ETF INVESTING IN EUROPE PREDICTED TO SKYROCKET

BlackRock forecasts that 10 million new investors across Europe will own iShares exchange traded funds over the next five years.

Fund Launches and Updates

EMEA

Bitpanda shuts entire crypto ETP range to focus on core business. etfstream

SSGA has more than halved the total expense ratio of its emerging markets ETF. SPDR MSCI Emerging Markets UCITS ETF will see its TER fall from 0.42% to 0.18% Investment Week.

Amundi has launched the US Tech 100 Equal Weight UCITS ETF. The fund invests in the 100 largest international companies by market capitalisation listed on the US technology exchange NASDAQ.

The fund is listed on the Deutsche Boerse with a total expense ratio (TER) of 0.07%. etfstream

iM Global Partner a new entrant to the ETF market has announced it will launch the iMGP DBi Managed Futures ETF with its Partner, Dynamic Beta investments.

This strategy has already been available to US investors for more than three years and has become the largest Managed Futures ETF in the industry. etfexpress

Leonteq is another new entrant to the market this week in Switzerland. The Swiss firm whose product is based on FuW Swiss 50 Index (FUW50 SW) has been listed on SIX Swiss Exchange in Swiss francs.

The ETP uses direct physical replication to track the FuW Swiss 50 Index which consists of the 50 largest companies that are domiciled and listed in Switzerland.

Constituents are initially equally weighted. The ETP comes with a management fee of 0.72%. Finews

BNP Paribas AM has followed BlackRock and Amundi in reclassifying its €15bn Article 9 ETF range to Article 8 as downgrades top €50bn worth of assets in November alone. etfstream

Euronext has launched Eurozone and France equity indices targeting gender equality as “first pillars” in a broader range addressing gender balance in the workplace.

Euronext Equileap Gender Equality Eurozone 100 and Euronext Equileap Gender Equality France 40 indices offer exposure to companies with strong gender equality performance. Euronext

LGIM strips gold mining ETF of ESG label. The firm quotes it was “on the basis that the fund no longer promotes the environmental or social characteristics that are built into the index tracked by the fund”. Investment Week

AMERICAS

Meet Kevin, the ETF. Millennial YouTuber Kevin Paffrath, whose Meet Kevin channel boasts nearly 2 million subscribers, is lending his name to an exchange-traded fund investing in Apple Inc., Tesla Inc. and other companies.

He believes can boost prices of their products without crimping demand. The Meet Kevin Pricing Power ETF (PP) has an expense ratio of 0.77%. ETF.com

Goldman Sachs makes ‘white-label’ bet on white-hot ETF market. Goldman’s decision to become the first big-name institution to launch a “white label” exchange traded fund business is being seen as a large bet that ETFs will continue to seize market share from mutual funds. FT

Bitwise refiles for Bitcoin Strategy Optimum Yield ETF in the face of crypto meltdown. seekingalpha

ProShares launched the ProShares S&P Global Core Battery Metals ETF (NYSE Arca: ION), an ETF that invests only in companies mining battery metals. etftrends

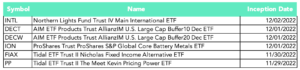

Full list of U.S. launches:

ASIA-PACIFIC

Australia’s exchange-traded funds market is on track to become bigger than ever by the end of the year, after a powerful equities rebound in October fuelled a record month of growth.

The market cap of the country’s ETF industry surged 5.9% last month, jumping by A$7.3 billion ($4.9 billion) to A$131.7 billion, according to recent analysis by BetaShares. Bloomberg

Flows

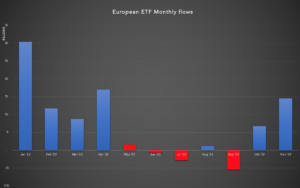

The recovery for European ETF flows continues as the region recorded the third best month of the year with $14.5bn of inflows. +$6.3bn for Equities and $8.5bn for Fixed Income. iShares, UBS, DWS and Vanguard all recorded inflows of + $1bn.

Record $3 Billion Exodus Hits Credit ETF in Abrupt Risk Reversal .More than $3 billion exited the $36 billion iShares iBoxx $ Investment Grade Corporate Bond ETF (ticker LQD) in the US, Bloomberg data show. Bloomberg

CLICK to listen stories of inspiring leaders. This week we speak to Carmen Cheung, Head of ETFs and Passive Investments at Samsung Asset Management.

Noteworthy

BlackRock predicts European investors will lead a digital investing revolution as ETF savings plans become mainstream.

According to BlackRock ETF usage in Europe is set to explode, driven by the evolution of commission free trading platforms. The US-based fund giant expects digital investing channels in Europe to grow to €500bn worth of ETFs by 2026 etfexpress

The firm goes on to forecast that 10 million new investors across Europe will own iShares exchange traded funds over the next five years.

State Street and Brown Brothers Harriman terminate $3.5bn acquisition deal.

Both parties have mutually agreed to terminate a $3.5bn proposed acquisition deal for BBH’s investor services arm.

After considering modifications to the deal based on regulatory feedback, State Street said it expected to face further delays and would still not be able to resolve all necessary approvals.

State Street concluded it was no longer worth investing time and resources into completing the deal while BBH agreed on the basis it did not think State Street would be able to obtain the necessary regulatory approvals. etfstream

BNY Mellon to launch ETFs in Europe, says CEO. Hanneke Smits says US group will ‘eventually’ bring ETFs to Europe.

“We don’t have a specific date but eventually yes we will. ETFs are increasingly in demand by investors” Ignites

Additional reads

BlackRock CEO says ‘next generation for markets’ is tokenization. decrypto

HSBC will have to share custody with JPMorgan of $52 bln in gold bars. Reuters

Actively managed ETFs gain ground in Europe despite passive wave. Bloomberg

Renewed focus on conflicts of interest at index providers. etfstream

The man behind the infamous ETF shorting Cathie Wood’s flagship strategy is no longer in control of the fund after splitting from the firm he joined just seven months ago. Bloomberg

From behind the desk

There is one month left in the year.

Most people are ready to coast to the finish line, but one good month can make the whole year feel like a success.

What can you do in the next 30 days to build momentum and finish the year on a high note?