2023 HERE WE COME

2022 is over and most will say good riddance to hit. The ETF industry has continued to grow but certainly took some hits last year from the blow up in crypto to the closure of most Russia focused ETFs. We have lost some firms along the way but have added a few new entrants.

We remain bullish for the year ahead. In the US we have witnessed more and more Mutual Fund managers migrate to the ETF wrapper and even though the pickup has been MUCH slower in Europe, we feel that is going to change this year.

Fund Launches and Updates

EMEA

DWS is to switch four ETFs from synthetic replication to Physical replication. The change will effect the MSCI EM Asia ESG Screened Swap Ucits ETF, MSCI EM Latin America ESG Swap Ucits ETF, MSCI EM Europe, Middle East & Africa ESG Swap Ucits ETF and the MSCI AC Asia ex Japan ESG Swap Ucits ETF. Ignites

Mirae Asset Securities is to acquire the market maker GHCO in a $40m deal. Looks like another step from Mirae to enhance their global ETF footprint. ETFstream

AMERICAS

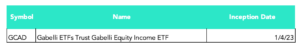

GAMCO Investors, Inc., also known as Gabelli Funds, launched an ETF focused on aerospace and defense. The Gabelli Commercial Aerospace & Defense ETF (GCAD) charges an expense ratio of 0.9% and trades on the NYSE Arca. ETF.com

Full list of U.S. launches:

ASIA-PACIFIC

CSOP CSI STAR and CHINEXT 50 Index ETFs listed on SGX making it the second firm to participate in the Singapore Exchange (SGX) and the Shenzhen Stock Exchange (SZSE) ETF link.The first was UOBAM Ping An ChiNext ETF, which launched in Nov of last year. etfexpress

Flows

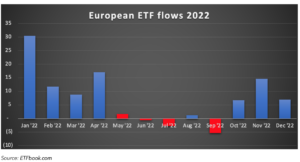

In the EMEA region, $90bn of Inflows for European ETFs in 2022 compared to inflows of $195bn in 2021.

Equities +$61bn, Fixed Income +$33bn, Commodities -$5bn

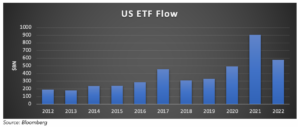

In the Americas region, $580bn of Inflows US ETFs in 2022 compared to inflows of $908bn in 2021.

Equities +$387bn, Fixed Income +$194bn, Commodities -$4bn.

Podcast of stories from inspiring leaders from the ETF and Digital Assets industry.

This week we speak to Arnaud Llinas, Head of ETFs, Indexing & Smart Beta at Amundi and Howie Li, Global Head of Index & ETFs at Legal & General Investment Management.

CLICK to listen to them.

Noteworthy

BlackRock, Vanguard, State Street could be responsible for up to two-thirds of the 50% spike in women on US company boards in recent years, according to a paper by the National Bureau of Economic Reasearch. Etf.com

ETF market expanded in 2022 through bear market, but took hits, according to Bloomberg:

Near-record launches: The market gloom did little to discourage new fund entrants, as 430 ETFs came to market.

Energy ruled: Only one S&P 500 sector gained in all of 2022: energy. It surged roughly 60% for the year

Mutual funds gave way: Investors spurned mutual funds at a record clip, driving a nearly $1.7 trillion gap in the flow of money from the older investment vehicles into ETFs

Brutal bond year: The fixed-income space was a big underperformer as the Fed ratcheted up rates

Crypto’s downfall: The industry sustained one of its toughest stretches yet. Crypto-focused ETFs slumped, with the ProShares Bitcoin Strategy ETF (BITO) falling nearly 64%.

SPAC bust: Funds built around special-purpose acquisition companies — which were one of the hottest things to emerge in the pandemic years — sank as investors walked away from the speculative investment vehicles. An index tracking the industry fell more than 24%

Additional reads

Check out our latest report 2023 ETF AND DIGITAL ASSETS OUTLOOK, where various leaders across the ETF ecosystem share their predictions for the year ahead. Blackwater

Fidelity remains bullish on Bitcoin. ETFtrends

More ETF predictions for 2023 with Nate Geraci. etftrends

From Behind the Desk

Where is all the snow gone?

Climate change must be biting as there is no snow in Europe so far this winter and therefore no skiing.

The situation is so bad that many ski resorts have had to close. Half of the 7,500 ski slopes in France are currently closed, due to “a lack of snow and a lot of rain”, according to the CNN.

We wonder if this is a one-off event or a sign of the future. Time will tell.