2025 Will Be the Year Of…

January is the year of predictions so here is what I see when I gaze into my crystal ball:

Vanguard becomes the largest ETF manager in the world

Nine out of ten of every new ETF launched in the US is actively managed

Whilst the growth of Active ETFs in Europe turns out to be disappointing

The SEC approves ETF share classes for mutual funds, resulting in the US ETF market growing by 50%

At least ten European Mutual Fund managers launch ETFs, eight of which choose to do so with a white label partner

Index funds in the UK grow at a faster rate than ETFs

India becomes the fastest growing ETF market in the world

Retail adoption of ETFs in Europe grows to 25% of the market, forcing managers to double down on their digital distribution strategies

ETFs focused on Private Markets becomes the fastest growing segment of the industry

ETF issuer consolidation gathers pace with at least one top twenty manager being taken over

Salary inflation for those working in ETFs grows by 10%

One thing’s for sure: the ETF world never stands still, and while my crystal ball might be a little cloudy, 2025 is shaping up to be another transformative year for the industry. Let’s see how many of these predictions come true.

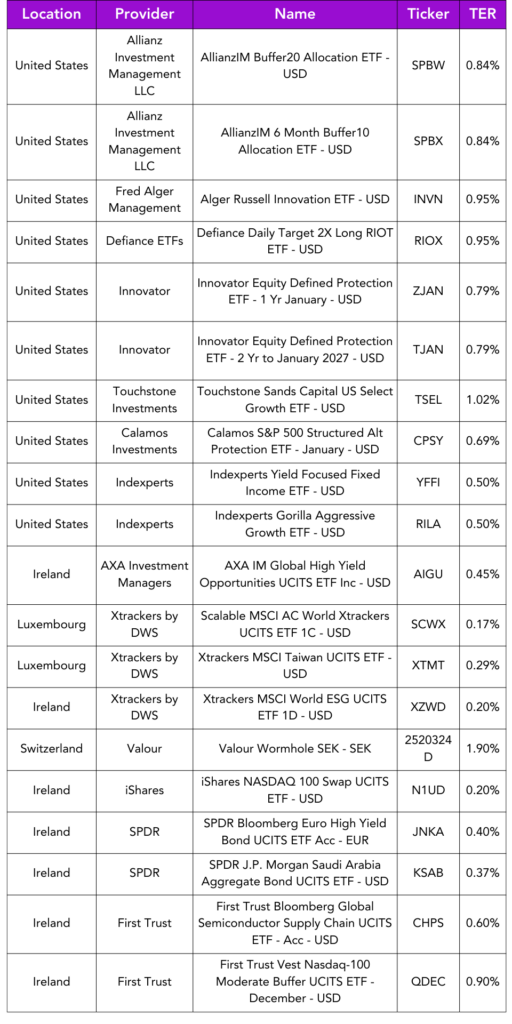

Launches this week

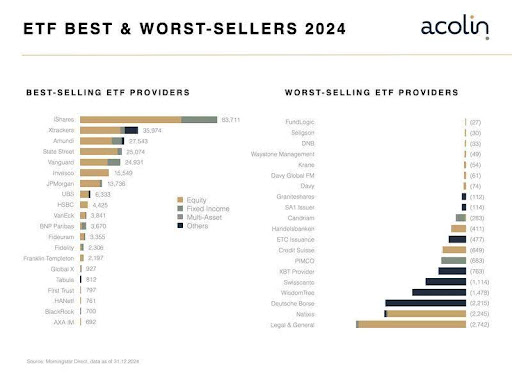

Flows & performance

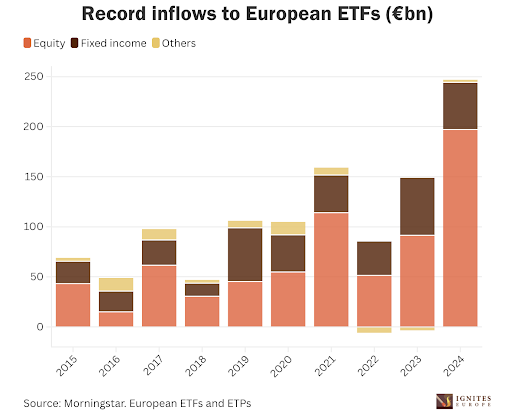

- European ETFs brought in record inflows last year with net inflows of €247bn, an increase of €102bn on the total for 2023, Morningstar data shows. The previous European record for annual ETF flows was €159 billion in 2021.

-

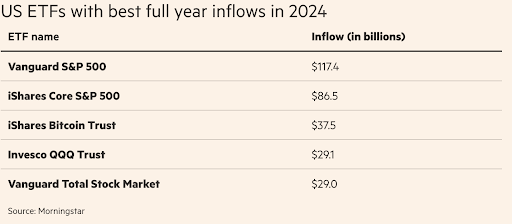

Vanguard beat iShares in full-year US ETF flows for the fifth straight year in 2024, powered by its US equity market trackers including $117 billion for the Vanguard S&P 500 ETF (VOO) alone, according to new data from Morningstar. Equity funds were responsible for $773.2 billion including $591 billion for US equity, while fixed income posted $302.1 billion, 94% of it going to taxable bond funds. Active ETFs, meanwhile, logged $295 billion in inflows, more than doubling their 2023 record and raising their market share to 8.6% , from 6.4% Crypto exchange-traded products (ETPs) saw $585 million in inflows in the first three days of 2025, according to CoinShares data. However, this strong start was not enough to offset a dip at the end of 2024, with crypto ETPs experiencing $75 million in net outflows the last week of the year. Despite the late-year drop, 2024 proved to be a historic year for crypto ETFs, with total inflows reaching $44.2 billion, marking a 320% increase from the previous record of $10.5 billion set in 2021.

Things of interest

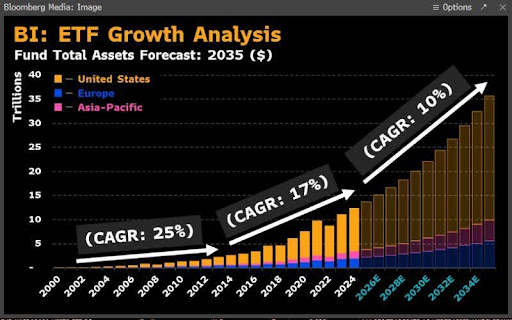

The folks at Bloomberg are reassessing their own predictions about ETF growth having earlier last year predicted global ETFs would grow to $35 trillion by 2035. Looks like that target might arrive sooner than expected.

| BNP Paribas is to acquire AXA Investment Managers (AXA IM) after signing an official share purchase agreement. The two parties entered exclusive negotiations in August over the €5.1 billion deal, with the new business to manage approximately €1.5 trillion in assets upon closing – currently expected for the summer of 2025.

|

The Luxembourg regulator is to relax transparency requirements for active ETFs by allowing managers to publish holdings with a one-month lag.

In a move designed to attract active ETFs to domicile in the country, the CSSF declared that “actively managed UCITS ETFs should publish the full portfolio holdings…at least on a monthly basis with a maximum time lag of one month.”

Approximately 4,000 ETFs are trading in the U.S. after more than 1,500 funds launched last year. The number of ETFs soared 62% for the year according to etf.com data. The tally stood at 2,476 one year ago. This was offset by approximately 200 closures in 2024.

Saudi Arabia’s Public Investment Fund (PIF) has allocated $200 million to the SPDR J.P. Morgan Saudi Aggregate Bond ETF, the first globally listed Saudi-focused exchange-traded fund. The fund, launched in partnership with State Street Global Advisors, is listed on the London Stock Exchange and Xetra. The investment is in line with the goals of Saudi Vision 2030, marking a noteworthy advancement in promoting the international visibility of Saudi Arabia’s financial markets and attracting overseas investments.

Career corner

Movers and Shakers

-

Chris Heakes has joined Harvest ETFs in Canada as a senior PM. He joins from BMO.

-

Ruby Nam has joined Nasdaq as Head of Korea Index Licensing. She joins from Mirae.

-

Saul Mendoza has joined T.Rowe Price as an ETF sales specialist. He joins from JP Morgan.

-

Tim Whelan has joined Goldman Sachs as an ETF specialist. He joins from Juniper Square.

-

Zach Schiller has joined RBC Capital Markets as ETF Sales and Trading at RBC Capital Markets. He joins from BMO.

- Michael Laughlin has joined Janus Henderson Investors as an Active ETF Product Strategist. He joins from Morningstar.

On the Move

-

European Featured Opportunities

- Associate Counsel – Europe, Remote: Join a fast-growing Exchange Traded Products (ETP) provider, focused on delivering innovative financial products. Their first range of single stock ETPs was listed on London Stock Exchange in December 2017. They have since expanded their footprint, listing new products across multiple exchanges, including London Stock Exchange, Euronext and XETRA.

US Featured Opportunities

- Head of Strategic Development – New York: The Head of Strategic Development will lead efforts to expand the depth and breadth of market adoption of our index offering. This role will lead cross-functional teams to identify market trends, customer needs, and untapped opportunities within the Self-Directed, Wealth, and Institutional channels. The individual will be responsible for crafting the strategy by which we will capitalize on these growth opportunities, as well as the means of measuring progress to ensure efficient and successful execution.

Tip of the week

-

Tip of the Week

10 tips to negotiate a higher salary in 2025

-

Know Your Worth: Research industry benchmarks—use surveys, salary tools, and your network.

-

Show Your Impact: Document achievements that improved revenue, cut costs, or increased efficiency. Numbers speak.

-

Align with Goals: Highlight how your role drives your company’s success.

-

Pick the Right Moment: Post-achievement or during reviews = ideal timing.

-

Build Your Case: Bring evidence (market data + achievements) to the table.

-

Practice Your Pitch: Rehearse for confidence and clarity.

-

Future-Focused: Show how you’ll contribute to future success.

-

Negotiate Professionally: Collaborative, not confrontational.

-

Plan B Ready: Explore bonuses, benefits, or upskilling if a raise isn’t possible.

-

Know Your Exit Strategy: If undervalued long-term, it may be time to move on.

-

About us

New Year, New Financial Goals – Do You Know Someone Who Could Use The Saver’s Guide to Investing?

A fresh year brings fresh financial ambitions. Maybe you’ve set your goals, but what about your friends or loved ones who are still just saving? Helping them take the first step into investing could make all the difference.

Moolah Invest’s Saver’s Guide to Investing breaks down the essentials into simple, actionable steps – perfect for turning smart savers into confident investors.

If someone you care about is ready to start their investing journey, this guide could be exactly what they need to build confidence and momentum.

Share The Saver’s Guide to Investing and help your friends and family make their money work harder.