Donald Rumsfelds known unknowns and the trouble with AI

During the Iraq war, then Secretary for Defence, Donald Rumsfeld, talked about things you know but don’t know and things you don’t know but know (mind twisting I know). Anyway, poor Don is now gone but I feel his spirit lives on in the world of ETFs.

Speaking to a number of mutual fund managers with wannabe ETF intentions has left me somewhat worried about what they know and don’t know about ETFs or, more worryingly, about what they think they know about ETFs.

Now, I’m far from being the smartest guy in the room, but I do recognise cow crap when I see it, and there is a lot of cow crap in circulation when it comes to what these managers are being told and lead to believe about ETFs.

So for the wannabe ETF managers out there, try seeking out the facts and avoid dipping into the Donald Rumsfeld playbook.

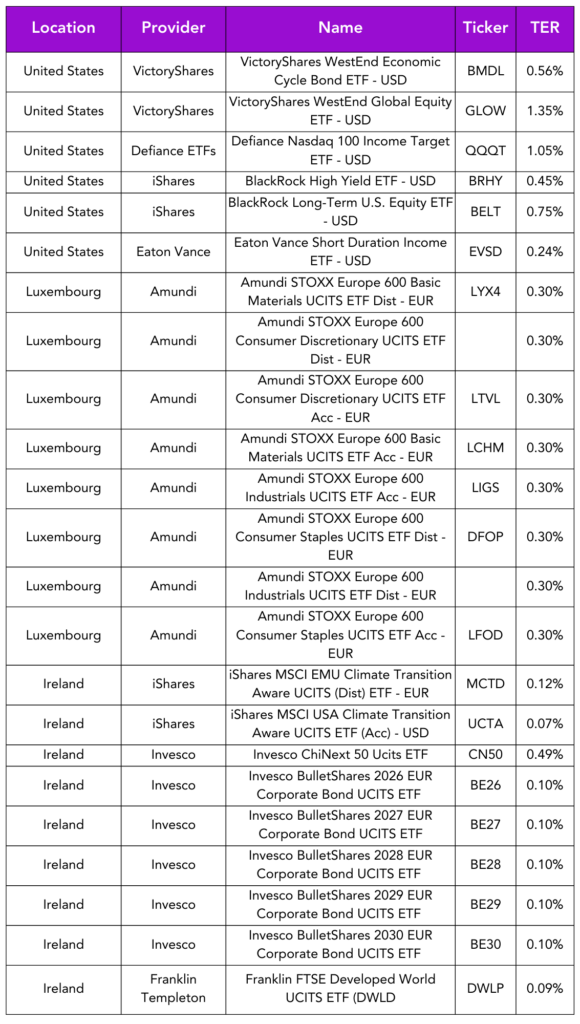

Launches this week

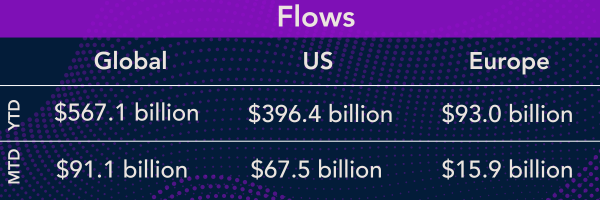

Flows & performance

Singapore’s ETF market suffers largest outflows in APAC so far in 2024. Locally domiciled ETFs saw cumulative outflows of US$278.5 million during that period, with BlackRock’s Asia high-yield bond ETF accounted for bulk of outflows with US$210M in redemptions.

Most other major markets in Asia Pacific, including South Korea, Japan, Australia and Hong Kong, all had over US$3 billion each in net inflows into their locally listed ETFs, with Malaysia and Thailand also registering positive flows.

Things of interest

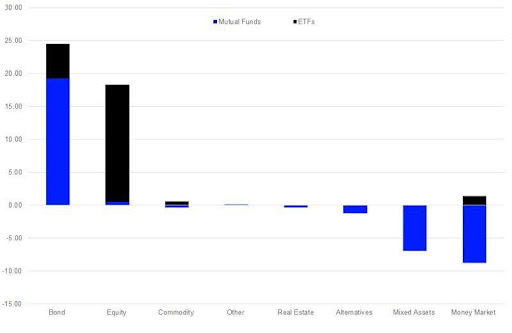

The European fund industry enjoyed inflows over the course of May, mainly driven by ETFs. Mutual funds (+€2.3 bn) and ETFs (+€25.1 bn) This flow pattern led to overall estimated net inflows of €27.4 bn over the course of May 2024.

The value of tokenised assets is expected to reach around $2 trillion (€1.9 trillion) by 2030 due to increased adoption of tokenisation by mutual funds, exchange traded funds and alternative funds, according to research from McKinsey. This prediction, which the consultancy makes in a newly published report on the “transformational power of tokenising assets”, excludes cryptocurrencies such as bitcoin and stablecoins such as tether. McKinsey says in the report, that the value of tokenised assets could double to around $4 trillion “in a bullish scenario”.

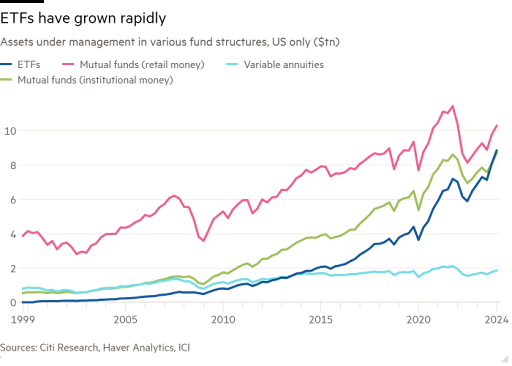

ETFs could seize half of current US mutual fund assets, according to Citi, who believes $6tn to $10tn of assets in long-term mutual funds is at risk of capture by ETFs.

Most vulnerable to predation are mutual funds held outside of tax-exempt retirement accounts, which are unable to compete with the ability of many ETFs to defer capital gains tax liabilities that accumulate within a fund.

Citi estimates that between half and all of the $2.4tn currently held by retail investors in non tax-exempt mutual funds is a potential target for replacement by ETFs. In addition, between a quarter and a half of the $4.1tn of equivalent money held by institutional investors, and up to a fifth of the $1.3tn non-taxable variable annuity market is also up for grabs.

Betashares in Australia have received a cash injection of up to A$300m from Temasek, a global investment company headquartered in Singapore. The investment comes as Betashares AUM is now over A$38 billion.

News that Germany’s Baader Bank is entering the ETF market with a strategy that will use artificial intelligence to aid stock selection is not that newsworthy in itself but it does beg the questions about the success of these types of strategies.

People still seem to insist that AI will never truly replace the role of the portfolio manager, a point I personally believe to be misguided. But whereas for now a PM can explain why a holding is in the portfolio, AI funds are finding it more difficult to articulate where the performance is being generated from and why.

A few years ago, there was a Korean manager called Qraft who launched a suite of AI ETFs in the US. The performance was incredible but the trouble was they couldn’t explain it to clients and that’s where they came unstuck. ETFs and black boxes don’t go hand in hand.

Career corner

Movers and Shakers

- Andrew Ye has joined Grayscale from Global X as Senior Portfolio Consultant

Salary Trends

The average total comp for a Product Developer in Europe is:

- VP – $224k

- ED – $289k

- MD – $382k

Tip of the week

Update your LinkedIn profile. Its such an easy thing to do but very often overlooked. LinkedIn is meant to be your online resume but far too many people don’t treat it as such, not providing a proper description of what they do and what their value proposition is.

If you don’t make it clear to recruiters what you do, then how are you going to be found?

About us

Hot off the press

This week we’re spotlighting a new series of blog pieces that we created in partnership with DWS, highlighting the launch of the Xtrackers US National Critical Technologies ETF.

Update your LinkedIn profile. Its such an easy thing to do but very often overlooked. LinkedIn is meant to be your online resume but far too many people don’t treat it as such, not providing a proper description of what they do and what their value proposition is.

If you don’t make it clear to recruiters what you do, then how are you going to be found?

Ready to transform your vision into impactful content? Get in touch today to learn more about our content creation services.