5 reasons why 2025 could be even better than 2024

2024 was a blockbuster year for ETFs, breaking records and setting new trends. But the stars are aligning for 2025 to push the industry even further. Here’s why this year could bring even greater success, driven by shifts in how ETFs are used and who’s investing in them.

Mutual Fund Managers Pivot to ETFs

The ETF industry is welcoming an influx of mutual fund managers who are finally embracing the shift toward ETFs. In 2025, expect even more mutual fund companies to launch ETF versions of their flagship strategies to retain assets and attract a new generation of investors.

The Continued Surge of Active ETFs

Active ETFs took centre stage in 2024, with investors seeking alternatives to traditional mutual funds. In 2025, this trend is set to accelerate as more high-profile managers enter the ETF space. With active ETFs proving their value in volatile markets, they’re poised to capture a bigger slice of both institutional and retail portfolios.

ETFs Becoming the Backbone of Model Portfolios

Advisors are increasingly building client portfolios with ETFs as their foundation. In 2025, expect even greater adoption of ETFs in model portfolios as technology makes it easier to customize and automate asset allocation. This shift could drive inflows from advisors who traditionally favoured mutual funds or bespoke investment strategies.

Retail Investors Embrace ETFs Like Never Before

The retail revolution in ETFs is here. With fractional trading, commission-free platforms, and broader education, retail investors are discovering the benefits of ETFs in droves. In 2025, this trend could explode further as financial literacy improves and younger generations enter the market with a preference for simple, efficient investment options.

The Crypto ETF Revolution Takes Off

With a potential wave of regulatory clarity, 2025 could see a whole new wave of crypto ETFs flooding the market. The crypto craze has the potential to bring billions in fresh assets under management (AUM) as mainstream investors finally get easy access to digital assets through ETFs.

The ETF revolution is far from over. With active ETFs booming, mutual fund managers joining the fray, and retail and advisor adoption surging, 2025 could set a new high-water mark for the industry. There’s a lot to be excited about.

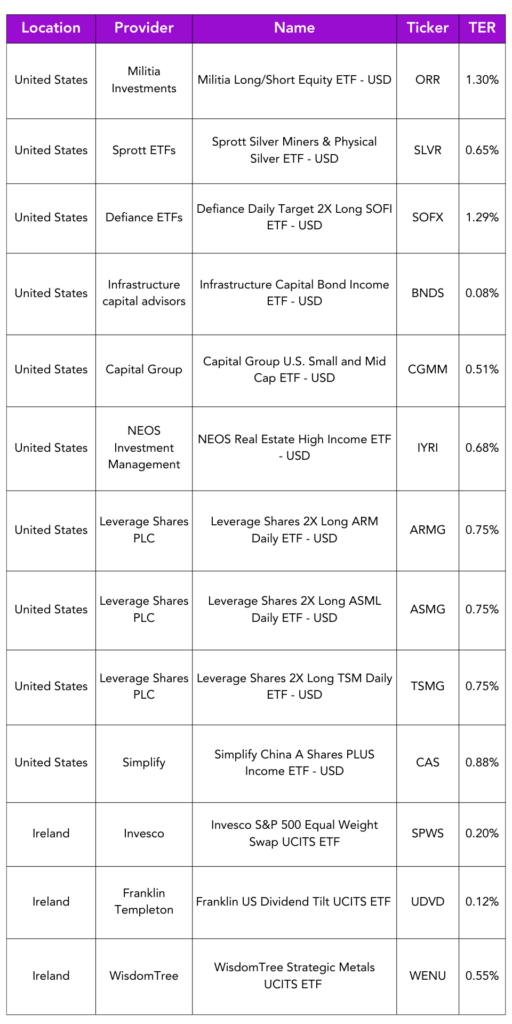

Launches this week

Flows & performance

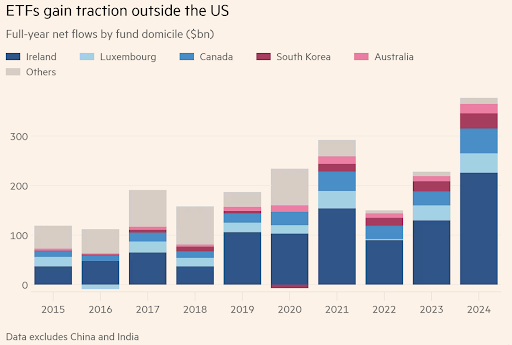

Global ETF flows hit a record $1.5tn last year with the buying frenzy accelerating after Donald Trump’s presidential victory in November.

The net inflows obliterated the previous full-year record of $1.2 trillion set in 2021 according to data from Morningstar, which includes most major investment markets except China and India. Total assets hit $13.8 trillion, a rise of $2.7 trillion during the year, and nearly five times the $2.9 billion level of a decade ago.

The net inflows obliterated the previous full-year record of $1.2 trillion set in 2021 according to data from Morningstar, which includes most major investment markets except China and India. Total assets hit $13.8 trillion, a rise of $2.7 trillion during the year, and nearly five times the $2.9 billion level of a decade ago.

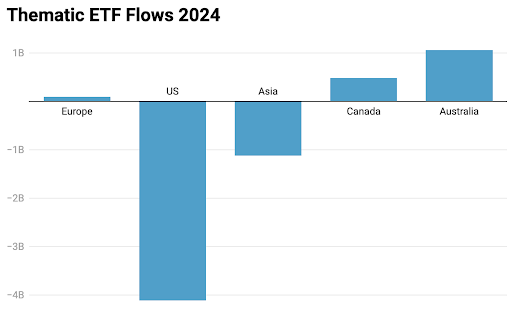

Are Thematics beginning to lose their shine? 2024 wasn’t the year Thematic ETFs were hoping for. Globally, these niche products faced $3.7 billion in outflows, a clear sign that investors pulled back from some of the more adventurous corners of the ETF market.

According to Trackinsight, out of 93 themes tracked, only 30% managed to record inflows. This means nearly 7 out of 10 thematic categories ended the year in the red.

Suffice it to say that BlackRock had a stellar 2024, as its latest earnings report revealed that the asset manager hit a high of $11.55 trillion in assets under management at the end of the fourth quarter last year.

From an ETF perspective, the report shows that of the record $641 billion worth of investor inflows for the year ended Dec. 31, as $390 billion went into ETFs, including $226 billion into equity and $164 billion into fixed income.

Things of interest

Five months after telegraphing its move into the ETF space Lazard Asset Management has filed with the SEC to introduce its first ETFs. The firm’s maiden ETF suite will include the Lazard Emerging Markets Opportunities ETF, the Lazard Equity Megatrends ETF, the Lazard International Dynamic Equity ETF, the Lazard Japanese Equity ETF, and the Lazard Next Gen Technologies ETF.

SSGA is hiring a Head of EMEA ETF-as-a-Service Business Development. This person will drive the growth and expansion of the EaaS platform, focusing on strategic business development, client acquisition, and engagement. Does this mean they are pushing more into the white label / platform provider space as they did with Fideuram last year?

State Street Global Advisors has agreed a distribution deal with digital wealth management platform Moneyfarm, to boost the sale of its ETFs to Italian investors. Under the agreement, more than 60 vehicles in the SPDR ETF suite will be available through Moneyfarm’s Italian securities account platform, which launched in October 2023.

5 ETF predictions for 2025

When it comes to predicting the future one man who definitely has his finger on the pulse is Nate Geraci at The ETF Store. Here are his 5 ETF predictions for 2025:

-

Fee Wars Among S&P 500 ETFs

Either Vanguard’s VOO or BlackRock’s IVV, or both, are expected to lower their fees further (possibly as low as 0.01%) to surpass SPDR S&P 500 ETF (SPY) as the largest ETF by assets. -

The Year of Crypto ETFs

2025 could see explosive growth in crypto ETFs due to anticipated regulatory clarity under a new administration. The total number of crypto-related ETFs is expected to surge, potentially surpassing gold ETFs in assets if bitcoin prices remain strong. -

Private Credit ETFs Face Challenges

Efforts to launch private credit ETFs, such as those proposed by State Street, may stall due to liquidity mismatches and regulatory concerns. -

Mainstreaming of 351 Exchanges

351 exchanges, allowing investors to transfer appreciated stocks into ETFs tax-free, are predicted to gain popularity. -

Leveraged Single Stock ETF Implosion

The rapid growth of leveraged single stock ETFs, now a $20 billion market, carries inherent risks due to volatility decay and leverage effects. A sharp decline in a highly volatile underlying stock could cause a leveraged ETF to implode, potentially leading to significant losses and highlighting the risks of these products for retail investors.

Career corner

Movers and Shakers

- Following the majority acquisition of Trackinsight, Kepler Cheuvreux is on a hiring spree.

- Cédric Farhat based in Paris, joins from Agora Capital in Geneva, where he served as Head of ETF.

- Tobias Sjöström Chanteloup, based in Stockholm, will focus on ETF distribution to Nordic investors. He was previously at JP Morgan

- BITA, the index provider has hired Varun Jain as their Chief Revenue Officer. He joins from MerQube.

- James Thomas has rejoined State Street Global Advisors after departing ARK Invest Europe last December. In his new role he will be based in Dubai.

- Hirad Riazi has joined Goldman Sachs as ETF Marketing. He joins from BlackRock.

- Mo Haghbin has joined Proshares as a Managing Director. He joins from Invesco.

Tip of the week

The Bright Side of Office Life

After years of remote work, it’s easy to forget the upsides of the traditional office. But returning to an in-person environment can bring significant benefits:

-

Reignite Collaboration and Creativity

There’s a reason why brainstorming sessions are better in person. Ideas flow more freely, feedback happens in real-time, and those impromptu hallway chats? They often lead to breakthrough moments. -

Strengthen Workplace Relationships

Slack messages and Zoom calls can’t replace the bonds built over coffee breaks and team lunches, and going for a beer after work. In-office interactions foster stronger relationships, which can lead to better teamwork—and a more enjoyable workday. -

Be Seen and Heard

Out of sight, out of mind is a very real risk. Being physically present in the office keeps you visible to your managers and colleagues, which is key for career growth. It’s much easier to advocate for yourself when you’re in the room. -

Separate Work and Home

Remote work blurred the lines between personal and professional life, leaving many feeling “always on.” Returning to the office can help reestablish boundaries and bring back that crucial work-life balance.

About us

New Year, New Financial Goals – Do You Know Someone Who Could Use The Saver’s Guide to Investing?

A fresh year brings fresh financial ambitions. Maybe you’ve set your goals, but what about your friends or loved ones who are still just saving? Helping them take the first step into investing could make all the difference.

Moolah Invest’s Saver’s Guide to Investing breaks down the essentials into simple, actionable steps – perfect for turning smart savers into confident investors.

If someone you care about is ready to start their investing journey, this guide could be exactly what they need to build confidence and momentum.

Share The Saver’s Guide to Investing and help your friends and family make their money work harder.