brand but will keep the same investment objectives.

Merrill Lynch plans to triple the number of active ETFs on its platforms, including ETF versions of mutual funds that already exist. The wirehouse’s full-coverage platform houses 100 active ETFs and aims to hit 300 over the next three to five years.

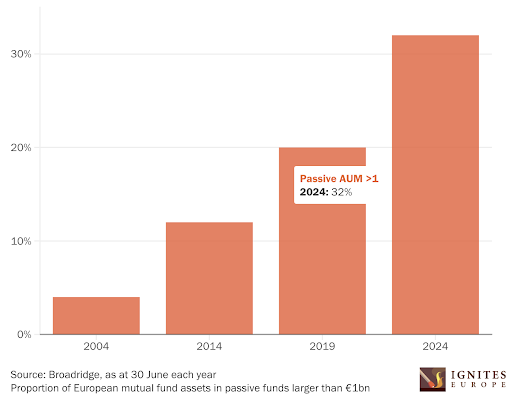

Size is everything. Broadridge data shows that the number of passive products with AUM greater than $1bn is growing rapidly in Europe and now account for almost one third of overall industry assets. Wow.

Inflows to ETFs implementing equity options strategies have ballooned over the past three years, with 110 funds now holding at least USD200 million in assets, accounting for USD120 billion in assets under management, according to Bloomberg.

Investors are adding to this at a rapid pace, with nearly USD4 billion in net inflows in July and USD24 billion through 2024’s first seven months.

Active, Active Active…that’s all we hear now. But if the below is true then get used to it.

Career corner

Movers and Shakers

- Travis Spence has been named global head of ETFs

- Goldman Sachs Asset Management has appointed Simon Hutcheson as head of international ETF strategy and development from State Street Global Advisors

- GSAM has also hired Alvaro Quiros as a portfolio manager in its fixed income ETF team, moving across from JPM

- GHCO strategy head Roxane Sanguinetti has departed the firm. No update on her next destination

- Lazard Asset Management has hired Robert Forsyth from SSGA as Managing Director and Global Head of ETFs

Tip of the week

I have had a lot of conversations recently with people who started a new job only to be let go 12 months later due to the firm “realigning its priorities”.

It begs the question – How much Due Diligence can you really do when Interviewing for a new role?

Hindsight is a great thing but are there potential red flags you can identify when interviewing for a new job? Talk is cheap and people always talk a good game but can you believe what you hear?

A good dose of suspicion should always be on your mind as the one who bears the brunt of these outcomes is you, not them.

About us

It’s Great to Be Back

Over the coming weeks, we’ll continue to share all of the exciting projects we’ve been working on over the break. Stay tuned, and thank you for following along!