ETFs… It´s Summer, but there’s a Tsunami coming

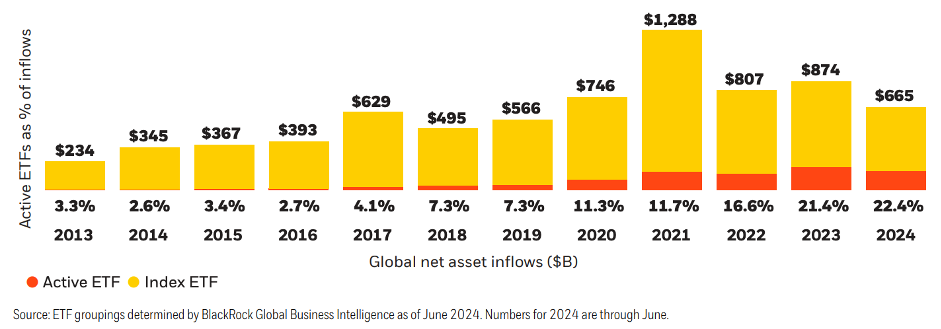

Blackrock has put out a report bigging up the active ETF space and they are not wrong. Whilst still a tiny segment of the global ETF market, their growth has been impressive and it’s not stopping.

Up until now Mutual Fund managers have been scratching their heads as to how to enter the ETF space but Active ETFs have just given them a porthole.

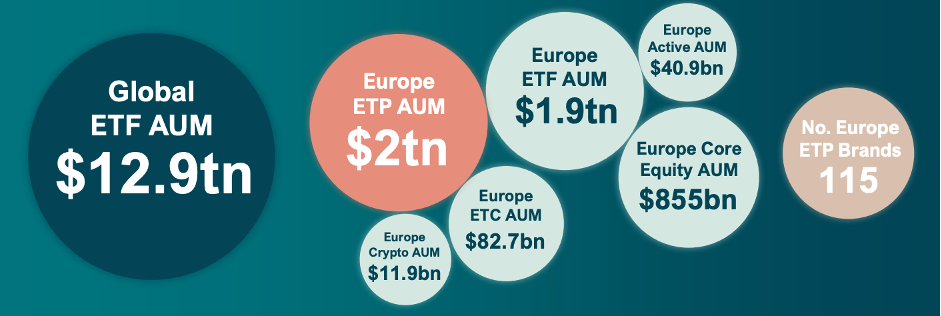

The US is obviously leading the way but Europe is stirring too. According to HANetf, they have received over 300 enquiries for ETP launches so far in 2024, a 40% increase in active ETF enquiries over 2023. Impressive numbers.

It feels like a Tsunami is coming, which is going to reshape the Global ETF landscape.

Launches this week

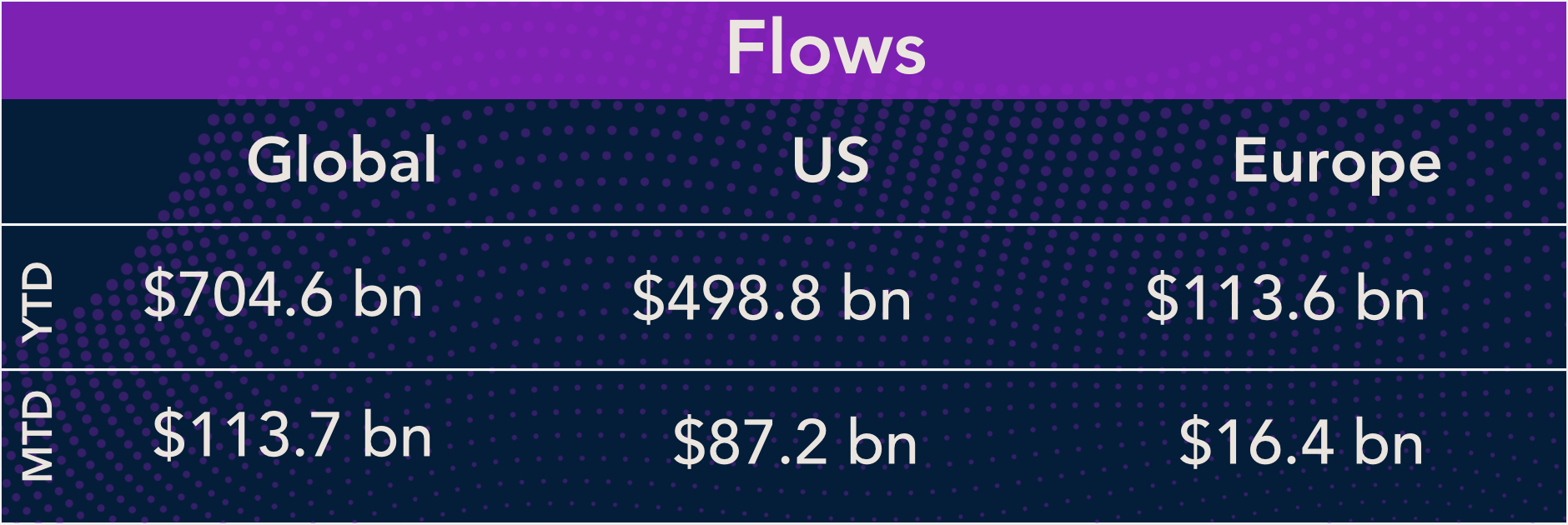

Flows & performance

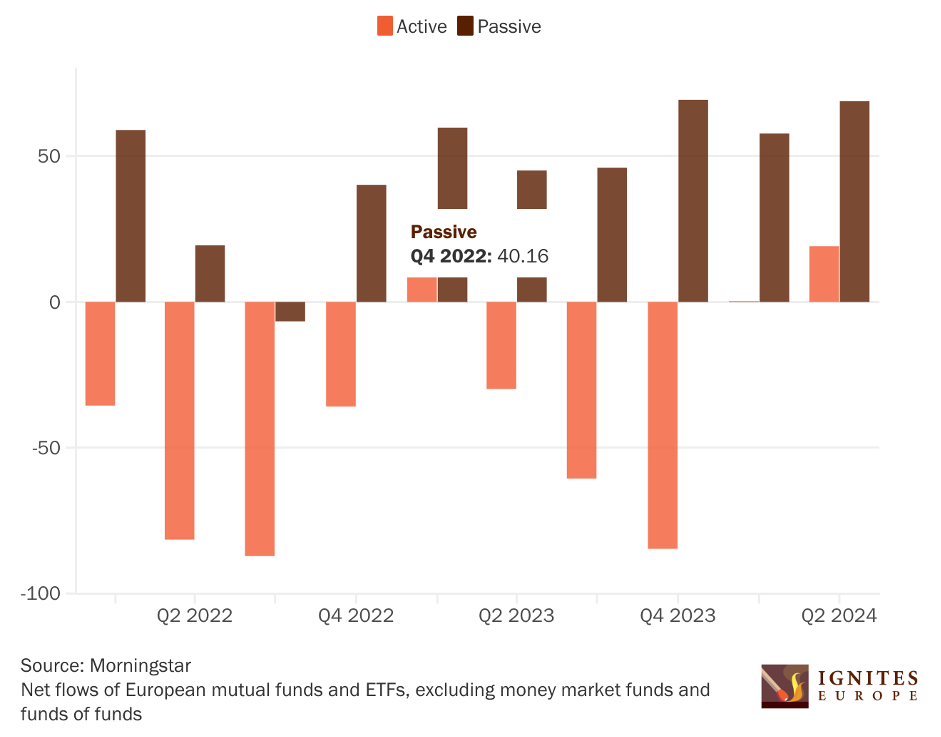

Active funds (mutual funds + ETFs) in Europe have rebounded in Q2 after a miserable past few years.

Active funds have now experienced two quarters of inflows, in a sign the products may be experiencing a turnaround in fortunes following two years of outflows.

Listen & learn

ETF SUCCESS STORIES, a podcast series focused on profiling companies who have achieved success in the ETF ecosystem and uncovering what led to that success.

Today, Bernie Thurston, founder and CEO of Ultumus, shares the story behind the inception of his firm, the challenges he encountered along the way, and offers valuable advice for aspiring entrepreneurs.

Things of interest

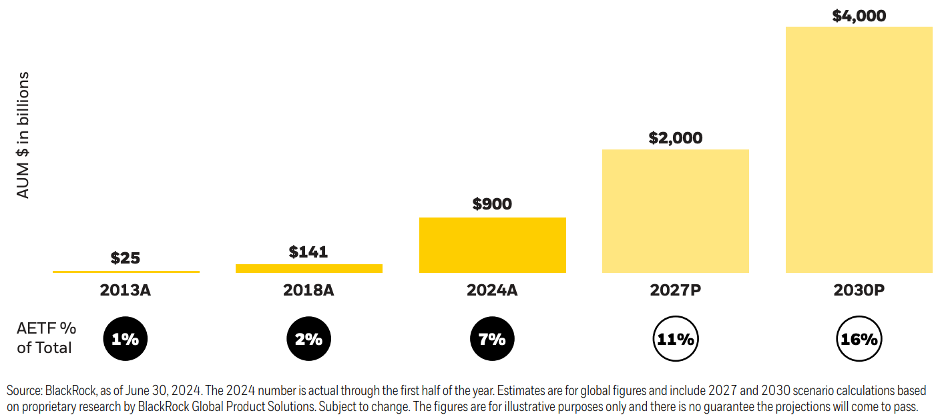

Active ETF assets under management AUM globally are projected to quadruple to $4trn by 2030, according to a report by BlackRock.

The report, titled Decoding Active ETFs: How the growth of active ETFs is unlocking innovation and opportunity for investors, said the growth means active ETFs would account for 16% of the global ETF industry by 2030.

HanETF have launched a new quarterly report titled Exchange Traded Europe.

The best part has to be this quote from Co-Founder Hector MacNeill:

“Managers of mutual funds are like dinosaurs, looking to the sky and seeing a little black dot and saying: ‘No, that’s nothing to worry about’. And as it comes closer, they see it has ‘ETF’ written on it, just prior to it hitting them in the face.”

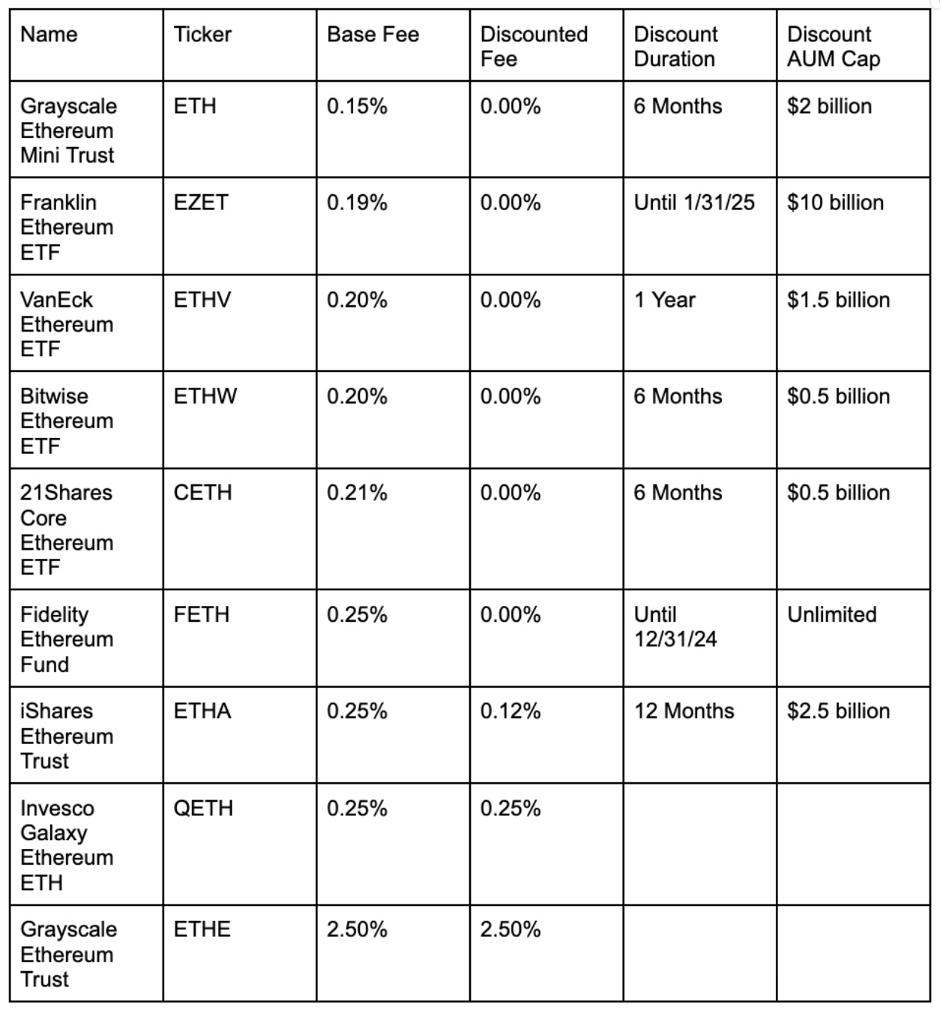

Ethereum ETFs are coming with the launch of nine products on July 23.

Here is what to know:

Raymond James plans to launch its first ETFs in 2025.

The firm has no immediate plans to convert any of its existing mutual funds into ETFs, but it will consider putting “high-demand investment strategies” across Raymond James Investment Management and its affiliates into ETF wrappers.

Career corner

Movers and Shakers

- Evan Ong has joined GraniteShares as head of ETFs in Asia. He was previously at FTSE Russell.

- Mo Sparks has joined Raymond James from NYSE to lead their ETF initiative.

- Chris Doran has joined Westwood Holdings Group as Head of ETF Distribution & National Accounts. He was previously at SEI.

- Hetal Patel has joined CBOE in Europe as Director of ETF listings. She was previously at LSE.

Tip of the week

You can learn more in one year at a smaller firm than you can in ten years at a large firm, so have an open mind to your next role. Too many people look to play it safe and think it’s much better to have a big-name shop on their cv than a smaller firm. I disagree.

Big shops pigeon hole you, they suck out any entrepreneurial spark you might have had and they turn you into a widget. At a smaller firm, you can have way more impact and do work that truly makes a difference.

Isn’t that worth that risk?

About us

Explore the Findings: Germany ETF Market Insights. Leading the EU

With a staggering $4 trillion in assets under management, Germany holds the crown as the largest asset management market in the EU. Of this, $520 billion is in ETFs, capturing 29% of the European ETF market.

As the largest ETF market in Europe, Germany’s trends are poised to shape the broader European landscape. However, for new entrants, brand recognition and targeted strategies are key.

Tap into more insights in our new Germany ETF Market report.