Riding the ETF wave. When will the bubble burst?

The ETF success story continues to go from strength to strength. Records are being smashed, new entrants are piling into the market, active ETFs are catching fire and investors seemingly can’t get enough of the products all over the world. Who would have imagined it would have been this good, eh?

But, how long will the party go on for? Nothing lasts forever, right, and one good idea eventually gets replaced by another (unless you work in mutual funds where you think nothing ever changes).

Some commentators have said the birth of tokenization will mark the end of ETFs, but it’s difficult to see that happening at this stage. For an industry renowned for its innovation, it would be foolish to think that there is not someone out there with an idea that ultimately will end up replacing ETFs. The question is, what could it be?

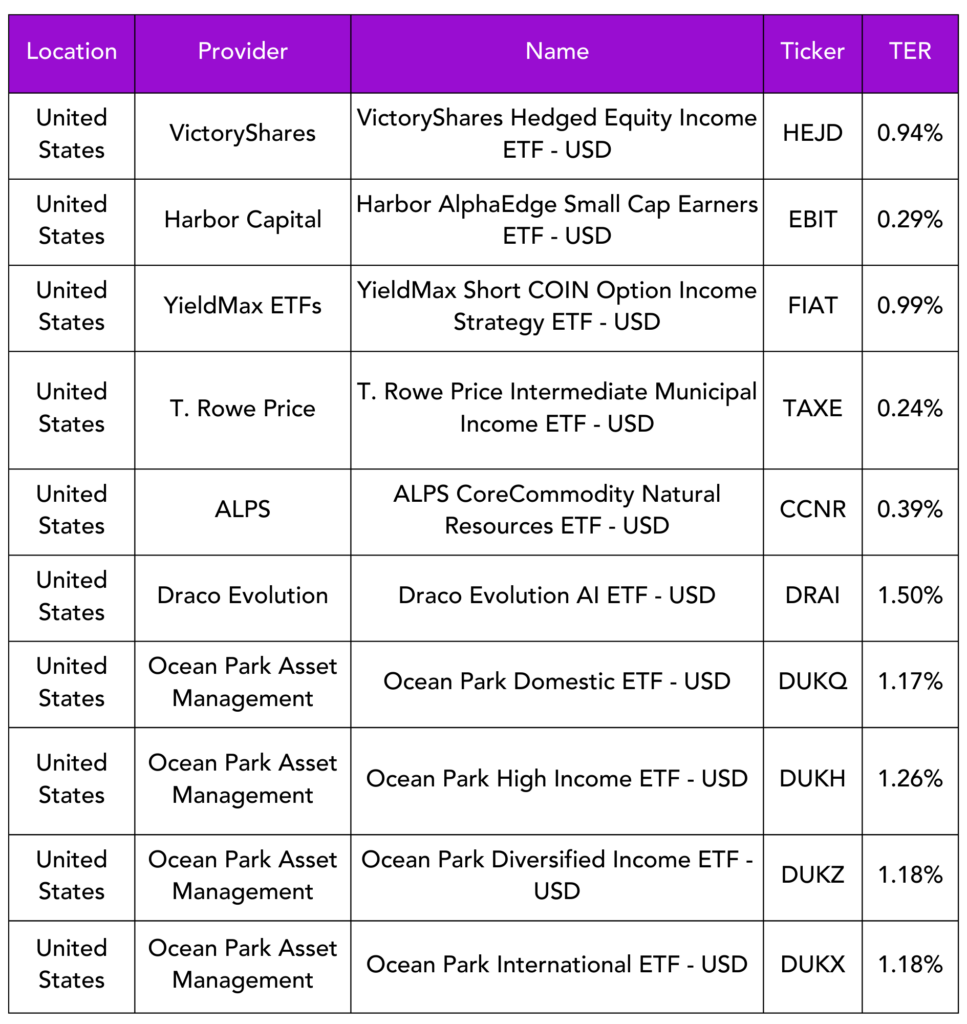

Launches this week

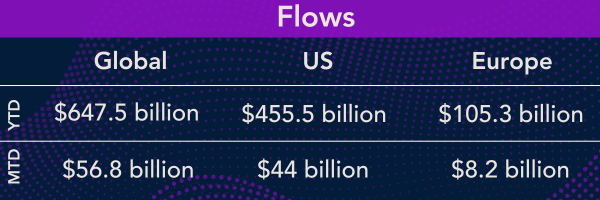

Flows & performance

Australia’s booming ETF industry raced past the milestone of A$200 billion (US$134.9 billion) as of the first half of the year, bolstered by active product development and renewed investor appetite for global and domestic equities strategies. Total assets for the Australian ETF sector reached a new all-time high of A$205.3 billion as of the financial year that ended in June, according to Betashares data.

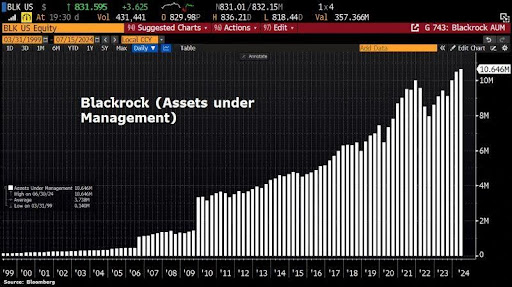

In the second quarter of this year, BlackRock have reported they managed a record $10.65 trillion in assets. This increase was due to the rising value of client assets and the inflow of investments into the company’s ETFs. In the quarter, BlackRock saw total net inflows of $81.57 billion, slightly higher than the $80.16 billion from a year earlier. The majority of the inflows, at $83 billion, went into exchange-traded funds, marking their best start to a year on record.

Listen & learn

What does it take to expand a family business into an international success? For VanEck, it’s all about unwavering client support. Today, we revisit the ETF Success Story of VanEck Europe with CEO, Martijn Rozemuller. Glean insights from their journey to success.

Things of interest

Circa5000 is set to exit the European ETF market a year after launching a suite of five thematic ETFs. The group announced the closure of all five ETFs in a shareholder notice, citing low assets under management (AUM) across the range. Combined, the ETFs had around £15m of assets.

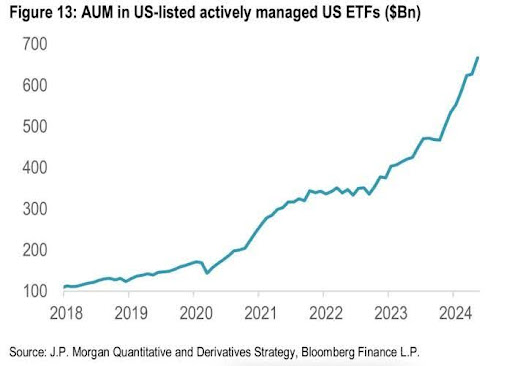

According to research from JP Morgan in the US, for the 4th consecutive year, most new ETFs are active. 76% of new ETF issues over the past year were actively managed, addressing new investment themes and a shift from passive to active strategies.

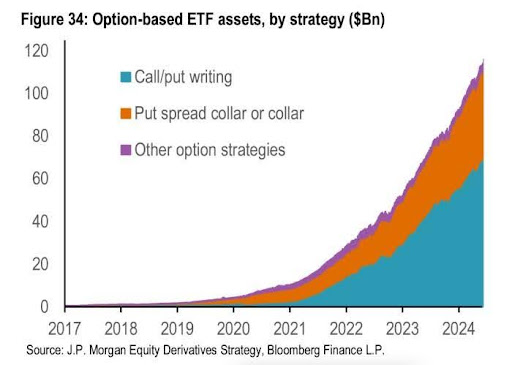

Popular strategies among new active ETFs include managed risk/defined outcome, factor investing, call/put writing, and thematic funds, making up nearly half of all new ETFs.

The trend from passive to active ETFs has accelerated recently with significant growth in international equities, style-based ETFs, sector funds, and fixed income ETFs.

Managed risk aiming to reduce volatility, led new ETF categories, representing 16% of new launches. These funds use option strategies to offer targeted returns and downside protection.

BlackRock said it could start developing ETFs for private assets following its $3.2bn acquisition of data provider Preqin. The group said it sees opportunities to build private asset indices using Preqin data, boosting the industry’s transparency and making it more attractive to investors.

The price of Ether has topped $3,300 amid anticipation that a spot ETH ETF could launch as soon as the end of this week. Ether is currently trading at $3,331 and has rallied 16% from a price of $2,909 in the last week.

Last but not least, it looks like ETF.com have moved to a subscription based model. No more free content from those guys.

Career corner

Movers and Shakers

- Peter Finn has moved to Lunate in the UAE as head of ETF Portfolio Management. He was previously at LGIM in London.

- 21Shares global head of distribution Isabell Moessler is set to depart the group at the end of the year

- Charlie Burns has joined Harvest ETFs in Canada as a Regional Sales Manager

- Tim Bradbury has joined SSGA in Australia to lead their Australian funds and ETF business.

Tip of the week

Be careful about burning bridges. The ETF business is a small community, everyone knows everyone somehow. Therefore, making enemies, being unkind or unhelpful to people is never a clever idea. Just because you sit in a high position today, doesn’t mean the same will be true tomorrow. If you burned bridges on the way up then the way down might be a very painful experience. So, treat others as you would like to be treated yourself.

About us

Explore the Findings: Spain ETF Market Insights

Did you know the Spanish Asset Management market is estimated to have approximately $450B total AUM?

While ETF growth in Spain has faced hurdles, the market’s overall size and evolving landscape present notable opportunities.

Explore the region in our Spain ETF Market report – full access, totally free.